Japan Managed Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Managed IT Infrastructure & Data Center, Managed Network, Managed Communication & Collaboration, Managed Information, Managed Security, and Others), By Deployment Type (On-premise and Cloud), and Japan Managed Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Managed Services Market Size Insights Forecasts to 2035

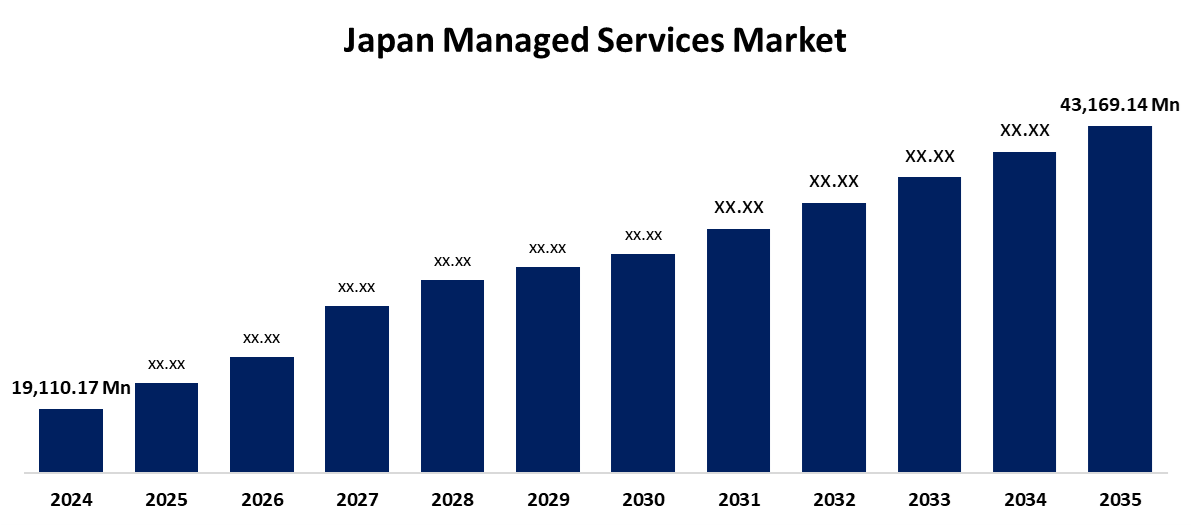

- The Japan Managed Services Market Size Was Estimated at USD 19,110.17 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.69% from 2025 to 2035

- The Japan Managed Services Market Size is Expected to Reach USD 43,169.14 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Managed Services Market Size is anticipated to reach USD 43,169.14 Million by 2035, growing at a CAGR of 7.69% from 2025 to 2035. The embrace of cloud computing, cybersecurity, and hybrid IT models by large corporations and SMEs fuels the digital transformation wave that has swept over Japan in recent years.

Market Overview

The Japan Managed Services Market refers to the outsourcing of IT operations such as network, cloud, security, and workplace management to third-party providers, helping organizations optimize performance, reduce costs, and focus on core business activities. The growing need for affordable IT solutions is one of the main factors propelling the managed services industry in Japan. Companies are always looking for methods to lower operating expenses without sacrificing or lowering the quality of their services. Businesses can reduce the requirement for sizable in-house teams by offloading the burden of infrastructure maintenance to managed service providers (MSPs) through the outsourcing of IT operations. This change allows companies to save a lot of money by concentrating their resources on core operations and depending on outside knowledge for IT support.

Report Coverage

This research report categorizes the market for the Japan managed services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan managed services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan managed services market.

Japan Managed Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19,110.17 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.69% |

| 2035 Value Projection: | USD 43,169.14 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Service Type, By Deployment Type and COVID-19 Impact Analysis |

| Companies covered:: | Fujitsu, NTT Data Group Corporation, Sentree, Fusion Systems Group, VeriServe, IBM Corporation, Accenture, Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for improved security, streamlined operations, and cost-effective IT is driving the managed services market in Japan. Businesses are increasingly turning to outsourcing IT services for increased scalability and flexibility as controlling their IT infrastructure becomes more complex. The industry is also expanding as a result of the quick uptake of automation, data analytics, and cloud-based solutions. With an emphasis on digital transformation projects, businesses are embracing managed services more and more to optimize their IT environments and remain competitive. This tendency is also influenced by the government's push for digitalization and the growth of remote labor, as companies look to cut expenses and increase operational efficiency.

Restraining Factors

Although managed services have many benefits, they are not widely adopted in Japan because of worries about data control and privacy, particularly in highly regulated industries like healthcare and banking. In-house IT teams are preferred by many traditional organizations because of cultural familiarity and trust. A lack of bilingual IT specialists for international service coordination and high upfront expenses for integration and transition are additional major obstacles. The long-term cost advantages of managed services are also not well known to some SMEs.

Market Segmentation

The Japan managed services market share is classified into service type and deployment type.

- The managed IT infrastructure & data center segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan managed services market is segmented by service type into managed IT infrastructure & data center, managed network, managed communication & collaboration, managed information, managed security, and others. Among these, the managed IT infrastructure & data center segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Managed IT Infrastructure & Data Center, the largest segment, offers organizations important IT infrastructure management services, such as network systems, servers, and data storage.

- The on-premise segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan managed services market is segmented by deployment type into on-premise and cloud. Among these, the on-premise segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. On-premise implementation is still useful for companies that need to have control over their data and IT infrastructure. Businesses in highly regulated sectors like finance and healthcare, where data security and compliance are of utmost importance, frequently favor it.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan managed services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujitsu

- NTT Data Group Corporation

- Sentree

- Fusion Systems Group

- VeriServe

- IBM Corporation

- Accenture

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Managed Services Market based on the below-mentioned segments:

Japan Managed Services Market, By Service Type

- Managed IT Infrastructure & Data Center

- Managed Network

- Managed Communication & Collaboration

- Managed Information

- Managed Security

- Others

Japan Managed Services Market, By Deployment Type

- On-premise

- Cloud

Need help to buy this report?