Japan Natural Food Color Market Size, Share, and COVID-19 Impact Analysis, By Pigment Type (Carotenoid, Curcumin, Anthocyanin, Paprika Extract, Spirulina Extract, Chlorophyll, and Carmine), By Functionality (Dairy Food Products, Beverages, Packaged Food/Frozen Products, Confectionery Products, and Bakery Products), and Japan Natural Food Color Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesJapan Natural Food Color Market Insights Forecasts to 2035

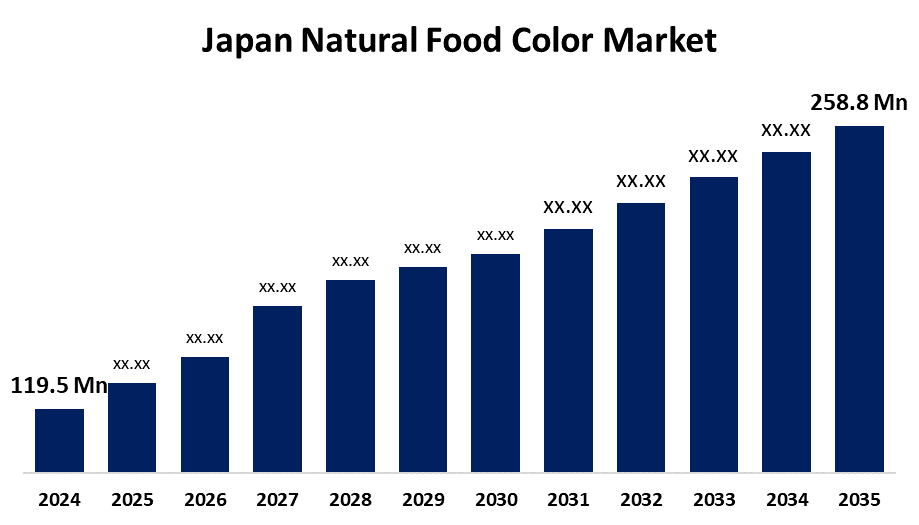

- The Japan Natural Food Color Market Size Was Estimated at USD 119.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.28% from 2025 to 2035

- The Japan Natural Food Color Market Size is Expected to Reach USD 258.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Natural Food Color Market Size is anticipated to reach USD 258.8 Million by 2035, growing at a CAGR of 7.28% from 2025 to 2035. The Japan natural food color market is growing due to the higher consumer demand for clean-label and plant-based food, utmost significance for food safety, and social media influence on the look of food.

Market Overview

The Japan natural food color refers to the manufacturing and use of plant, algae, and insect-derived pigments to naturally color food, hence increasing the visual appeal, quality, and health condition of a food item. They are used in beverages, confectionery, bakery, snack foods, sauces, dairy products, and nutraceuticals to increase appearance, offer functional antioxidants, and meet consumer demand for clean-label, natural products. Competitive advantages are the high-quality local manufacture, stringent regulation regimes, and R&D on enzyme-assisted extraction, fermentation-based pigment manufacture, nanoencapsulation, and algae cultivation for stable, high-purity colorants. Expansion opportunities exist in functional foods and 3D-printed meals and in the application of biotechnology to produce stable, heat-stable pigments suitable for industrial processing. Drivers are high health awareness, ecological sensitivity, and aesthetic preference for visual appearance, encouraged by Japan's leading food-tech and fermentation capabilities. Safety and quality are guaranteed by government measures under the Food Sanitation Act and MHLW, while encouragement for clean-label and sustainable methods is in line with consumer and foreign trade policies.

Report Coverage

This research report categorizes the market for the Japan natural food color market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan natural food color market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan natural food color market.

Japan Natural Food Color Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 119.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.28% |

| 2035 Value Projection: | USD 258.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Pigment Type, By Functionality |

| Companies covered:: | Mitsubishi Corporation Life Sciences, Hansen Holding A/S, Sensient Technologies, Takasago International Corporation, San- Ei Gen F.F.I., Inc., Givaudan Japan, Koninklijke DSM N.V, Dohler Group, Maruzen Chemicals Co. Ltd, D.D. Williamson, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan natural food color market is motivated by increased consumer demand for clean-label, healthy products and increasing resistance to synthetic additives. The country's advanced food processing base supports innovation in natural pigments. Cumulative interest in functional foods, plant-based foods, and sustainability continues to drive the adoption. Strong R&D capabilities, regulator support, and new market technology in algae-derived and fermentation-based colorants all contribute to driving market development, positioning Japan as a natural food color innovation leader.

Restraining Factors

Japan natural foods color market is limited by expensive production, low stability of natural pigments when exposed to heat and light, strict regulatory clearances, and inconsistency in maintaining color quality over a range of food processing applications.

Market Segmentation

The Japan natural food color market share is classified into pigment type and functionality.

- The carotenoid segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan natural food color market is segmented by pigment type into carotenoid, curcumin, anthocyanin, paprika extract, spirulina extract, chlorophyll, and carmine. Among these, the carotenoid segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they are most in demand for their role as colorants and functional nutrients with antioxidant ability. Increased health consciousness on the part of Japanese consumers has stimulated demand for foodstuffs that include functional and natural ingredients. Beta-carotene and lutein are especially in demand in beverages and dairy products on the basis of their deep color shades and perceived eye and skin health benefits.

- The beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan natural food color market is segmented by functionality into dairy food products, beverages, packaged food/frozen products, confectionery products, and bakery products. Among these, the beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the country's highly dynamic ready-to-drink (RTD) functional drink, tea, and juice industries, which are all centered on natural ingredients and aesthetically pleasing visual appearance. Natural colorants over artificial ones are preferred by Japanese consumers, compelling beverage companies to apply pigments such as anthocyanins, carotenoids, and spirulina for their health benefits.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan natural food color market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Corporation Life Sciences

- Hansen Holding A/S

- Sensient Technologies

- Takasago International Corporation

- San- Ei Gen F.F.I., Inc.

- Givaudan Japan

- Koninklijke DSM N.V

- Dohler Group

- Maruzen Chemicals Co. Ltd

- D.D. Williamson

- Others

Recent Developments:

- In January of 2025, Sentient Japan introduced a natural purple sweet potato extract-based pigment series that resists color fading in acidic beverage systems, addressing Japan's rapidly developing health drink and functional tea markets.

- In November 2024, Mitsubishi Life Sciences introduced its "Benifuji" plant extract platform, offering customizable red and orange hues from native safflower species for infant food and medicinal snacks.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan natural food color market based on the below-mentioned segments:

Japan Natural Food Color Market, By Pigment Type

- Carotenoid

- Curcumin

- Anthocyanin

- Paprika Extract

- Spirulina Extract

- Chlorophyll

- Carmine

Japan Natural Food Color Market, By Functionality

- Dairy Food Products

- Beverages

- Packaged Food/Frozen Products

- Confectionery Products

- Bakery Products

Need help to buy this report?