Japan Luxury Footwear Market Size, Share, and COVID-19 Impact Analysis, By Product (Formal Shoes and Casual Shoes), By End-Use (Men, Women, and Children), By Distribution Channel (Online and Offline), and Japan Luxury Footwear Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Luxury Footwear Market Insights Forecasts to 2035

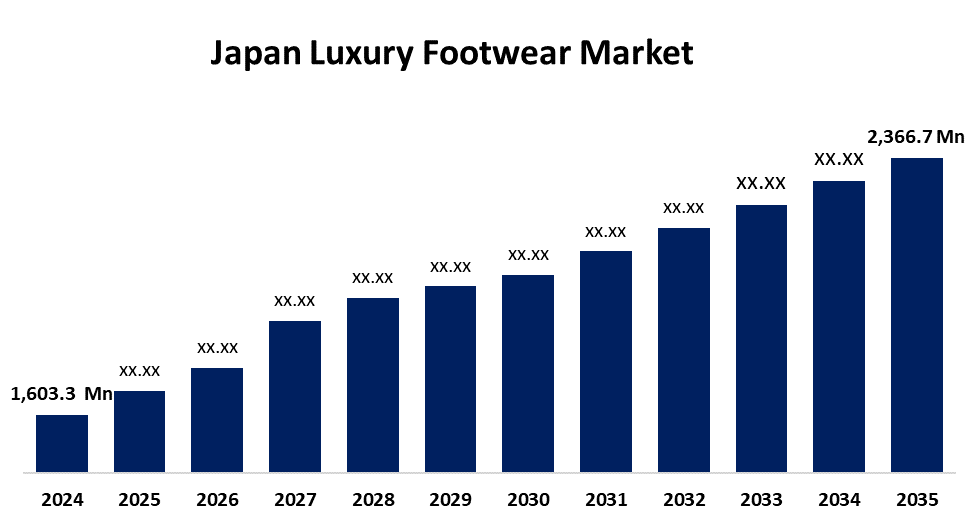

- The Japan Luxury Footwear Market Size Was Estimated at USD 1,603.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.60% from 2025 to 2035

- The Japan Luxury Footwear Market Size is Expected to Reach USD 2,366.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan luxury footwear market is anticipated to reach USD 2,366.7 million by 2035, growing at a CAGR of 3.60% from 2025 to 2035. The luxury footwear sector in Japan thrives with increasing discretionary incomes, increased brand awareness, and the growth of the tourism sector. Consumers focus on superior workmanship, durability, and elegance, which is inspiring demand for upmarket brands.

Market Overview

The luxury footwear market in Japan is referred to by an advanced consumer base that includes quality, craftsmanship, and subtle sophistication. Japan's upscale footwear sector is complemented by a strong domestic artisan sector with skills for high-quality, made-to-measure footwear. This implies Japanese luxury footwear retains a reputation as superior quality and well-crafted, such that it differentiates itself within the country market. The growing demand for luxury online shopping provides a wonderful opportunity for Japanese footwear market. Events like Tokyo Fashion Week and trade shows like Micam Tokyo play beneficial roles in linking luxury footwear businesses with local distributors, fueling market growth and brand awareness throughout Japan. Principal drivers for the growth of the market are rising disposable incomes, improved brand recognition, and an emerging tourism economy. In addition, collaborations among luxury houses and renowned designers have given rise to niche lines, capturing a variety of consumer tastes. Japan imposes strict quality and safety standards on imported footwear, such that products are of superior quality prior to being launched to market. Intellectual property laws are similarly strictly enforced to protect brand originality and avoid duplication, providing an environment conducive to long-term development and consumer loyalty.

Report Coverage

This research report categorizes the market for the Japan luxury footwear market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan luxury footwear market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan luxury footwear market.

Japan Luxury Footwear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,603.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.60% |

| 2035 Value Projection: | USD 2,366.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By End-Use, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Louis Vuitton Japan Co., Ltd, Onitsuka Tiger, ASICS Japan Co., Ltd, Guccio Gucci SpA, Prada S.p.A, Visvim, BERLUTI Japan Co., Ltd, J. Choo Limited, Caleres, Inc, UBIQ, Burberry Limited, Christian Louboutin LLC, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The luxury footwear market in Japan is driven by increased disposable incomes, increased fashion consciousness, and a strong taste for quality and craftsmanship. Urban consumers want quality, fashionable products that convey uniqueness and status. The collaborations between the luxury brand and Japanese designers also fuel demand. Furthermore, the shift towards sustainable and ethically made products also propels consumption behavior. The growth of e-commerce sites and luxury shopping experiences also feeds additional market expansion, accessible to more fashion-focused consumers, making luxury footwear more accessible.

Restraining Factors

The Japan luxury footwear market is limited by expensive product prices, silencing high-end consumers. Volatilities in the economy, shifting consumer preferences towards embracing minimalism, and stiff competition from overseas brands also challenge domestic expansion and brand loyalty in the industry.

Market Segmentation

The Japan luxury footwear market share is classified into product, end-use, and distribution channel.

- The formal shoes segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan luxury footwear market is segmented by product into formal shoes and casual shoes. Among these, the formal shoes segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the high demand from consumers is prefer elegance, quality, and status in their shoes, especially in business and official social events. Luxury formal shoes are typically constructed from superior materials and feature superior craftsmanship, which makes them expensive and appealing to consumers appreciate uniqueness and sophistication.

- The women segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan luxury footwear market is segmented by end-use into men, women, and children. Among these, the women segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the fact that women's extensive exposure to fashion and luxury products, where footwear is an essential part of fashion wear. Luxury women's footwear consists of a large number of styles ranging from designer heels to fashion flats, each aimed at offering exclusivity and a fashion statement that has universal appeal to female consumers of various ages.

- The offline segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan luxury footwear market is segmented by distribution channel into online and offline. Among these, the offline segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the demand for personalized customer service and the in-store shopping experience offered by offline retailers has grown. Luxury footwear customers prefer to experience the product first-hand, such as test-driving different styles and receiving customized advice from expert sales associates.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan luxury footwear market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Louis Vuitton Japan Co., Ltd

- Onitsuka Tiger

- ASICS Japan Co., Ltd

- Guccio Gucci SpA

- Prada S.p.A

- Visvim

- BERLUTI Japan Co., Ltd

- J. Choo Limited

- Caleres, Inc

- UBIQ

- Burberry Limited

- Christian Louboutin LLC

- Others

Recent Developments:

- In February 2025, AMIRI and Maison MIHARA YASUHIRO debuted a limited-sneaker collaboration that combines rock 'n' roll aesthetic and luxury streetwear. With special handcrafted soles and striking designs, the collaboration honors both brands' heritage and can be found only at select retail outlets globally.

- In December 2024, Japanese luxury footwear company Onitsuka Tiger, owned by Asics Corporation, is mulling the production of its shoes in India to avail itself of the growing premium footwear market there. With high double-digit growth and an announcement to increase the number of stores.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan luxury footwear market based on the below-mentioned segments:

Japan Luxury Footwear Market, By Product

- Formal Shoes

- Casual Shoes

Japan Luxury Footwear Market, By End-Use

- Men

- Women

- Children

Japan Luxury Footwear Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?