Japan Meat Processing Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type (Slicing, Bending, Dicing, Grinding, and Massaging & Marinating), By Meat Type (Beef, Mutton, Pork, and Others), and Japan Meat Processing Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Meat Processing Equipment Market Insights Forecasts to 2035

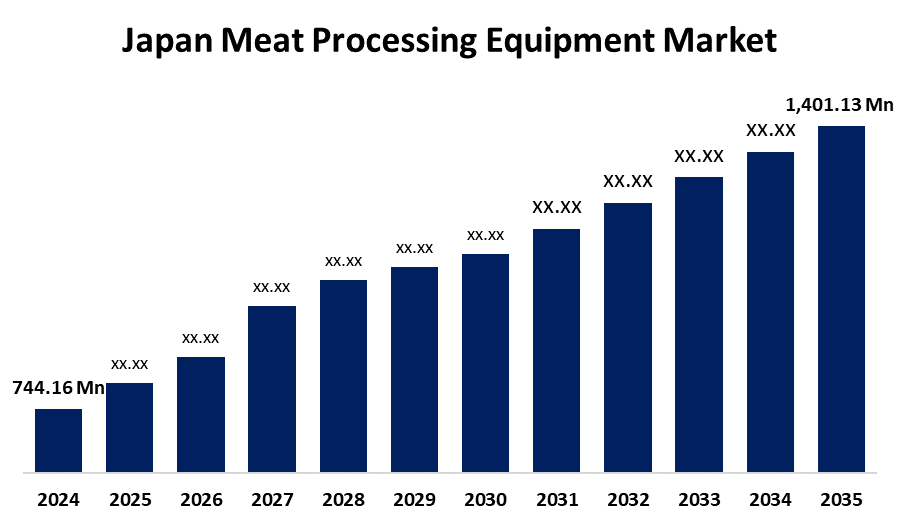

- The Japan Meat Processing Equipment Market Size was estimated at USD 744.16 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.92% from 2025 to 2035

- The Japan Meat Processing Equipment Market Size is Expected to Reach USD 1,401.13 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Meat Processing Equipment Market is anticipated to reach USD 1,401.13 million by 2035, growing at a CAGR of 5.92% from 2025 to 2035. Rising demand for processed and ready-to-eat meat products as a result of hectic lifestyles, improvements in automation, and food safety regulations are important factors that encourage investment in contemporary processing equipment.

Market Overview

The Japan meat processing equipment market refers to the industry focused on machinery used for processing meat, including slicing, grinding, marinating, and packaging. Japan's meat processing equipment market is changing as a result of the quick growth of alternative protein markets, which include plant-based and hybrid meat products. Food producers are expanding their product lines by adding plant-based proteins to their traditional animal products as consumers' concerns about sustainability and health grow. The need for specialist meat processing equipment that can handle different protein formulas and cutting-edge processing methods has increased as a result of this change. High-tech extrusion, mixing, and emulsification equipment is being purchased by businesses to create hybrid meat products that satisfy changing customer tastes. The demand for advanced meat processing solutions has also increased as a result of new processing techniques brought about by developments in food science and ingredient innovation.

Report Coverage

This research report categorizes the market for the Japan meat processing equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan meat processing equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan meat processing equipment market.

Japan Meat Processing Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 744.16 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.92% |

| 2035 Value Projection: | USD 1,401.13 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type, By Meat Type and COVID-19 Impact Analysis. |

| Companies covered:: | Mepaco, Minerva Omega Group s.r.l, Tomra Systems ASA, JBT, Nemco Food Equipment, LTD, RAM Beef Equipment, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for meat processing equipment in Japan is expanding due to a number of important factors. First, the demand for effective meat processing solutions has increased due to the growing consumption of processed and ready-to-eat meat products brought about by urbanization and busy lifestyles. Second, businesses are now investing in new processing equipment to ensure increased production while maintaining regulatory compliance, thanks to developments in automation and food safety standards. Furthermore, businesses are incorporating specialized machinery for the manufacture of hybrid meat and plant-based protein as a result of the growing demand for plant-based and alternative protein products. Furthermore, meat processors have adopted modern processing methods like high-pressure processing (HPP) and vacuum-sealed packaging solutions as a result of Japan's emphasis on sanitation, quality assurance, and minimizing food waste.

Restraining Factors

The high initial investment and ongoing maintenance costs of sophisticated meat processing equipment are among the main factors limiting the market for meat processing equipment in Japan. It is difficult for small and medium-sized businesses (SMEs) to implement automation, robotics, and IoT-enabled systems since they demand a large capital investment.

Market Segmentation

The Japan meat processing equipment market share is classified into type and platform.

- The slicing segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan meat processing equipment market is segmented by type into slicing, bending, dicing, grinding, and massaging & marinating. Among these, the slicing segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the growing need for precisely sliced meat products in the retail and catering industries, and slicing and dicing equipment commands a sizeable portion of the market.

- The pork segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan meat processing equipment market is segmented by platform into beef, mutton, pork, and others. Among these, the pork segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the popularity of processed pig products like ham and sausages, a significant portion of the equipment is used for processing pork.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan meat processing equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mepaco

- Minerva Omega Group s.r.l

- Tomra Systems ASA

- JBT

- Nemco Food Equipment, LTD

- RAM Beef Equipment

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Meat Processing Equipment Market based on the below-mentioned segments:

Japan Meat Processing Equipment Market, By Type

- Slicing

- Bending

- Dicing

- Grinding

- Massaging & Marinating

Japan Meat Processing Equipment Market, By Meat Type

- Beef

- Mutton

- Pork

- Others

Need help to buy this report?