Japan Non-Alcoholic Beverages Market Size, Share, COVID-19 Impact Analysis, By Beverage Type (Tea & Coffee, Juice, Water, Bubble/Sparkling Water, Carbonated Soft Drinks, Sports & Functional Drinks, Others), By Distribution Channel (Supermarket/ Hypermarket, Food Services, Convenience Stores, Specialty Stores, Retails), and Japan Non-Alcoholic Beverages Market Insights Forecasts to 2032

Industry: Consumer GoodsJapan Non-Alcoholic Beverages Market Insights Forecasts to 2032

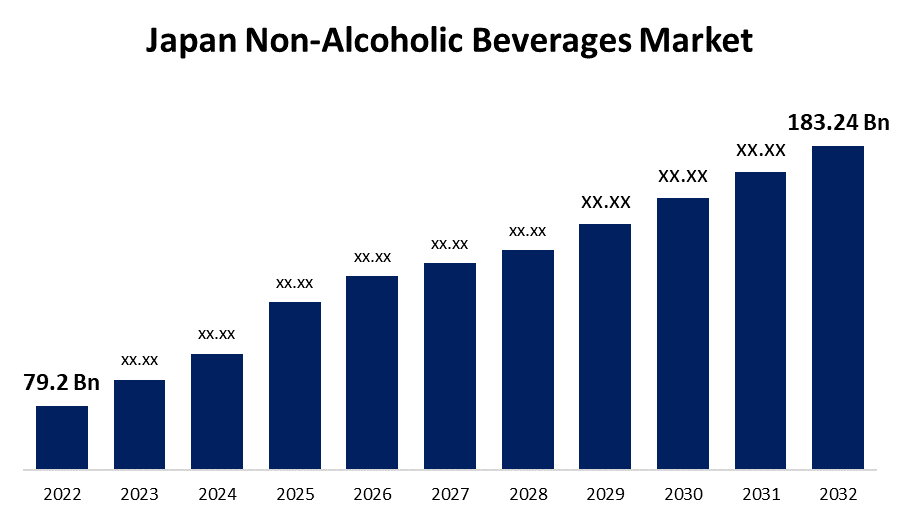

- The Japan Non-Alcoholic Beverages Market Size was valued at USD 79.2 Billion in 2022.

- The Market Size is growing at a CAGR of 8.75% from 2022 to 2032.

- The Japan Non-Alcoholic Beverages Market Size is expected to reach USD 183.24 Billion by 2032.

- Japan is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Japan Non-Alcoholic Beverages Market Size is expected to reach USD 183.24 Billion by 2032, at a CAGR of 8.75% during the forecast period 2022 to 2032.

Market Overview

The Non-Alcoholic Drinks category contains all non-alcoholic beverages. This market's blended beverages are also known as liquid refreshment beverages. Non-alcoholic drinks have grown in popularity in Japan, where population density is declining and younger individuals drink significantly less than earlier generations. The Lemon Sour, a lemon-flavored mix drink blended with a spirit and a soft drink and typically offered in an RTD can, is among the most common low-alcohol beverage in Japan. Although customers want lighter and less artificial beverages, they also want to try new flavors and sensations, with exotic flavor combinations being especially popular in the Japanese beverage market. In Japan, the demand for non-alcoholic beverages has been estimated to have grown roughly four times since a decade ago. Following customers' increasing adoption of the non-alcoholic categories, market producers are adapting to the emerging market conditions and upgrading their current offering portfolios, which forecasts productively for this industry's growth in the future.

Report Coverage

This research report categorizes the market for Japan Non-alcoholic Beverages Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Non-alcoholic Beverages Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Non-alcoholic Beverages Market.

Japan Non-Alcoholic Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 79.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.75% |

| 2032 Value Projection: | USD 183.24 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Beverage Type, By Distribution Channel, COVID-19 Impact Analysis |

| Companies covered:: | Asahi, Sapporo, Suntory, Cheerio, Sangaria, Yakult Honsha, Meiji, Takara Holdings, Asahi Soft Drinks, Harada Tea Processing Co., Ltd., Kirin Brewery Company. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan non-alcoholic beverages market accounts for more than 40% of the country's beverage sector and has been rising for an extended period. Because of the growing appeal of refreshment drinks such as tea and coffee, as well as the advancing cultural development among populations, the market provides investors with a comprehensive view of the industry. Furthermore, easy access beverages such as canned CSD and ready-to-drink (RTD) coffee/tea are becoming a widespread trend that provides 'grab-and-go' efficiency and encourages people to purchase them from retail stores or vending machines. Furthermore, sugar content reduction is a key driving force in additional segments of the Japanese non-alcoholic beverage market. While the overall beverage business is experiencing a decline, demand for carbonated energy and water-based drinks is increasing. Carbonated drink sales are increasing as more health-conscious consumers seek out new alternatives that are healthier and less sugary. As a result, increased consumer reliance on refreshing beverages and other creative products will drive growth in Japan's non-alcoholic beverage market over the projection period.

Market Segment

- In 2022, the water segment accounted for the largest revenue share of more than 27.8% over the forecast period.

On the basis of beverage type, the Japan Non-alcoholic Beverages Market is segmented into tea & coffee, juice, water, bubble/sparkling water, carbonated soft drinks, sports & functional drinks, and others. Among these, the water segment is dominating the market with the largest revenue share of 27.8% over the forecast period. The tourism industry's rapid growth and the mobility of sterilized bottled water are likely to boost demand for packaged water. The advancement in user-friendly packaging is one of the major reasons driving the demand for bottled water in the non-alcoholic beverage market. Furthermore, the sparkling/bubble water segment is expected to develop the fastest during the projected period. This segment is expanding due to the rising demand for pure, natural water.

- In 2022, the supermarket/hypermarket segment accounted for the largest revenue share of more than 39.2% over the forecast period.

On the basis of distribution channels, the Japan Non-alcoholic Beverages Market is segmented into supermarkets/hypermarkets, food services, convenience stores, specialty stores, and retailers. The supermarket/hypermarket segment, which is constantly changing and entrepreneurs are tapping on buyer's conveniences to give an easier shopping experience, is leading the market with the largest revenue share of 39.2% throughout the forecast period. The implementation of technical developments and platform equipment assists shops in providing appropriate beverage quality to buyers. AEON, Seiyu, Ito-Yokado, Maruetsu, and Inageya are among the supermarkets expanding their alcohol-free offerings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Non-alcoholic Beverages Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asahi

- Sapporo

- Suntory

- Cheerio

- Sangaria

- Yakult Honsha

- Meiji

- Takara Holdings

- Asahi Soft Drinks

- Harada Tea Processing Co., Ltd.

- Kirin Brewery Company

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On April 2023, SOTO premium sake is excited to introduce the first release in a new limited-edition series, SOTO X YAMAGATA MASAMUNE Omachi Kimoto Junmai Daiginjo. SOTO's collaboration with Japan's finest brewers honors the most coveted "Grand Cru" breweries in Japan and around the world.

- In July 2021, Asahi Beer announced that they will begin construction of a brewery for non-alcoholic beer-like products at their factory in Hakata, Kyushu, in western Japan. The entire investment amount is 3.1 billion yen (US$29.2 million). As a result of this capacity increase, they will be able to create one million cases of non-alcoholic beer-like beverages each year, including their signature "Dry Zero."

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Non-alcoholic Beverages Market based on the below-mentioned segments:

Japan Non-alcoholic Beverages Market, By Beverage Type

- Tea & Coffee

- Juice

- Water

- Bubble/Sparkling Water

- Carbonated Soft Drinks

- Sports & Functional Drinks

- Others

Japan Non-alcoholic Beverages Market, By Distribution Channel

- Supermarket/ Hypermarket

- Food Services

- Convenience Stores

- Specialty Stores

- Retails

Need help to buy this report?