Japan Mobile Security Software Market Size, Share, and COVID-19 Impact Analysis, By Operating System (Android, iOS, Windows, and Others), By Deployment Mode (Cloud-Based and On-Premises), By End-User (BFSI, Healthcare, Retail, IT and Telecommunications, Government, and Others), and Japan Mobile Security Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Mobile Security Software Market Insights Forecasts to 2035

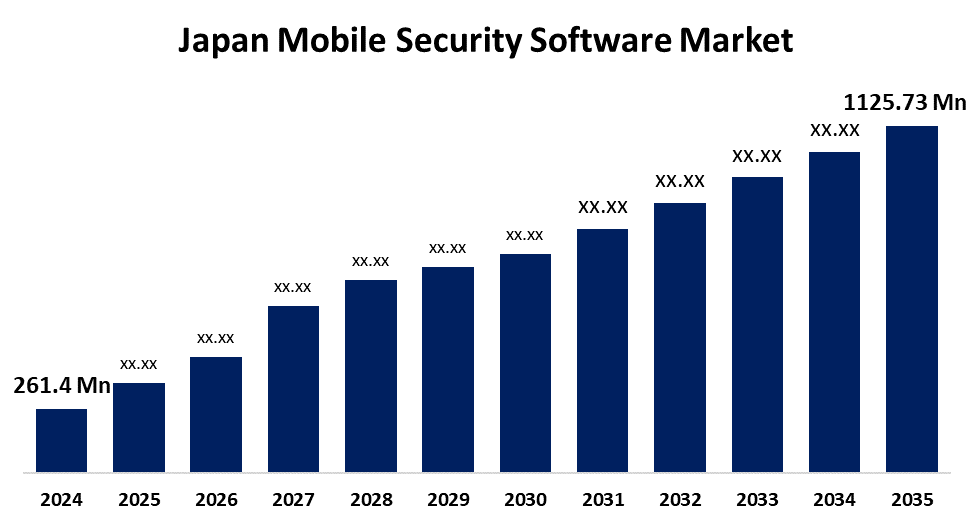

- The Japan Mobile Security Software Market Size Was Estimated at USD 261.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.2% from 2025 to 2035

- The Japan Mobile Security Software Market Size is Expected to Reach USD 1125.73 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Mobile Security Software Market Size is anticipated to Reach USD 1125.73 Million by 2035, Growing at a CAGR of 14.2% from 2025 to 2035. The Japan mobile security software market expands with a growing cyber threat, increased adoption of mobile banking, growing data privacy laws, horizontal integration, and expansion of the Internet of Things, all influencing the growing demand for robust solutions in mobile endpoint security.

Market Overview

The Japan Mobile Security Software Market Size refers to the protection of mobile devices, which comprises smartphones and tablets, against malware, phishing, breach of data, unauthorized access, among others. These are important software solutions in terms of securing personal and corporate data since mobile devices are becoming primary tools in communication, banking and shopping, and business activities. Businesses need prominent mobile security solutions given the increased remote work setup and BYOD policies. Japan strengths include advanced technological infrastructure, strong consumer adoption of mobile services, and high digital literacy. Opportunities lie in AI-powered threat detection, mobile device management integration, and cloud-based security solutions. The high smartphone penetration rate in Japan, increasing mobile-based transactions, and a growing threat landscape targeting mobile platforms all contribute to the market growth. Government initiatives promoting cybersecurity awareness, data protection laws, and support for secure digital transformation further support market expansion.

Report Coverage

This research report categorizes the market for the Japan mobile security software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan mobile security software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan mobile security software market.

Japan Mobile Security Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 261.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 14.2% |

| 2035 Value Projection: | USD 1125.73 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Operating System, By Deployment Mode |

| Companies covered:: | Fujitsu, Sophos, Trend Micro, Avast, NTT Security, Symantec, Bitdefender, Panda Security, FSecure, ESET, AVG Technologies, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan mobile security software market is driven by rising smartphone usage, increased mobile banking and online transactions, and growing cybersecurity threats targeting mobile devices. The shift to remote work and BYOD policies has heightened the need for secure mobile environments. Additionally, Japan strong digital infrastructure and high internet penetration support adoption. Government initiatives promoting data protection, along with increasing awareness of personal and enterprise data security, further contribute to the growing demand for advanced mobile security solutions across industries.

Restraining Factors

The Japan mobile security software market faces restraints such as high implementation costs, complex integration with existing IT systems, limited skilled cybersecurity professionals, and concerns over user privacy, which hinder widespread adoption of advanced mobile security solutions.

Market Segmentation

The Japan mobile security software market share is classified into operating system, deployment mode, and end-user.

- The android segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mobile security software market is segmented by operating system into android, iOS, windows, and others. Among these, the android segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Android's broad popularity and open nature introduce flexibility and exposure, which heighten malware and cyberattack risks. This places a premium on strong Android security solutions for its huge user base, particularly in rapidly developing markets where Android handhelds lead the market.

- The cloud-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mobile security software market is segmented by deployment mode into cloud-based and on-premises. Among these, the cloud-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increasing demand for flexible, scalable, and affordable solutions propels cloud-based mobile security software demand. Advantages such as real-time threat intelligence, auto-updating, and seamless integration with other cloud services drive adoption as companies increasingly move to cloud infrastructures.

- The BFSI segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mobile security software market is segmented by end-user into BFSI, healthcare, retail, IT and telecommunications, government, and others. Among these, the BFSI segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The BFSI industry, with stringent regulations and heightened cyber threats, invests heavily in high-end mobile security solutions to safeguard sensitive information, thwart fraud, and guarantee compliance. Mobile banking and mobile payment application growth further adds to the demand for strong security solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan mobile security software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujitsu

- Sophos

- Trend Micro

- Avast

- NTT Security

- Symantec

- Bitdefender

- Panda Security

- FSecure

- ESET

- AVG Technologies

- Others

Recent Developments:

- In February 2025, Fujitsu announced the Fujitsu Cloud Service Generative AI Platform, set to launch in Japan in fiscal year 2025, with worldwide expansion planned. Combining cloud ease with data confidentiality, it boosts productivity across business functions, from brainstorming and meeting summaries to automated code generation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan mobile security software market based on the below-mentioned segments:

Japan Mobile Security Software Market, By Operating System

- Android

- iOS

- Windows

- Others

Japan Mobile Security Software Market, By Deployment Mode

- Cloud-Based

- On-Premises

Japan Mobile Security Software Market, By End-User

- BFSI

- Healthcare

- Retail

- IT and Telecommunications

- Government

- Others

Need help to buy this report?