Japan Motorcycle Market Size, Share, and COVID-19 Impact Analysis, By Motorcycle Type (Standard, Sports, Cruiser, Touring, and Others), By Propulsion (ICE and Electric), and Japan Motorcycle Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationJapan Motorcycle Market Insights Forecasts to 2035

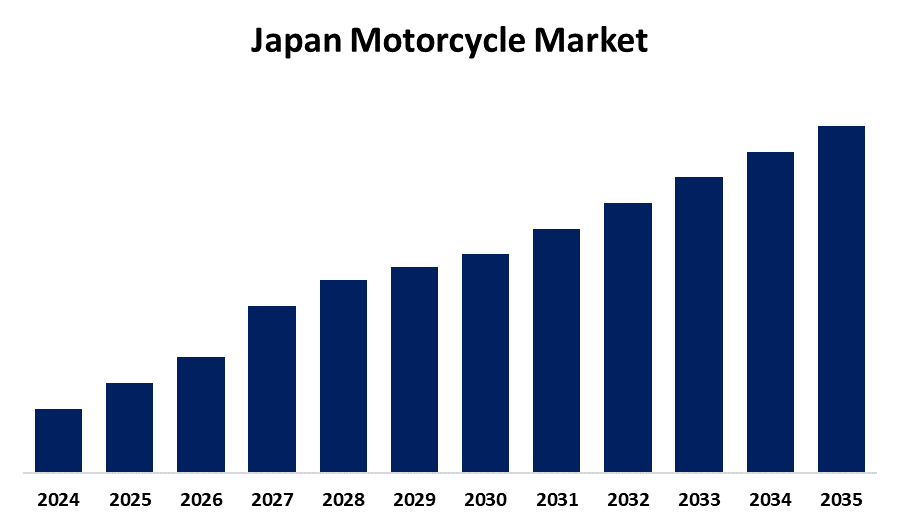

- The Japan Motorcycle Market Size is Expected to Grow at a CAGR of around 2.02% from 2025 to 2035

- The Japan Motorcycle Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Motorcycle Market Size is Anticipated to hold a significant share by 2035, growing at a CAGR of 2.02% from 2025 to 2035.

Market Overview

The Japan motorcycle market refers to the economic sector consisting of the production, import, export, distribution, and sale of motorcycles within Japan. This market accommodates numerous types of motorcycles. Growth opportunities in the Japanese motorcycle market come from electric and hybrid two-wheelers fueled by green policies and city commuting trends. Demographics with a higher age profile are increasing demand for lightweight scooters, and recovery in the tourism sector supports motorbike rentals. Niche segments such as retro and adventure bikes are coveted by enthusiasts. Moreover, Japan's robust R&D culture supports innovation in autonomous and connected motorcycle technology, with international export possibilities. Strategic collaborations with technology companies and enhanced after-sales capabilities can support foreign brands' competitive edge in this transforming world. Japan's motorcycle market is in the midst of a dramatic transformation in 2025. The government is mulling downgrading motorcycles up to 125cc to motorized bicycles, intending to increase the availability of two-wheeled transport. The plan, in consultation with the National Police Agency, targets bikes with less than 4kW power output, which could enable more people to use them without a motorcycle license.

Report Coverage

This research report categorizes the market for the Japan motorcycle market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan motorcycle market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan motorcycle market.

Japan Motorcycle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.02% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Motorcycle Type (Standard, Sports, Cruiser, Touring, and Others), By Propulsion (ICE and Electric) |

| Companies covered:: | Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Suzuki Motor Corporation, Kawasaki Motors, Ltd., Moriwaki Engineering Co., and Ltd. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese motorcycle industry is influenced by various factors. Increasing fuel prices and urban traffic have raised demand for fuel-efficient, small-capacity vehicles such as scooters and motorcycles. There has been a surge in demand for lightweight, easy-to-use two-wheelers due to an aging but active population. Growth in the electric motorcycle segment, aided by government policies favoring green transport, has also played a significant role. Moreover, the use of motorcycles as lifestyle products by younger age groups and for leisure touring adds to consistent demand. Japan's strong domestic brands, including Honda and Yamaha, are still innovating, appealing to domestic as well as international consumers. Moreover, increasing e-commerce and delivery services have widened commercial demand for motorcycles, especially in urban centers. These factors collectively are maintaining moderate but steady growth in Japan's motorcycle industry.

Restraining Factors

Restraining elements in Japan's motorcycle market are a declining younger population, tight emission and safety standards, urban traffic that restricts two-wheeler usage, car and public transport preference, and high ownership prices because of insurance and taxation. Moreover, the cultural image of motorcycles as a leisure and not a necessity restricts daily usage and market growth.

Market Segmentation

The Japan motorcycle market share is classified into material type and process.

- The sports segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan motorcycle market is segmented by motorcycle type into standard, sports, cruiser, touring, and others. Among these, the sports segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the rising youth interest, strong brand presence, and growing demand for high-performance bikes. Its projected high CAGR is driven by technological advancements, lifestyle marketing, and expanding motorsport culture, particularly among younger consumers seeking speed, style, and premium features in their motorcycles.

- The electric segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan motorcycle market is segmented by propulsion into ICE and electric. Among these, the electric segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the increasing environmental awareness, government incentives, and advancements in battery technology. Its high projected CAGR is driven by rising fuel costs, urban emission regulations, and growing consumer demand for sustainable, low-maintenance, and cost-efficient transportation alternatives across both commuting and recreational motorcycle segments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Motorcycle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Suzuki Motor Corporation

- Kawasaki Motors, Ltd.

- Moriwaki Engineering Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan motorcycle market based on the below-mentioned segments:

Japan Motorcycle Market, By Motorcycle Type

- Standard

- Sports

- Cruiser

- Touring

- Others

Japan Motorcycle Market, By Propulsion

- ICE

- Electric

Need help to buy this report?