Japan Medical Devices Reimbursement Market Size, Share, and COVID-19 Impact Analysis, By Claim (Underpaid and Fully Paid), By Payer (Public Payers and Private Payers), By Service Provider (Physician Office, Hospitals, Diagnostic Laboratories, and Others), and Japan Medical Devices Reimbursement Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Medical Devices Reimbursement Market Insights Forecasts to 2035

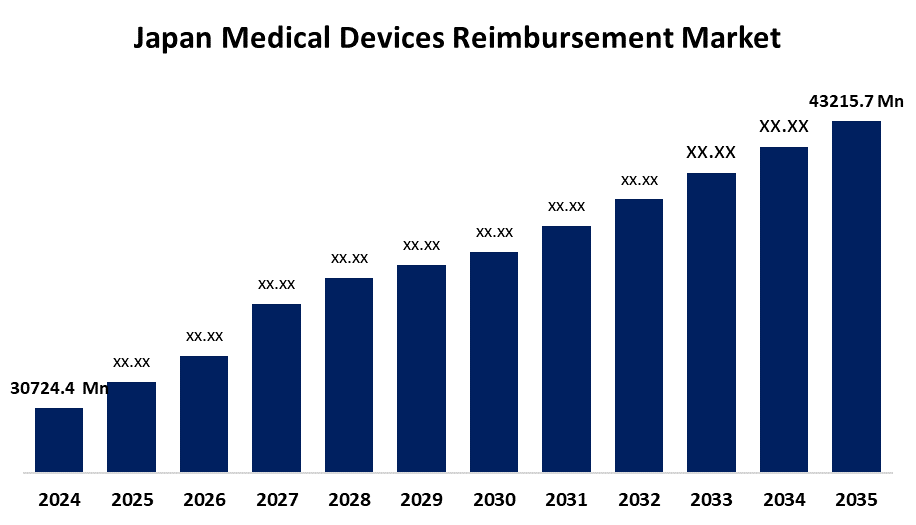

- The Japan Medical Devices Reimbursement Market Size Was Estimated at USD 30724.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.15% from 2025 to 2035

- The Japan Medical Devices Reimbursement Market Size is Expected to Reach USD 43215.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan medical devices reimbursement market is anticipated to reach USD 43215.7 million by 2035, growing at a CAGR of 3.15% from 2025 to 2035. The Japan reimbursement market for medical devices increases due to its aging population, government assistance for healthcare innovation, organized reimbursement schemes, and accelerated adoption of sophisticated medical technologies with a focus on economical, superior patient care.

Market Overview

The Japan medical devices reimbursement market refers to the organized framework where healthcare providers get paid for medical devices utilized in patient treatment. This market is significant in facilitating accessibility and affordability of new medical technologies, from diagnostic devices to therapeutic equipment. A strong point of this market is that Japan established a universal healthcare system, which enables reimbursement policies supporting innovation and the practice of advanced devices. Opportunities emerge from the continuous healthcare reforms by the government that aim at maximizing reimbursement structures, encouraging value-based care, and expediting approval procedures for new technologies. Major drivers are Japan growing elderly population, rising incidence of chronic illnesses, and rising need for advanced healthcare solutions. Additionally, initiatives such as Medical Device Regulatory and attempts at streamlining health technology assessments are likely to improve market expansion.

Report Coverage

This research report categorizes the market for the Japan medical devices reimbursement market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan medical devices reimbursement market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan medical devices reimbursement market.

Japan Medical Devices Reimbursement Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 30724.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.15% |

| 2035 Value Projection: | USD 43215.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Claim, By Service Provider, By Payer and COVID-19 Impact Analysis |

| Companies covered:: | Nihon Kohden, Omron, Nipro, Terumo, Sysmex, Menicon, Konica Minolta, Olympus, Fukuda, Hitachi Healthcare, Shimadzu Corporation, FUJIFILM Corporation, Canon Medical Systems, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan medical devices reimbursement market is fueled by the nations rapid aging population and the growing incidence of chronic illness, both of which raise demand for innovative medical devices. A strong universal healthcare system guarantees broad access and facilitates reimbursement of innovative devices. Government efforts aimed at healthcare reform, value-based care, and streamlined regulatory channels further spur adoption. Moreover, rising healthcare spending and increasing focus on delivering better patient outcomes are driving the market, providing opportunities for medical device manufacturers to increase their presence in Japan.

Restraining Factors

The reimbursement market for medical devices in Japan is restrained by complicated regulatory processes, long approval cycles, and rigorous pricing controls. Moreover, high prices for innovative devices and inadequate reimbursement coverage for some technologies inhibit market expansion and delay adoption rates.

Market Segmentation

The Japan medical devices reimbursement market share is classified into claim, payer, and service provider.

- The underpaid segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan medical devices reimbursement market is segmented by claim into underpaid and fully paid. Among these, the underpaid segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to reimbursement shortfalls, and convoluted billing systems typically result in part payments as a result of claim denial, coding mistakes, or insurance limitations. Volatile policies, absence of standard pricing, and time lags between device approval and reimbursement revisions also contribute to underpayment issues.

- The public payers segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan medical devices reimbursement market is segmented by payer into public payers and private payers. Among these, the public payers segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the nations system of universal healthcare that pays for most medical bills. Government-sponsored programs guarantee broad access to medical devices, making payers from the public sector the foremost source of reimbursement for health providers and patients alike.

- The physician office segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan medical devices reimbursement market is segmented by service provider into physician office, hospitals, diagnostic laboratories, and others. Among these, the physician office segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the medical offices are critical in the management of chronic illnesses and outpatient treatment, both of which greatly rely on medical devices such as monitoring devices, diagnostic machines, and minor therapeutic devices. Since many patients have their first contact with them, these offices receive many consultations, thus utilizing such devices frequently.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan medical devices reimbursement market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nihon Kohden

- Omron

- Nipro

- Terumo

- Sysmex

- Menicon

- Konica Minolta

- Olympus

- Fukuda

- Hitachi Healthcare

- Shimadzu Corporation

- FUJIFILM Corporation

- Canon Medical Systems

- Others

Recent Developments:

- In December 2022, Terumo Corporation announced expanded reimbursement coverage for the Dexcom G6 CGM System under Japan’s medical insurance system. With the new “C150” category, more diabetes patients can access the concurrent glucose monitoring system, which transmits glucose data every five minutes via a wearable sensor.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan medical devices reimbursement market based on the below-mentioned segments:

Japan Medical Devices Reimbursement Market, By Claim

- Underpaid

- Fully Paid

Japan Medical Devices Reimbursement Market, By Payer

- Public Payers

- Private Payers

Japan Medical Devices Reimbursement Market, By Service Provider

- Physician Office

- Hospitals

- Diagnostic Laboratories

- Others

Need help to buy this report?