Japan Low Voltage Electric Motor Market Size, Share, and COVID-19 Impact Analysis, By Efficiency (Standard Efficiency, High Efficiency, Premium Efficiency, and Super Premium Efficiency), By Application (Pumps and Fans, Compressors, and Others), By End-Use (Commercial HVAC Industry, Food, Beverage and Tobacco Industry, Mining Industry, Utilities, and Others), and Japan Low Voltage Electric Motor Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsJapan Low Voltage Electric Motor Market Insights Forecasts to 2035

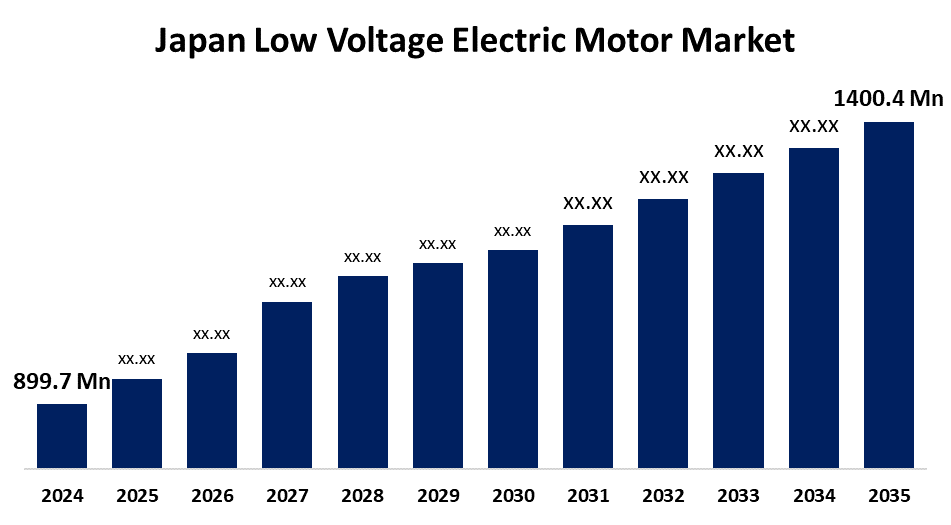

- The Japan Low Voltage Electric Motor Market Size Was Estimated at USD 899.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.1% from 2025 to 2035

- The Japan Low Voltage Electric Motor Market Size is Expected to Reach USD 1400.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Low Voltage Electric Motor Market Size is Anticipated to Reach USD 1400.4 Million by 2035, Growing at a CAGR of 4.1% from 2025 to 2035. The Japan low voltage electric motor market is increasing with stringent energy efficiency regulations, industrial automation growth, and growing electric vehicle adoption. Demand for sustainable motors in applications like robotics, automotive, HVAC systems, and consumer electronics drives this.

Market Overview

The Japan low voltage electric motor market refers to the industry devoted to motors of voltages under 1,000 volts, commonly utilized in operations such as HVAC equipment, industrial automation, consumer appliances, electric vehicles (EVs), and renewable energy systems. The motors are valued for their energy efficiency, reliability, and capacity to accommodate compact designs in power driven machinery. Its strengths are its modern engineering prowess, strong electronics and automotive sectors, and focus on precision manufacturing. The opportunities are to develop electric mobility, smart home appliances, and industrial upgrades. Market expansion is fueled by the growing uptake of sustainable technologies, increased demand in the manufacturing and automotive industries, and pressure for automation and intelligent manufacturing. Government policies that encourage energy saving, carbon neutrality, and electrification of transport, initiated by the Ministry of Economy, Trade and Industry (METI), facilitate the proliferation of optimized motors.

Report Coverage

This research report categorizes the market for the Japan low voltage electric motor market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan low voltage electric motor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan low voltage electric motor market.

Japan Low Voltage Electric Motor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 899.7 Million |

| Forecast Period: | 2024-2035 |

| 2035 Value Projection: | USD 1400.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Efficiency, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Nidec Motor Corporation, ABB, Fuji Electric, Yaskawa Electric Corporation, Toshiba, Oriental Motor, Siemens, Johnson Electric, Mitsubishi Electric Corporation, Hitachi, Regal Rexnord Corporation, HD Hyundai Electric Co., Ltd., TECO Electric & Machinery Co. Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan low voltage electric motor market is experiencing growing demand for sustainable technologies, rising industrial automation, and increased adoption of electric vehicles. Growing applications in HVAC systems, smart appliances, and renewable energy systems also drive market expansion. Japan robust manufacturing industry, technological sophistication, and drive towards carbon neutrality improve market potential. Government policies encouraging energy conservation and electrification in transport and industry also assist in the adoption of low voltage electric motors by different sectors.

Restraining Factors

The Japan low voltage electric motor is constrained by high upfront expenses, intricate integration with existing systems, and dependence on foreign raw materials. Also, supply chain interruption and lack of awareness in small industries restrict wider usage and deployment.

Market Segmentation

The Japan low voltage electric motor market share is classified into efficiency, application, and end-use.

- The high efficiency segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan low voltage electric motor market is segmented by efficiency into standard efficiency, high efficiency, premium efficiency, and super premium efficiency. Among these, the high efficiency segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its optimal value in cost versus performance, adherence to regulatory requirements, and universal industrial acceptance. IE2 motors provide energy savings compared to conventional motors without the higher initial cost of premium or super-premium motors, thus being commercially attractive.

- The pumps and fans segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan low voltage electric motor market is segmented by application into pumps and fans, compressors, and others. Among these, the pumps and fans segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to their widespread application in industrial, commercial HVAC, agricultural, and water-management systems, where energy efficiency, robustness, and universal applicability render them the preponderant among use cases.

- The commercial HVAC industry segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan low voltage electric motor market is segmented by end-use into commercial HVAC industry, food, beverage and tobacco industry, mining industry, utilities, and others. Among these, the commercial HVAC industry segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to they provide wide application in commercial and industrial structures for HVAC installations, fueled by stringent sustainable regulations, increased construction and retrofit activity, and robust demand for energy-conserving, high-performance motors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan low voltage electric motor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nidec Motor Corporation

- ABB

- Fuji Electric

- Yaskawa Electric Corporation

- Toshiba

- Oriental Motor

- Siemens

- Johnson Electric

- Mitsubishi Electric Corporation

- Hitachi

- Regal Rexnord Corporation

- HD Hyundai Electric Co., Ltd.

- TECO Electric & Machinery Co. Ltd.

- Others

Recent Developments:

- In March 2025, Toshiba began mass production of the TB9103FTG gate driver IC for automotive brushed DC motors used in power windows, seats, and door locks. Compact and efficient, it supports H-bridge/half-bridge setups, aids vehicle electrification, and meets AEC-Q100 Grade 1 standards for improved system miniaturization.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan low voltage electric motor market based on the below-mentioned segments:

Japan Low Voltage Electric Motor Market, By Efficiency

- Standard Efficiency

- High Efficiency

- Premium Efficiency

- Super Premium Efficiency

Japan Low Voltage Electric Motor Market, By Application

- Pumps and Fans

- Compressors

- Others

Japan Low Voltage Electric Motor Market, By End-Use

- Commercial HVAC Industry

- Food, Beverage & Tobacco Industry

- Mining Industry

- Utilities

- Others

Need help to buy this report?