Japan Mobile and Wireless Backhaul Market Size, Share, and COVID-19 Impact Analysis, By Component (Equipment and Services), By Equipment (Microwave Equipment, Millimeter Equipment, Sub-6 GHz Equipment, and Others), By Service (Network Services, System Integration Services, and Professional Services), and Japan Mobile and Wireless Backhaul Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Mobile and Wireless Backhaul Market Insights Forecasts to 2035

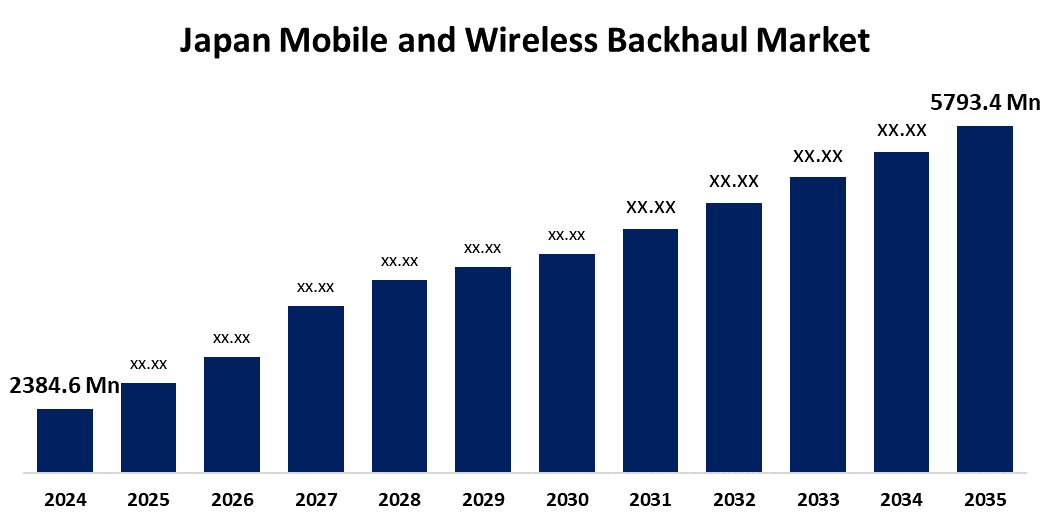

- The Japan Mobile and Wireless Backhaul Market Size Was Estimated at USD 2384.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.4% from 2025 to 2035

- The Japan Mobile and Wireless Backhaul Market Size is Expected to Reach USD 5793.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Mobile and Wireless Backhaul Market Size is anticipated to Reach USD 5793.4 Million by 2035, Growing at a CAGR of 8.4% from 2025 to 2035. The Japan mobile and wireless backhaul market is growing due to the increasing 5G demand, smart city deployment, and IoT growth. All these trends necessitate a more robust infrastructure that will provide quicker data speeds, reduced latency, and increased device connectivity.

Market Overview

The Japan Mobile and Wireless Backhaul Market Size refers to equipmnt, such as microwave, millimetere wave ub 6 GHz, Satellite, and fober, as well as services that interconnect cell sites, small cells, and base stations with the core network. It supports increasing mobile data traffic that can be used to provide 4G and 5G connectivity, IoT, and enterprise broadband services. Strengths derived from advanced telecom infrastructure in Japan, sophisticated R&D, especially at Yokosuka Research Park, and prominent local Players like NEC and Fujitsu, which team up for backhaul innovation. Opportunities include millimeter wave technology, integrating edge computing, rural connectivity through satellites or microwave, and service upgrades tied to network slicing and virtualization. Impactors include, explosive growth of smartphones and data consumption, massive deployment of 5G calling for dense small locations, and implementation of SDN and network virtualization, improving flexibility and cost savings. Government efforts, such as the 5G Promotion Plan, ICT strategy, broadband policy, and MIC led spectrum allocation, promote infrastructure, promote infrastructure investment and digitalization throughout Japan.

Report Coverage

This research report categorizes the market for the Japan mobile and wireless backhaul market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan mobile and wireless backhaul market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan mobile and wireless backhaul market.

Japan Mobile and Wireless Backhaul Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2384.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.4% |

| 2035 Value Projection: | USD 5793.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component, By Equipment |

| Companies covered:: | Fujitsu, ZTE, KDDI Corporation, Ericsson, NEC, Anritsu Corporation, Huawei, Rakuten Mobile, Nokia, Ceragon Networks, Siae Microelettronica, Cisco, Samsung Electronics, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan mobile and wireless backhaul market is propelled by aggressive 5G rollout, growing mobile data traffic, and IoT and smart device expansion. Demand for high-speed, low-latency connectivity in urban and rural environments drives infrastructure upgrades. Evolution in millimeter-wave and microwave technology facilitates small cell densification to deliver 5G performance. In addition, the emergence of network virtualization, SDN, and government-sponsored digital transformation plans further encourages investment in cost-effective, scalable backhaul solutions to address growing bandwidth and reliability needs.

Restraining Factors

The Japan mobile and wireless backhaul market is also hindered by high infrastructure deployment expenses, availability limitations of spectrum, and integration complexities with existing legacy systems. Rural coverage gaps and regulatory complexities are also in place to potentially slow down timely network extension and updating efforts.

Market Segmentation

The Japan mobile and wireless backhaul market share is classified into component, equipment, and service.

- The equipment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mobile and wireless backhaul market is segmented by component into equipment and services. Among these, the equipment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the critical role of backhaul gear in facilitating efficient data transmission over extensive network infrastructures. With the increasing 4G and 5G networks, high-speed, reliable equipment demand increases, aided by development in microwave, millimeter-wave, and sub-6 GHz technologies.

- The microwave equipment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mobile and wireless backhaul market is segmented by equipment into microwave equipment, millimeter equipment, sub-6 GHz equipment, and others. Among these, the microwave equipment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to its cost efficiency and reliability for medium to long distances. It has a good balance between capacity and range without cabling. Its spectrum efficiency and capacity have been further improved by technological advancements, making it increasingly popular among network operators.

- The network services segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mobile and wireless backhaul market is segmented by service into network services, system integration services, and professional services. Among these, the network services segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the critical role of network services in deploying, running, and supporting backhaul infrastructure. With increasingly complex mobile networks through 5G, the services support smooth data transmission and enable operators to address growing demand for instant, uninterrupted connectivity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan mobile and wireless backhaul market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujitsu

- ZTE

- KDDI Corporation

- Ericsson

- NEC

- Anritsu Corporation

- Huawei

- Rakuten Mobile

- Nokia

- Ceragon Networks

- Siae Microelettronica

- Cisco

- Samsung Electronics

- Others

Recent Developments:

- In April 2025, KDDI Corporation partnered with AMD to adopt 4th Gen EPYC processors for its 5G virtualized network. Leveraging advanced chiplet technology, these processors offer high performance with lower power consumption, enabling KDDI to efficiently manage increased 5G traffic while reducing energy usage.

- In October 2020, Fujitsu launched "Private Wireless Managed Services" to enable private 5G and LTE deployment, supporting digital transformation. The service provides comprehensive support, including PoC, licensing, radio measurement, network design, construction, and maintenance, ensuring smooth integration into real-world business operations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan mobile and wireless backhaul market based on the below-mentioned segments:

Japan Mobile and Wireless Backhaul Market, By Component

- Equipment

- Services

Japan Mobile and Wireless Backhaul Market, By Equipment

- Microwave Equipment

- Millimeter Equipment

- Sub-6 GHz Equipment

- Others

Japan Mobile and Wireless Backhaul Market, By Service

- Network Services

- System Integration Services

- Professional Services

Need help to buy this report?