Japan Mammography Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Digital Systems, Analog Systems, Breast Tomosynthesis, and Other Product Types), By End Users (Hospitals, Specialty Clinics, and Diagnostic Centers), and Japan Mammography Market Insights, Industry Trend, Forecasts to 2032.

Industry: HealthcareJapan Mammography Market Insights Forecasts to 2030

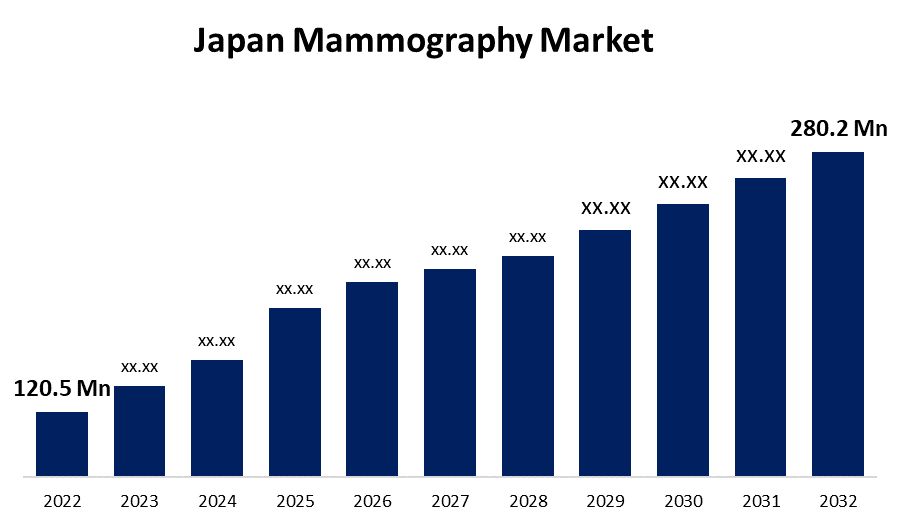

- The Japan Mammography Market Size was valued at USD 120.5 Million in 2022.

- The Market Size is Growing at a CAGR of 8.7% from 2022 to 2032

- The size is expected to reach USD 280.2 Million by 2032.

- The Japan Mammography Market key players are actively advertising their products to stay in the competition and capture the attention of consumers all over the world.

Get more details on this report -

The Japan Mammography Market Size was valued at USD 120.5 Million in 2022 and is expected to grow USD 280.2 Million by 2032, at a CAGR OF 8.7% from during the forecast period (2022-2032).

Market Overview

Mammography is a type of medical imaging that is often used to identify breast cancer. The Japan Mammography Market is a subset of the greater Japanese medical imaging market. The market is likely to expand in the coming years as the country's incidence of breast cancer rises and its older population grows. Furthermore, there is a growing awareness of the necessity of breast cancer screening in Japan, which is projected to fuel demand for mammography systems. Overall, the Japan Mammography Market is predicted to develop in the coming years as the incidence of breast cancer rises and people become more aware of the need for breast cancer screening. As technology advances, it is anticipated that new and novel mammography systems will be created, boosting market expansion even further.

Report Coverage

This research report categorizes the market of Japan mammography market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan mammography market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan mammography market.

Japan Mammography Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 120.5 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.7% |

| 2032 Value Projection: | USD 280.2 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By End Users, COVID-19 Impact Analysis |

| Companies covered:: | Analogic Corporation, Canon Medical Systems Corporation, Fujifilm Corporation, GE Healthcare, Hologic Inc., Koninklijke Philips NV, Siemens Healthineers, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The technical improvements in breast imaging and investments from various organizations in breast cancer screening campaigns are the primary drivers driving the market growth. Also, the rising prevalence of breast cancer in the country is a driving factor in the market's expansion. For example, according to GLOBOCAN statistics, approximately 92,024 new cases of breast cancer were reported in Japan in 2020. The rising number of breast cancer patients may create a great demand for a safe and precise diagnosis of the disease shortly. In Japan, there is a need to develop enhanced screening procedures or increase the imaging capabilities of mammography equipment to screen women aged 40-49 years due to higher breast density. As a result, there is a surge in the adoption of modern digital mammography devices with higher resolution and imaging capabilities. Therefore, the IS market being investigated is likely to grow rapidly in Japan.

Restraining Factors

Mammography systems can be costly to buy and operate, which may limit their availability to some healthcare providers. This may reduce the number of facilities able to provide breast cancer screening services. Also, some people may be hesitant to have mammography tests due to worries about radiation exposure. While mammography equipment is designed to reduce radiation exposure, some patients may be concerned about the potential dangers. Moreover, competition from alternative breast cancer screening methods may restrict the growth of Japan mammography market.

COVID 19 Impacts

COVID-19 had significant effects on the Japanese market analyzed since all non-emergency hospital visits were stopped. According to the comprehensive survey of living conditions (a population-based nationwide cross-sectional survey), the breast cancer screening rate in women aged 40 to 69 years in 2019 was roughly 48.9%, including both opportunistic and population-based screening. According to the same survey, which was conducted in the year 2020, these levels fell dramatically in the year 2020 due to the pandemic. The survey investigated the association between scheduled breast cancer screening cancellation or postponement, health-related factors, and socioeconomic situations. The conclusion said that out of 1,874 women who had an appointment for breast screening, approximately 26.3%, or 493 women, canceled their screening between April and May 2020. As a result, the results show that COVID-19 decreased the number of women attending hospitals for breast cancer screening, which the Japanese market evaluated.

Market Segment

- In 2022, breast tomosynthesis is dominating the largest market share over the forecast period.

On the basis of product types, the Japan mammography market is bifurcated into digital systems, analog systems, breast tomosynthesis, and other product types. Among these, breast tomosynthesis held the largest market share during the forecast period owing to there being an urgent need in Japan to develop alternative screening approaches or to improve the imaging capabilities of mammography equipment to screen women aged 40 to 49. This leads to the widespread use of modern digital mammography equipment with high resolution and imaging capabilities, and such research investigations boost breast tomosynthesis segment awareness and growth. Breast tomosynthesis, also known as Digital breast tomosynthesis (DBT)/3D mammography, is a new technology that aids radiologists in the diagnosis of breast cancer. These mammography techniques use a sequence of two-dimensional images to create a three-dimensional image of the breast. Kanako Ban claimed in the article she wrote 'Breast cancer screening using digital breast tomosynthesis compared to digital mammography alone for Japan Women published in 2021 that utilizing digital breast tomosynthesis (DBT) for breast cancer screening in Japanese women enhanced the recall rate.

- In 2022, the hospital segment is witnessing a higher growth rate during the forecast period

Based on the end users, the Japan mammography market are segmented into hospitals, specialty clinics, and diagnostic centers. Among these, the nanobiotechnology segment is expected to have a higher market share value during the forecast period. This is due to hospitals having the resources and infrastructure required to offer mammography services, such as the equipment, personnel, and space needed to operate mammography systems. Furthermore, many Japan hospitals have dedicated breast cancer facilities that provide complete breast cancer screening and treatment services, such as mammography.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan mammography market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Analogic Corporation

- Canon Medical Systems Corporation

- Fujifilm Corporation

- GE Healthcare

- Hologic Inc.

- Koninklijke Philips NV

- Siemens Healthineers

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2021, Kao Group announced the launch of a Pink Ribbon Campaign 2021 to raise awareness of breast cancer among Japan people and to promote mammography for cancer detection.

- In August 2021, FUJIFILM Holdings Corporation, a Japan provider of diagnostic imaging and medical informatics solutions, announced today that its ASPIRE Cristalle mammography system with digital breast tomosynthesis (DBT) now includes Screen Point Medical's new, FDA-cleared Transpara powered by Fusion AI for 2D and 3D mammography.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Japan Mammography Market based on the below-mentioned segments:

Japan Mammography Market, By Product Type

- Digital Systems

- Analog Systems

- Breast Tomosynthesis

- Other Product Types

Japan Mammography Market, By End Users

- Hospitals

- Specialty Clinics

- Diagnostic Centers

Need help to buy this report?