Japan Liquid Macrofiltration Filters Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bag Filters, Cartridge Filters, and Others), By Application (Water & Wastewater Treatment, Chemical & Petrochemical, Food & Beverage, Pharmaceutical, Power Generation, and Others), By End-User (Industrial, Municipal, and Residential), and Japan Liquid Macrofiltration Filters Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Liquid Macrofiltration Filters Market Insights Forecasts to 2035

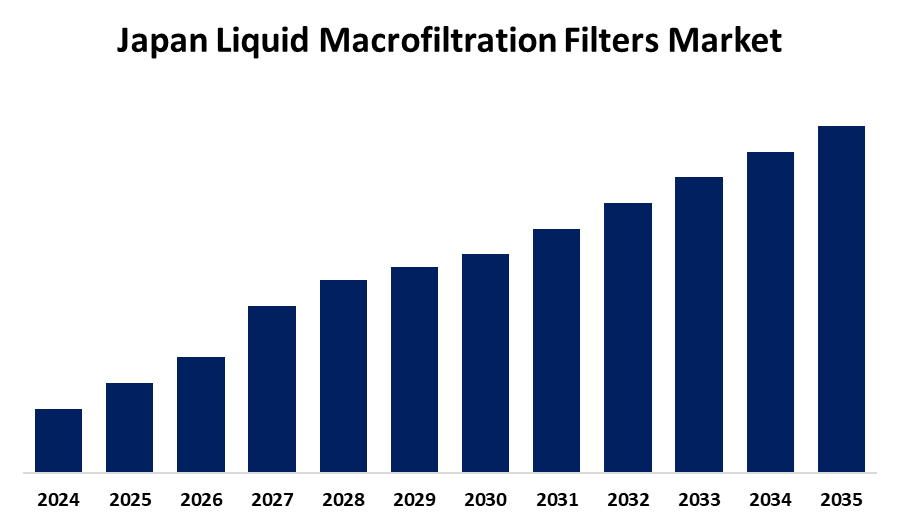

- The Japan Liquid Macrofiltration Filters Market Size is Expected to Grow at a CAGR of 8.3% from 2025 to 2035

- The Japan Liquid Macrofiltration Filters Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Liquid Macrofiltration Filters Market Size is Expected to Hold a Significant Share by 2035, at a CAGR of 8.3% during the forecast period 2025-2035. The Japan liquid macrofiltration filters market is growing due to increasing demand for pure water, industrial growth, and environmental laws. Market increase is also prompted by new technology in filtration and the focus on green practices.

Market Overview

The Japan Liquid Macrofiltration Filters Market Size can be defined as systems that remove larger particles, including suspended solids and rubbish, from wastewater, process streams, and water using cartridges, bag filters, filter presses, and mesh screens. Extensively applied across water or wastewater treatment, chemical, pharma, food & beverage, mining, and pulp & paper sectors, these filters provide product quality, operational efficiency, and regulatory compliance. It boasts Japans advanced filtration technology, strong industrial base, and focus on quality control and environmental preservation. Opportunities lie in the innovation of AI or IoT-based monitoring, green modular systems, and growth in pharmaceuticals and high-purity sectors. Market drivers include Japans high environmental standards, fears of water shortages and subsequent recycling and reuse, and active industrial growth in its core industries such as chemicals and electronics. Government initiatives, including high-quality water standards, investment in wastewater facilities, and regulations for enforcement, drive the adoption of macrofiltration systems for environmental protection and public health.

Report Coverage

This research report categorizes the market for the Japan liquid macrofiltration filters market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan liquid macrofiltration filters market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan liquid macrofiltration filters market.

Japan Liquid Macrofiltration Filters Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.3% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Mitsubishi Chemical Aqua Solutions, Toray Industries, Avidity Science, Fuji Filter Manufacturing, Nippon Micro Filter Co., Ltd., Asahi Filter MFG. Co., Ltd., F-tech Inc., Kurita Water Industries, Noritake Co., Limited, Mahle Filter Systems Japan, and Other Key Comapnies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan liquid macrofiltration filters market is driven by stringent environmental regulations, growing need for pure water, and the need for effective wastewater treatment across all industries. Growth in industries of chemicals, food & beverages, and pharmaceuticals drives filtration needs. Water scarcity situations are compelling reusing and recycling operations. Technological improvements in filtration, along with greater investment in water infrastructure and sustainability initiatives, support the widening application of macrofiltration systems across Japans industrial base.

Restraining Factors

The Japan liquid macrofiltration filters market is hampered by high initial installation and maintenance costs, low efficiency in removing fine particles, competition from other technologies, and slow take-up in small industries due to budget constraints and a lack of awareness.

Market Segmentation

The Japan liquid macrofiltration filters market share is classified into product type, application, and end-user.

- The bag filters segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan liquid macrofiltration filters market is segmented by product type into bag filters, cartridge filters, and others. Among these, the bag filters segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they are economical and effective in the treatment of high volumes of liquids. Bag filters are utilized most predominantly in industries like chemicals, petrochemicals, and food & beverage, where they are applied for the separation of particulate contaminants from liquid streams.

- The water & wastewater treatment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan liquid macrofiltration filters market is segmented by application into water & wastewater treatment, chemical & petrochemical, food & beverage, pharmaceutical, power generation, and others. Among these, the water & wastewater treatment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to increasing demand for clean water and stricter environmental regulations. This industry retains its popularity during the period, as increasing urbanization and industrial processes call for efficient wastewater management solutions.

- The industrial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan liquid macrofiltration filters market is segmented by end-user into industrial, municipal, and residential. Among these, the industrial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the need for clean process water and removal of particulate contaminants in a number of industrial applications. Chemical, pharma, food & beverage, and power generation industries require efficient filtration solutions for product quality and equipment integrity maintenance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations or companies involved within the Japan liquid macrofiltration filters market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Chemical Aqua Solutions

- Toray Industries

- Avidity Science

- Fuji Filter Manufacturing

- Nippon Micro Filter Co., Ltd.

- Asahi Filter MFG. Co., Ltd.

- F-tech Inc.

- Kurita Water Industries

- Noritake Co., Limited

- Mahle Filter Systems Japan

- Others

Recent Developments:

- In October 2024, Asahi Kasei Medical released Planova™ FG1, a next-generation higher-flux virus removal filter for the manufacture of biotherapeutics. Its bioprocess business encompasses Planova™ filters, associated equipment, biosafety testing services, and CDMO operations for plasma-derived products and biopharmaceuticals.

- In May 2021, Toray Industries released the Torayvino Branch home water purifier in Japan. Released under the Torayvino brand, which was first introduced in 1986, the Branch is Japans first-ever purifier that allows users to switch between tap water and purified water easily by raising a faucet handle.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan liquid macrofiltration filters market based on the below-mentioned segments:

Japan Liquid Macrofiltration Filters Market, By Product Type

- Bag Filters

- Cartridge Filters

- Others

Japan Liquid Macrofiltration Filters Market, By Application

- Water & Wastewater Treatment

- Chemical & Petrochemical

- Food & Beverage

- Pharmaceutical

- Power Generation

- Others

Japan Liquid Macrofiltration Filters Market, By End-User

- Industrial

- Municipal

- Residential

Need help to buy this report?