Japan Medical Device Market Size, Share, and COVID-19 Impact Analysis, By Product (Medical & Diagnostic Equipment, Consumables & Supplies, And Implants), By Application (Orthopedic, Cardiovascular, Oncology, Dental, Gynecology & Urology, Ophthalmology, Dermatology, And Others), By End User (Hospitals, Diagnostic Laboratories), and Japan Medical Device Market Insights Forecasts to 2032

Industry: HealthcareJapan Medical Device Market Insights Forecasts to 2032

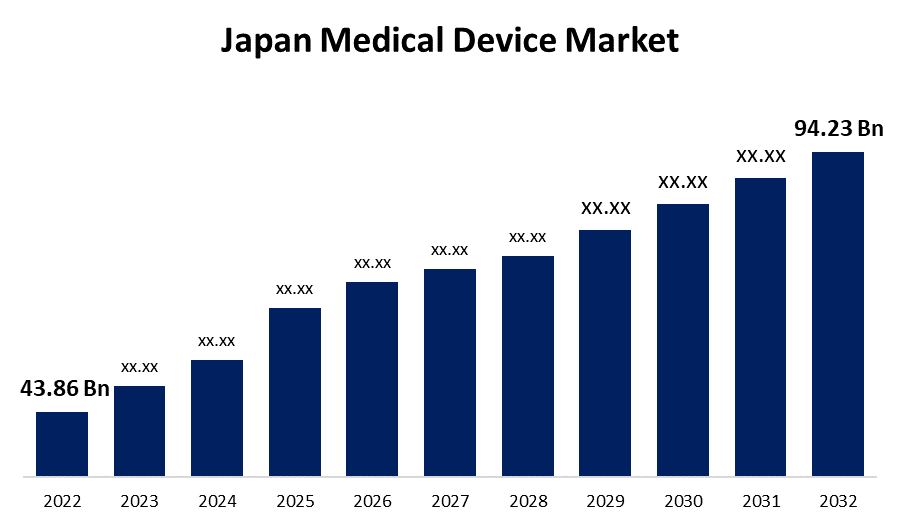

- The Japan Medical Device Market Size was valued at USD 43.86 Billion in 2022.

- The Market is Growing at a CAGR of 7.95% from 2022 to 2032.

- The Japan Medical Device Market Size is expected to reach 94.23 Billion by 2032.

Get more details on this report -

The Japan Medical Device Market Size is expected to reach USD 94.23 Billion by 2032, at a CAGR of 7.95% during the forecast period 2022 to 2032.

Market Overview

A medical device is any appliance, apparatus, software, material, or other object that can be used by individuals in isolation or combination (as defined by the manufacturer) for medical purposes. In the laboratory diagnostic instruments are also considered medical devices. These medical devices are used to test samples taken from the body, such as tissue, bodily fluids, and blood; for example, blood glucose, lateral flow, and pregnancy tests. Heart pacemakers and other implantable medical devices are also covered; these devices typically have implants and may or may not need external power and operation sources. Japan has the world's second-largest medical device market. According to Spherical Insights research report healthcare, regulatory, and reimbursement landscape - in Japan, favourable conditions for improved medical products and new technological innovations for better healthcare make Japan more open and appealing for healthcare investment. The Japanese government has launched new initiatives to speed up the regulatory approval review process and the launch of innovative medical products. Furthermore, various steps have been taken by the Ministry of Health, Labour, and Welfare (MHLW) to significantly improve the transparency of the approval review system in order to achieve a quick review process that is equivalent to, or faster than, that of North American and European markets. The government also established the medical information database to provide innovators with access to medical records, which has resulted in faster medical device development and patient access.

Report Coverage

This research report categorizes the market for Japan medical device market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan medical device market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan medical device market.

Japan Medical Device Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 43.86 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.95% |

| 2032 Value Projection: | USD 94.23 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Olympus, Terumo, Nipro, Nihon Kohden, Fukuda, Omron, Konica Minolta, Menicon, Shimadzu Corporation, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Sedentary lifestyles are contributing to an increase in the prevalence of chronic diseases such as cancer, diabetes, and other infectious diseases. Various countries' healthcare agencies are focusing on increasing diagnosis and treatment rates through awareness campaigns. The patient population requiring diagnostic procedures and tests is growing in tandem with the increasing prevalence and awareness of such conditions among the general population. Thus, changing lifestyles that lead to physical inactivity can increase the risk of heart disease, which is expected to increase demand for medical devices due to increased heart surgeries to open blocked arteries in patients, boosting market growth during the forecast period 2023-2032.

Restraining Factors

In previous years, the Japan medical device industry has seen changes in terms of new technologies being implemented and new design modifications being prepared. However, the high cost of these devices, which includes a higher acquisition cost and subsequent maintenance costs, leads to an overall increase in device cost and ownership. Some advanced devices are linked to various other components such as chips, batteries, sensors, and other accessories that must be replaced on a regular basis.

Market Segment

- In 2022, the medical and diagnostic segment accounted for the largest revenue share over the forecast period.

Based on the product the Japan medical device market is segmented into medical and diagnostic equipment, consumables and supplies, and implants. Among these, the medical and diagnostic segment has the largest revenue share over the forecast period. Medical and diagnostic procedures assist doctors in understanding all of the previously mentioned aspects, yet they also allow doctors to determine whether the chosen treatment is effective in curing or halting the progression of a specific condition. Furthermore, manufacturers are concentrating their efforts on the development of novel technologies that can aid in the accurate diagnosis and treatment of diseases.

- In 2022, the orthopedic segment accounted for the largest revenue share over the forecast period.

On the basis of application, the Japan medical device market is segmented into orthopedic, cardiovascular, oncology, dental, gynecology and urology, ophthalmology, dermatology, and others. Among these, the orthopedic segment has the largest revenue share over the forecast period. Orthopedic treat a wide range of acute and chronic musculoskeletal conditions using specialized medical, surgical, physical, and rehabilitative methods. The increased use of these devices for joint restoration, trauma fixation, spinal disorders, and partial and total knee and hip joint fixation will drive market growth in this segment.

- In 2022, the hospitals segment is expected to hold the largest share of the Japan medical devices market during the forecast period.

Based on the end user, the Japan medical device market is classified into hospitals, diagnostic laboratories. Among these, the hospitals segment is expected to hold the largest share of the Japan medical device market during the forecast period. Hospitals are growing during the forecast period due to increased funding for small and medium-sized clinics and long-term care centres worldwide by public and private players to improve healthcare infrastructure. The growing emphasis of healthcare agencies and the government on the development of healthcare infrastructure and routine diagnosis and treatment of patients has resulted in increased awareness among the general population, which is propelling market growth during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Medical Device Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Olympus

- Terumo

- Nipro

- Nihon Kohden

- Fukuda

- Omron

- Konica Minolta

- Menicon

- Shimadzu Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On August 2023, ITOCHU Announces the Launch of One-Stop Support Services for Medical Device Development and Sales in Japan.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Medical Device Market based on the below-mentioned segments:

Japan Medical Device Market, By Product

- Medical And Diagnostic Equipment

- Consumables And Supplies

- Implants

Japan Medical Device Market, By Application Type

- Orthopedic

- Cardiovascular

- Oncology

- Dental

- Gynecology And Urology

- Ophthalmology

- Dermatology

- Others

Japan Medical Device Market, By End User

- Hospitals

- Diagnostic Laboratories

Need help to buy this report?