Japan Network Automation Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Services), By Network Type (Physical, Virtual, and Hybrid), By End Use (IT and Telecom, Manufacturing, Energy and Utility, Banking and Financial Services, Education, and Others), and Japan Network Automation Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Network Automation Market Insights Forecasts to 2035

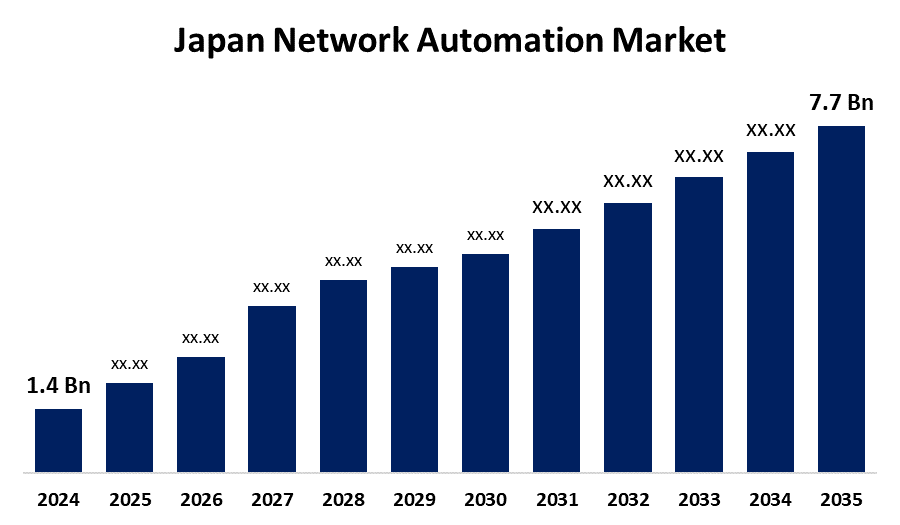

- The Japan Network Automation Market Size Was Estimated at USD 1.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.76% from 2025 to 2035

- The Japan Network Automation Market Size is Expected to Reach USD 7.7 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Network Automation Market Size is anticipated to Reach USD 7.7 Billion by 2035, Growing at a CAGR of 16.76% from 2025 to 2035. The Japan network automation market is growing at a rapid pace, fueled by digital transformation, 5G, and IoT complexity, cost optimization requirements, and the accelerating adoption of automation in industries like IT and telecoms to improve performance and efficiency.

Market Overview

The Japan Network Automation Market Size refers to software and technology that automates provisioning, configuration, monitoring, management, and security of network devices and services through technologies such as SDN, intent-based networking, manufacturing, utilities, education, and other industries, particularly as businesses embrace cloud, hybrid, and 5G architectures. Strengths are in Japan mature IT and telecom infrastructure, local carriers and vendors' competitiveness, and alignment with industrial automation leadership at large. Opportunities come from AI or ML-based restoration networks, SD WAN, NFV, intent-based systems, and Network as a Service models. Drivers in the market are sharply increasing errors, and increasing cybersecurity and compliance requirements. Government programs supporting wider digital transformation, including Society 5.0, the Digital Agency, and the national broadband and smart infrastructure initiatives, encourage adoption. Policies under METI, MIC, and the Digital Agency are intended to encourage DX, open innovation, subsidies, and regulatory reforms to catalyze network automation adoption.

Report Coverage

This research report categorizes the market for the Japan network automation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan network automation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan network automation market.

Japan Network Automation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 16.76% |

| 2035 Value Projection: | USD 7.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Component, By End Use |

| Companies covered:: | NEC Corporation, KDDI, Hitachi, Fujitsu, Mizuho, SoftBank, Cisco Systems, Rakuten, IBM Corporation, Sony, Panasonic Corporation, Nippon Telegraph and Telephone (NTT), Mitsubishi Electric Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan network automation market is fueled by rising data traffic, intensifying network complexity, and extensive digital transformation throughout industries. Adoption of cloud computing, 5G, and edge technologies is accelerating demand for agile, scalable networks. Companies look for enhanced operational effectiveness, lower human errors, and quicker service delivery. Further, increased cybersecurity requirements and regulatory compliance needs drive automation faster. Government policies supporting digital infrastructure and smart technology, like Society 5.0 and Digital Agency support, improve market growth further.

Restraining Factors

The Japan network automation market is constrained by high up-front implementation prices, integration issues with existing systems, and a lack of skilled individuals. Furthermore, security issues with data and low awareness levels among small businesses impede wide-scale adoption.

Market Segmentation

The Japan network automation market share is classified into component, network type, and end use.

- The solution segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan network automation market is segmented by component into solution and services. Among these, the solution segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The solution supports automation of network infrastructure, including applications such as configuration, performance, fault, and security management. It provides increased network reliability, security, and performance with improved efficiency through automation of mundane tasks and elimination of human errors.

- The physical segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan network automation market is segmented by network type into physical, virtual, and hybrid. Among these, the physical segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they provide better control of architecture because of direct hardware access. They offer better security owing to data is contained within the network, eliminating vulnerable internet links. They also offer better speed and reliability, facilitating market growth through the elimination of reliance on external internet connections.

- The IT and telecom segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan network automation market is segmented by end use into IT and telecom, manufacturing, energy and utility, banking and financial services, education, and others. Among these, the IT and telecom segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. IT and telecom industries operate complex, interrelated systems and growing data traffic, calling for quick and assured service delivery. Network automation responds to this demand by streamlining operations, minimizing human mistakes, enforcing consistent security policies, and facilitating quicker threat detection and response, making it obligatory for these markets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan network automation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NEC Corporation

- KDDI

- Hitachi

- Fujitsu

- Mizuho

- SoftBank

- Cisco Systems

- Rakuten

- IBM Corporation

- Sony

- Panasonic Corporation

- Nippon Telegraph and Telephone (NTT)

- Mitsubishi Electric Corporation

- Others

Recent Developments:

- In November 2024, NEC Corporation introduced Agentic AI to boost productivity by automating complex tasks. Integrating generative AI and IT services allows users to input tasks, which the AI then breaks down, designs workflows for, selects appropriate tools, and executes autonomously.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan network automation market based on the below-mentioned segments:

Japan Network Automation Market, By Component

- Solution

- Services

Japan Network Automation Market, By Network Type

- Physical

- Virtual

- Hybrid

Japan Network Automation Market, By End Use

- IT and Telecom

- Manufacturing

- Energy and Utility

- Banking and Financial Services

- Education

- Others

Need help to buy this report?