Japan Litigation Funding Investment Market Size, Share, and COVID-19 Impact Analysis, By Type (Single Case Funding, Portfolio Funding, and Law Firm Financing), By Application (Commercial Litigation, Bankruptcy Claims, International Arbitration, Intellectual Property Disputes, and Others), and Japan Litigation Funding Investment Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialJapan Litigation Funding Investment Market Insights Forecasts to 2033

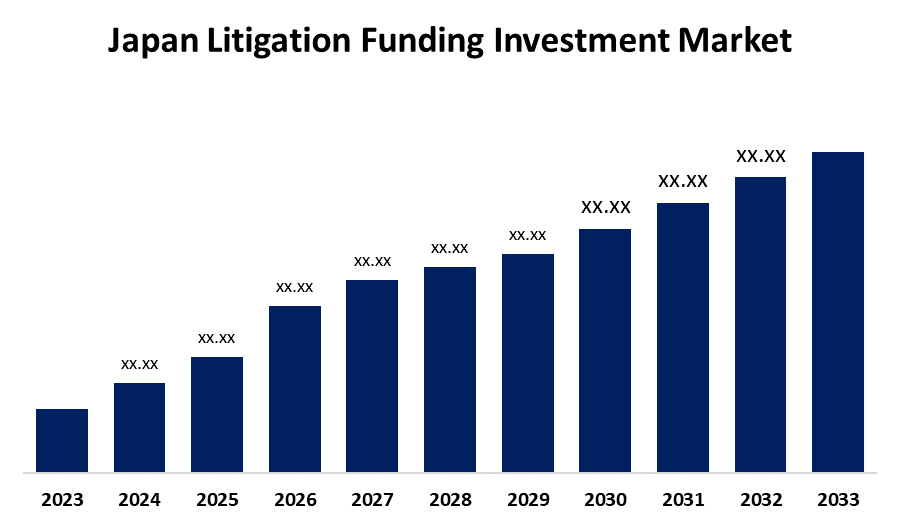

- The Japan Litigation Funding Investment Market Size is Growing at a CAGR of 10.53% from 2023 to 2033

- The Japan Litigation Funding Investment Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Japan Litigation Funding Investment Market Size is Anticipated to hold a significant share by 2033, Growing at a CAGR of 10.53% from 2023 to 2033.

Market Overview

The Japan litigation funding investment market refers to the industry focused on third-party financing for legal cases in Japan, enabling plaintiffs to pursue claims without bearing the full financial burden. The growing complexity of Japanese court cases, particularly in areas like intellectual property, business disputes, and international arbitration, is another important factor propelling the country's litigation financing investment market. In order to litigate these disputes successfully in Japan, significant financial and expert resources are frequently needed. Japanese litigation finance firms increase the likelihood of a successful outcome by providing both financial assistance and strategic knowledge. Involving litigation funders in Japan also lends legitimacy to the cases they decide to fund, which facilitates the recruitment of top legal resources and expertise in Japan.

Report Coverage

This research report categorizes the market for the Japan litigation funding investment based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan litigation funding investment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan litigation funding investment market.

Japan Litigation Funding Investment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.53% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Panasonic Corporation Hitachi Ltd. Sony Corporation Toshiba Corporation Sharp Corporation NEC Corporation Fujitsu Limited Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors propelling the expansion of the Japan litigation financing investment market is the rising cost of court disputes, which has increased demand for third-party funding sources. Legal expenditures, court costs, and the financial strain of lengthy litigation make it difficult for many individuals and organizations in Japan to pursue valid claims. In Japan, litigation funding gives plaintiffs the financial means to pursue court actions without having to pay up front, democratizing access to legal remedy. This trend is growing more relevant because legal costs are increasing in Japan. The Japan litigation finance investment industry is growing as a result of the country's strong emphasis on financial innovation and legal accessibility, providing options to reduce the financial burden of judicial processes.

Restraining Factors

The possibility of legal ambiguities and regulatory obstacles is one of the main dangers. Some jurisdictions may apply limits or rules that could hinder the market's expansion, even while others are gradually acknowledging and formalizing the importance of litigation finance.

Market Segmentation

The Japan litigation funding investment market share is classified into type and application.

- The single case funding segment is expected to hold a significant market share through the forecast period.

The Japan litigation funding investment market is segmented by type into single case funding, portfolio funding, and law firm financing. Among these, the single case funding segment is expected to hold a significant market share through the forecast period. The funder frequently conducts thorough due diligence when funding a single case in order to evaluate the case's merits and possible profits. Personal injury and high-value business litigation frequently include this kind of funding.

- The commercial litigation segment is expected to hold a significant market share through the forecast period.

The Japan litigation funding investment market is segmented by application into commercial litigation, bankruptcy claims, international arbitration, intellectual property disputes, and others. Among these, the commercial litigation segment is expected to hold a significant market share through the forecast period. One of the most important uses is commercial litigation, which deals with problems between companies about things like antitrust violations, shareholder conflicts, and contract breaches.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan litigation funding investment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Panasonic Corporation

- Hitachi Ltd.

- Sony Corporation

- Toshiba Corporation

- Sharp Corporation

- NEC Corporation

- Fujitsu Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Litigation Funding Investment Market based on the below-mentioned segments:

Japan Litigation Funding Investment Market, By Type

- Single Case Funding

- Portfolio Funding

- Law Firm Financing

Japan Litigation Funding Investment Market, By Application

- Commercial Litigation

- Bankruptcy Claims

- International Arbitration

- Intellectual Property Disputes

- Others

Need help to buy this report?