Japan Microcatheters Market Size, Share, and COVID-19 Impact Analysis, By Product (Delivery Microcatheters, Diagnostic Microcatheters, Aspiration Microcatheters, and Steerable Microcatheters), By Design (Single Lumen Microcatheters and Dual Lumen Microcatheters), By Application (Cardiovascular, Neurovascular, Peripheral Vascular, Oncology, and Other Applications), and Japan Microcatheters Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Microcatheters Market Insights Forecasts to 2035

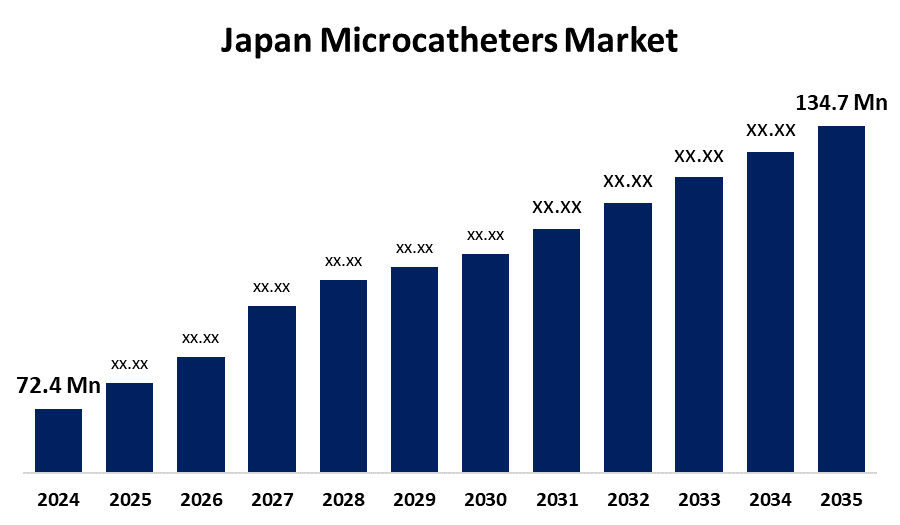

- The Japan Microcatheters Market Size Was Estimated at USD 72.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.81% from 2025 to 2035

- The Japan Microcatheters Market Size is Expected to Reach USD 134.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Microcatheters Market is Anticipated to Reach USD 134.7 Million by 2035, Growing at a CAGR of 5.81% from 2025 to 2035. The Japan microcatheters market is growing due to an aging population, increasing chronic illnesses, and improvements in minimally invasive treatments, fueling demand for cardiovascular, neurovascular, and cancer therapies to enable targeted, less invasive procedures and better patient outcomes across the medical disciplines.

Market Overview

The Japan microcatheters market refers to the production and application of small, soft tubes that can travel through narrow and tortuous blood vessels for diagnostic and treatment purposes, specifically in cardiology, neurology, and interventional radiology. These products are commonly applied to deliver drugs, embolic agents, or stents in minimally invasive interventions like aneurysm repair, stroke treatment, and tumor embolization. Strengths in Japan lie in advanced medical technology, high precision engineering, and an entrenched healthcare infrastructure that facilitates innovation. Opportunities lie in the creation of next generation microcatheters with improved flexibility, biocompatibility, and imaging compatibility, as well as applications in oncology and peripheral vascular disease. Market expansion is fueled by the increasing incidence of cardiovascular and neurovascular diseases, population aging, and the adoption of minimally invasive procedures. Government programs, such as regulatory incentives and finance under Japan healthcare innovation policies, further stimulate R&D in this segment, driving market growth and improving patient care.

Report Coverage

This research report categorizes the market for the Japan microcatheters market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan microcatheters market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan microcatheters market.

Japan Microcatheters Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 72.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.81% |

| 2035 Value Projection: | USD 134.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product, By Design and COVID-19 Impact Analysis. |

| Companies covered:: | Nipro Corporation, Boston Scientific, Asahi Intecc Co., Ltd., Terumo Corporation, Teleflex Incorporated, Stryker Corporation, Medtronic, Tokai Medical Products, Inc., Penumbra, Inc., Merit Medical Systems, Inc. and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan microcatheters market is fueled by the growing prevalence of cardiovascular and neurovascular diseases, accompanied by a rapidly aging population with a need for sophisticated medical intervention. Greater use of minimally invasive technologies boosts demand, given that microcatheters allow for controlled navigation in highly complex vascular pathways. Advances in technologies increasing flexibility, safety, and compatibility with imaging also drive growth. Also, robust healthcare infrastructure and favorable government policies encouraging medical device adoption and innovation are major factors in the growing market for microcatheters in Japan.

Restraining Factors

The market for Japan microcatheters is constrained by expensive device prices, strict regulatory clearances, limited reimbursement schemes, and the requirement of special training. Also, competition from other modes of treatment and procedural risk concerns restricts the extensive use and market expansion.

Market Segmentation

The Japan microcatheters market share is classified into product, design, and application.

- The steerable microcatheters segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan microcatheters market is segmented by product into delivery microcatheters, diagnostic microcatheters, aspiration microcatheters, and steerable microcatheters. Among these, the steerable microcatheters segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increased success rates and shorter procedure times. Their real-time tip angulation supports super-selective vessel access. Continuous developments in user friendly, state of the art devices further enhance their application in surgical procedures.

- The dual lumen microcatheters segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan microcatheters market is segmented by design into single lumen microcatheters and dual lumen microcatheters. Among these, the dual lumen microcatheters segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to their adaptability in intricate procedures, providing simultaneous diagnostic and therapeutic uses in cardiovascular and neurovascular interventions. Their effectiveness, decreased operative time, continuous technological developments, and increased adoption in emerging economies make them indispensable in minimally invasive medical procedures.

- The cardiovascular segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan microcatheters market is segmented by application into cardiovascular, neurovascular, peripheral vascular, oncology, and other applications. Among these, the cardiovascular segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing incidence of cardiovascular conditions, such as coronary artery disease and myocardial infarction has increased the demand for minimally invasive therapies, including stenting and angioplasty, which is driving microcatheter uptake. Furthermore, increased healthcare infrastructure and supportive reimbursement policies in developed nations also contribute to market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan microcatheters market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nipro Corporation

- Boston Scientific

- Asahi Intecc Co., Ltd.

- Terumo Corporation

- Teleflex Incorporated

- Stryker Corporation

- Medtronic

- Tokai Medical Products, Inc.

- Penumbra, Inc.

- Merit Medical Systems, Inc.

- Others

Recent Developments:

- In July 2021, Terumo Medical Corporation launched the AZUR™ Vascular Plug, the first microcatheter-compatible plug designed to occlude peripheral arteries up to 8mm. This innovation improves embolization procedures by offering precise, stable, and reliable occlusion, aligning with Terumo’s goal to improve clinical outcomes and provide economic value in interventional therapies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan microcatheters market based on the below-mentioned segments:

Japan Microcatheters Market, By Product

- Delivery Microcatheters

- Diagnostic Microcatheters

- Aspiration Microcatheters

- Steerable Microcatheters

Japan Microcatheters Market, By Design

- Single Lumen Microcatheters

- Dual Lumen Microcatheters

Japan Microcatheters Market, By Application

- Cardiovascular

- Neurovascular

- Peripheral Vascular

- Oncology

- Other Applications

Need help to buy this report?