Japan Mushroom Market Size, Share, and COVID-19 Impact Analysis, By Product (Button, Shiitake, Oyster, Matsutake, Truffles, and Others), By Form (Fresh and processed), By Application (Food, Pharmaceuticals, and Cosmetics), By Distribution Channels (Direct to Customer, Grocery Stores, Supermarkets & Hypermarkets, Convenience Stores and Online Stores), and Japan Mushroom Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Mushroom Market Insights Forecasts to 2035

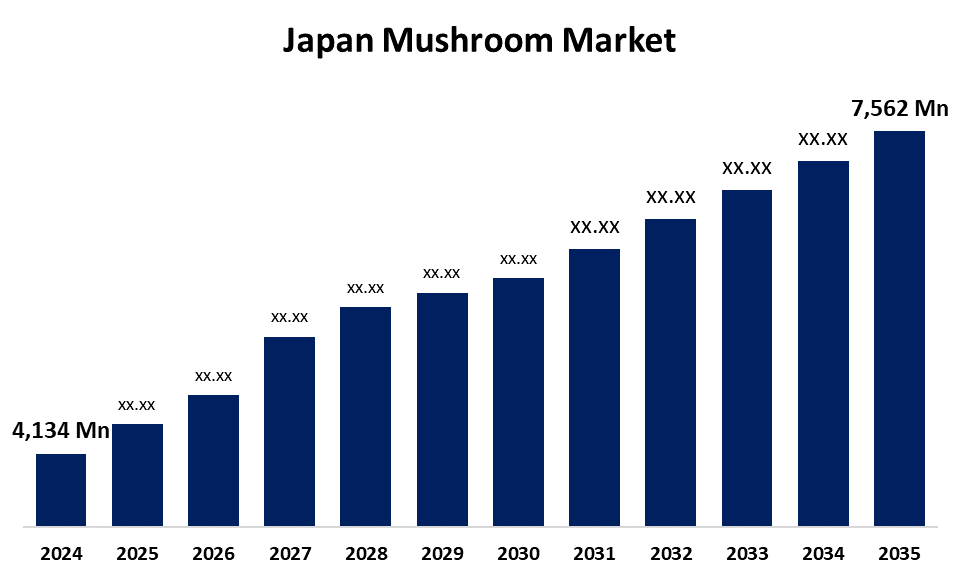

- The Japan Mushroom Market Size Was Estimated at USD 4,134 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.64% from 2025 to 2035

- The Japan Mushroom Market Size is Expected to Reach USD 7,562 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Mushroom Market Size is Anticipated to Reach USD 7,562 Million by 2035, Growing at a CAGR of 5.64% from 2025 to 2035. The Japan mushroom market is driven by various factors, including the rising trend of vegan diets, rising awareness about the health benefits of mushrooms, rising health consciousness, an agaging population, and rising demand for functional foods.

Market Overview

The mushroom market involves cultivation, distribution, and consumption of edible and medicinal mushrooms. Mushrooms contain essential nutrients including selenium, vitamin D, glutathione and ergothioneine. These nutrients help to reduce oxidative stress and preventation of chronic illnesses such as dementia, cancer and heart diseases. The mushroom has a high nutritional profile, making it popular among health-conscious individuals. They are high in fibers and digestive enzymes, hence they are used in healthy diets. Mushrooms are widely used in various industries, mainly the food industry, pharmaceuticals and the cosmetic industry. The development in mushroom packaging technology, such as the development of materials that control the humidity to improve their shelf life, drives the expansion of the mushroom market. The rising inclination towards veganism and plant-based diets also contributes to the expansion of this market. The rising preferences for organic and clean-label food products are key trends in the Japan mushroom market. The rising demand for vegan meat alternatives offers an opportunity for the development of mushroom-based snacks, beverages and ready meals.

Report Coverage

This research report categorizes the market for the Japan mushroom market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan mushroom market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan mushroom market.

Japan Mushroom Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,134 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.64% |

| 2035 Value Projection: | USD 7,562 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Form, By Distribution Channels COVID-19 Impact Analysis. |

| Companies covered:: | Monaghan Mushrooms, Bonduelle S.A., Hokuto Corporation, Kinoko Co., Ltd., Toei Shinyaku Co., Ltd, Yukiguni Maitake Co., Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan mushroom market is experiencing rapid growth owing to various factors. The mushrooms have a great nutritional profile; hence they are widely used in dietary supplements. One of the main driving factors is the rising demand for plant-based diets. Due to their flavor and high nutritional value, they are widely used in the food industry. The expansion of e-commerce plays an important role in the Japanese mushroom market for specialty and organic types of mushrooms. The rising urbanization demand for convenient and longer shelf-life products increases the demand for processed and packaged mushrooms.

Restraining Factors

Despite positive driving factors mushroom market has some challenges. The mushroom production requires a high cost of production, which makes the final product expensive, making it unaffordable for price-sensitive consumers. The mushrooms' short production lifecycle and high yields shorten the harvest time, which reduces the production quality.

Market Segmentation

The Japan mushroom market share is classified into product, form, and distribution channels.

- The shiitake segment held the dominant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan mushroom market is segmented by product into button, shiitake, oyster, matsutake, truffles, and others. Among these, the shiitake segment held the dominant share in 2024 and is expected to grow at a rapid CAGR during the forecast period. This segmental growth is attributed to its nutritional advantages and shorter spore incubation period.

- The fresh segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mushroom market is segmented by form into fresh and processed. Among these, the fresh segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to people becoming more health-conscious and they are prioritising organic and unprocessed food.

- The supermarkets & hypermarkets segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mushroom market is segmented by distribution channels into direct to customer, grocery stores, supermarkets & hypermarkets, convenience stores and online stores. Among these, the supermarkets & hypermarkets held the highest share in 2024 and are expected to grow at a significant CAGR during the forecast period. This is due to they allow consumers to inspect the product before purchase. They provide a wide range of brands under one roof.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan mushroom market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Monaghan Mushrooms

- Bonduelle S.A.

- Hokuto Corporation

- Kinoko Co., Ltd.

- Toei Shinyaku Co., Ltd

- Yukiguni Maitake Co., Ltd.

- Others

Recent Developments

- In February 2025, Yukiguni Maitake Co., Ltd. launched a new product, Mushroom Meat Maid with maitake mushrooms

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan mushroom market based on the below-mentioned segments:

Japan Mushroom Market, By Product

- Button

- Shiitake

- Oyster

- Matsutake

- Truffles

- Others

Japan Mushroom Market, By Form

- Fresh

- Processed

Japan Mushroom Market, By Application

- Food

- Pharmaceuticals

- Cosmetics

Japan Mushroom Market, By distribution channels

- Direct to Customer

- Grocery Stores

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Stores

Need help to buy this report?