Japan Mobility as a Service (MaaS) Market Size, Share, and COVID-19 Impact Analysis, By Service (Ride Hailing, Car Sharing, Micro Mobility, Bus Sharing, and Train Services), By Business Model (B2B, B2C, and P2P), and Japan Mobility as a Service (MaaS) Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Mobility as a Service (MaaS) Market Insights Forecasts to 2035

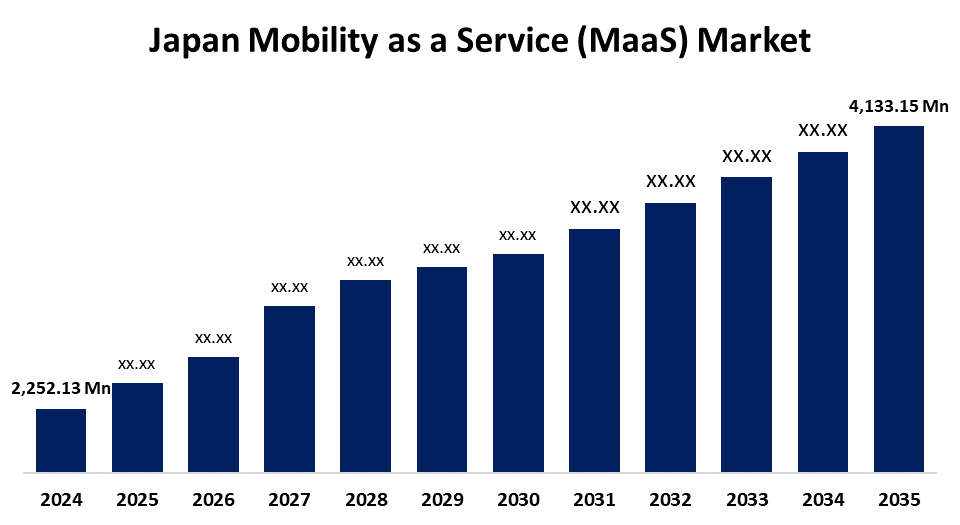

- The Japan Mobility as a Service (MaaS) Market Size Was Estimated at USD 2,252.13 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.67% from 2025 to 2035

- The Japan Mobility as a Service (MaaS) Market Size is Expected to Reach USD 4,133.15 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Mobility as a Service (MaaS) Market Size is anticipated to reach USD 4,133.15 Million by 2035, Growing at a CAGR of 5.67% from 2025 to 2035. The market is driven by government initiatives supporting smart city development and rising demand for efficient, eco-friendly transportation.

Market Overview

The Japan mobility as a service (MaaS) market refers to integrated digital platforms that combine various transportation services such as ride-hailing, public transit, and car-sharing into a seamless, user-friendly experience. Numerous initiatives are highlighted in government reports to assist the adoption of MaaS as part of larger smart city goals. MaaS is becoming more and more integrated into urban planning, according to surveys by municipal authorities. There are current pilot studies exploring several MaaS models in major cities. The contribution of MaaS to attaining sustainability objectives and alleviating urban congestion is emphasized in policy texts. The number of public-private partnerships is increasing; several agreements between transportation authorities and tech companies have been established. Data from the government indicates that funding for smart mobility projects is increasing. Transit-oriented development is becoming more prevalent, which supports MaaS initiatives, according to urban planning studies.

Report Coverage

This research report categorizes the market for the Japan mobility as a service (MaaS) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan mobility as a service (MaaS) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan mobility as a service (MaaS) market.

Japan Mobility as a Service (MaaS) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,252.13 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.67% |

| 2035 Value Projection: | USD 4,133.15 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Service and By Business Model |

| Companies covered:: | Uber Technologies, BMW Group, Skedgo, Moovit Inc., Citymapper, Whim, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The strong technological infrastructure in Japan is driving the quick uptake of MaaS systems. According to surveys, real-time analytics, IoT, and AI are widely incorporated into transportation systems, increasing productivity and facilitating smooth multimodal travel. Real-time information and route optimization through user-friendly mobile applications are becoming more and more prevalent. High smartphone penetration rates, according to government data, make these services easily accessible. The capabilities of MaaS platforms are being enhanced by the rollout of 5G networks; major telecom providers have reported increased coverage in metropolitan areas. Industry publications emphasize how transport operators and software businesses are working together to create increasingly complex MaaS products. According to user satisfaction surveys, integrated mobility apps that provide thorough ticketing and travel planning are becoming more and more popular. When MaaS platforms are connected with public transportation, transportation authorities observe an increase in ridership.

Restraining Factors

High infrastructure costs and intricate integration with current transportation networks provide difficulties despite expansion. Adoption is slowed by regulatory obstacles pertaining to data protection and transportation rules. Additionally, while many consumers still choose conventional modes of transportation, their unwillingness to adopt entirely digital mobility solutions hinders market penetration. Market expansion is also impacted by incumbent transportation providers' competition and low awareness in rural areas.

Market Segmentation

The Japan mobility as a service (MaaS) market share is classified into service and business model.

- The ride hailing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The Japan mobility as a service (MaaS) market is segmented by service into ride hailing, car sharing, micro mobility, bus sharing, and train services. Among these, the ride hailing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by high urban population density, convenience of on-demand transportation, and government initiatives supporting smart mobility solutions.

- The B2C segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mobility as a service (MaaS) market is segmented by business model into B2B, B2C, and P2P. Among these, the B2C segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that MaaS platforms' main user base consists of individual commuters and travelers. Consumer demand for smooth travel experiences, subscription-based transportation services, and the growth of app-based mobility solutions all contribute to B2C's market domination.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan mobility as a service (MaaS) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Uber Technologies

- BMW Group

- Skedgo

- Moovit Inc.

- Citymapper

- Whim

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Mobility as a Service (MaaS) Market based on the below-mentioned segments:

Japan Mobility as a Service (MaaS) Market, By Service

- Ride Hailing

- Car Sharing

- Micro Mobility

- Bus Sharing

- Train Services

Japan Mobility as a Service (MaaS) Market, By Business Model

- B2B

- B2C

- P2P

Need help to buy this report?