Japan Liquid Biopsy Market Size, Share, and COVID-19 Impact Analysis, By Biomarker (Circulating Tumor Cells, Extracellular Vehicles, and Others), By Technology (Multi-gene parallel Analysis (NGS) and Single Gene Analysis (PCR Microarrays)), and Japan Liquid Biopsy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Liquid Biopsy Market Insights Forecasts to 2035

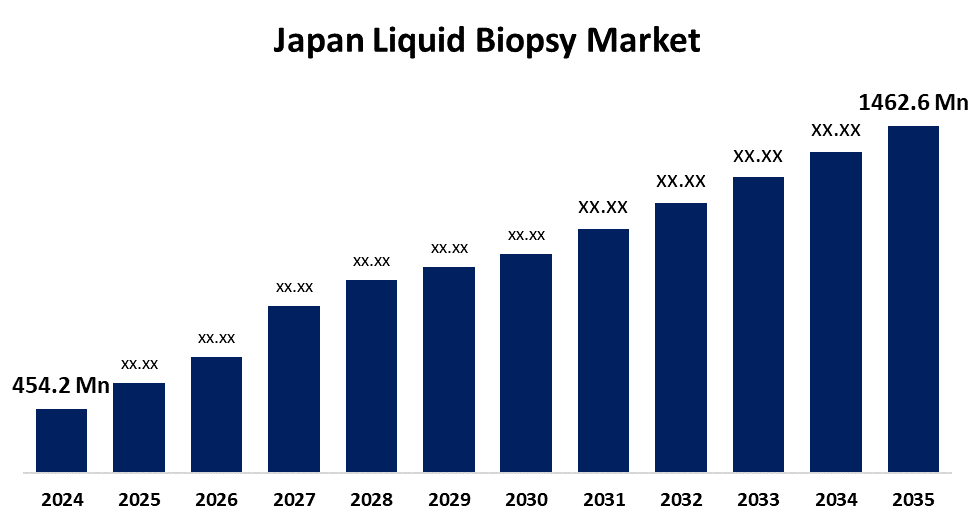

- The Japan Liquid Biopsy Market Size Was Estimated at USD 454.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.22 % from 2025 to 2035

- The Japan Liquid Biopsy Market Size is Expected to Reach USD 1462.6 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Liquid Biopsy Market Size is anticipated to Reach USD 1462.6 Million by 2035, Growing at a CAGR of 11.22 % from 2025 to 2035. The liquid biopsy market in Japan is driven by various factors, including growing emphasis on non-invasive diagnostic methods, an increase in the prevalence of cancer, technological advancements, and government support and regulatory approvals.

Market Overview

A liquid biopsy is a non-invasive diagnostic technique that examines a sample of blood or another physiological fluid to identify and track several biomarkers linked to conditions like cancer, including circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs). The Japan liquid biopsy market refers to the development, manufacturing, distribution, and commercialization of technologies and services to analyze body fluids. It is used in hospitals and laboratories, specialty clinics, academic and research centres, and others. Liquid biopsies are being used by medical experts more often to create personalized treatment regimens based on the genetic makeup of tumors. Japan is experiencing a sharp rise in cancer cases, with around 1 million new cases reported recently, emphasizing the urgent need for effective diagnostics. Liquid biopsy, being non-invasive and real-time, is gaining importance. Support from organizations like the Japan Society of Clinical Oncology is further driving its market growth. Increased collaboration between academic institutions and biotech firms is set to drive innovation in liquid biopsy technologies, spurred by the demand for better cancer detection solutions.

Report Coverage

This research report categorizes the market for the Japan liquid biopsy market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan liquid biopsy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan liquid biopsy market.

Japan Liquid Biopsy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 454.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 11.22 % |

| 2035 Value Projection: | USD 1462.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Biomarker, By Technology |

| Companies covered:: | Fujirebio, Sysmex Corporation, Daiichi Sankyo, Natera, Chugai Pharmaceutical, Guardant Health, HaploX, MiRXES Japan Co., Ltd., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan is experiencing significant growth in cancer cases, which creates the demand for effective cancer diagnostics and monitoring methods is one of the key driving factors for this market. New developments in digital droplet PCR and next-generation sequencing (NGS) are transforming the potential of liquid biopsy diagnostics. New developments in digital droplet PCR and next-generation sequencing (NGS) are transforming the potential of liquid biopsy diagnostics, which further expands the market. Japan's government is supporting liquid biopsy through faster PMDA approvals and research partnerships, ensuring safety and boosting market growth. Japan is shifting toward personalized medicine, with liquid biopsy enabling real-time tumor profiling for tailored treatments. Educational efforts and clinician adoption are driving strong demand in the liquid biopsy market.

Restraining Factors

The affordability of liquid biopsy is limited by its reliance on expensive technology such as NGS and biomarker detection. Accessibility is reduced by this high cost, particularly in healthcare systems with inadequate funding. Additionally, strict regulations further led to the delay of product approval and market entry.

Market Segmentation

The Japan liquid biopsy market share is classified into biomarker and technology.

- The circulating tumor cells segment held a significant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan liquid biopsy market is segmented by biomarker into circulating tumor cells, extracellular vesicles, and others. Among these, the circulating tumor cells segment held a significant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period. This segmental growth is attributed to its widespread application associated with circulating tumor DNA in the liquid biopsy of cancer. Additionally, a new technique for the early detection of cancer made the possible for the identification of aberrant circulating DNA from cancer cells.

- The multi-gene parallel analysis (NGS) segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan liquid biopsy market is segmented by technology into multi-gene parallel analysis (NGS) and single gene analysis (PCR microarrays). Among these, the multi-gene parallel analysis (NGS) segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to NGS allows the detection of various tumor-causing mutations. Additionally, fast advancements in NGS technology have resulted in considerable cost savings for highly accurate sequencing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan liquid biopsy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujirebio

- Sysmex Corporation

- Daiichi Sankyo

- Natera

- Chugai Pharmaceutical

- Guardant Health

- HaploX

- MiRXES Japan Co., Ltd.

- Others

Recent Developments

- In March 2022, Guardant Health, Inc., a global leader in precision oncology, announced that Japan’s Ministry of Health, Labour and Welfare (MHLW) had granted regulatory approval for Guardant360 CDx, a liquid biopsy test designed for comprehensive genomic profiling in patients with advanced solid tumors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan liquid biopsy market based on the below-mentioned segments:

Japan Liquid Biopsy Market, By Biomarker

- Circulating Tumor Cells

- Extracellular Vehicles

- Others

Japan Liquid Biopsy Market, By Technology

- Multi-gene parallel Analysis (NGS)

- Single Gene Analysis (PCR Microarrays)

Need help to buy this report?