Japan Liquefied Petroleum Gas (LPG) Vehicles Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Bio-Fuel LPG and Mono LPG), Vehicle Type (Passenger, Light Commercial and Heavy Commercial Vehicles), and Sales Channel (OEM and Aftermarket), and Japan Liquefied Petroleum Gas (LPG) Vehicles Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationJapan Liquefied Petroleum Gas (LPG) Vehicles Market Insights Forecasts to 2035

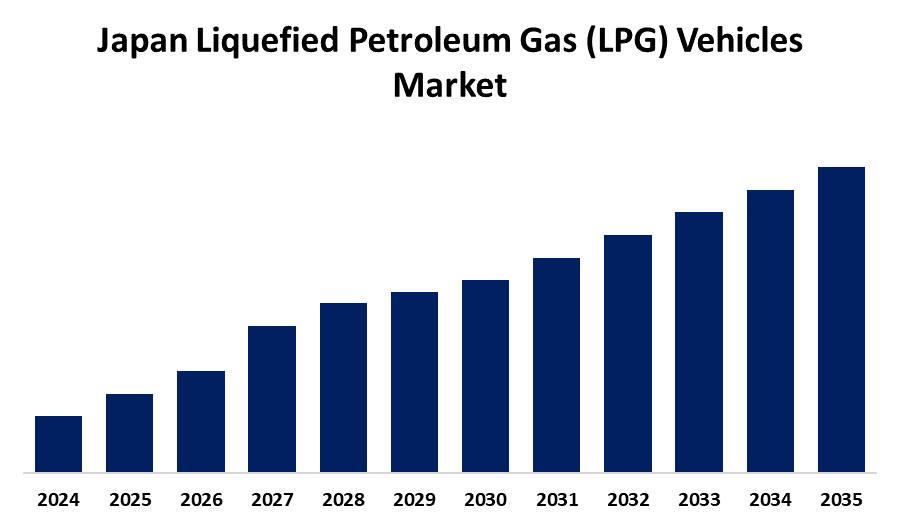

- The Japan liquefied petroleum gas (LPG) vehicles Market Size is Expected to grow at a CAGR of XX% from 2025 to 2035

- The Japan Liquefied Petroleum Gas (LPG) Vehicles Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Liquefied Petroleum Gas (LPG) Vehicles Market is Expected to hold a significant share By 2035, Growing at a CAGR of XX% from 2025 to 2035. The Japan liquefied petroleum gas (LPG) market, including automotive, is experiencing growth due to reasons like increased demand for cleaner fuels, incentives by the government for alternative fuel vehicles, and the potential of LPG in the shipping fuel market.

Market Overview

Japan liquefied petroleum gas (LPG) vehicles market describes demand for, and consumption of, LPG in Japan's motor vehicle sector, mainly as fuel for motor vehicles. Liquefied petroleum gas, also known as LP gas or LPG, is a fuel in gaseous form composed of a combustible mixture of hydrocarbon gases in propane and butane forms. It is a replacement for diesel and gasoline, with such advantages as lower fuel costs and fewer emissions. Japan has a background of LPG use, especially as a secure source of fuel owing to its dependence on imported oil. The LPG industry is growing as a result of drivers such as rising natural gas supply, virtual pipeline technology, and the demand for cleaner, more efficient fuels. Japan's LPG vehicles market offers business opportunities in the domestic market with millions of offices, homes, and commercial premises that rely on LPG. Besides, there's a less costly alternative that LPG is about power in particular, from electricity for uses such as heating, and further opportunities from developing in marine fuels. Internet of Things (IoT) and Artificial Intelligence (AI) technologies are under research to make LPG logistics and infrastructure more efficient and safer. The government of Japan supports encouraging the consumption of liquefied petroleum gas (LPG) in vehicles by implementing measures to curb emissions and ensure cleaner fuels. This involves the promotion of CNG and LPG dual-fuel vehicles, particularly in cities, where air quality must be sustained. The government is further implementing measures to increase the infrastructure for LPG fuel stations, hence making it more available. The Japan liquefied petroleum gas (LPG) vehicles market is largely influenced by the increasing use of LPG as a cleaner fuel, its relatively lower price than traditional fuels, and growing governmental encouragement for alternative fuels.

Report Coverage

This research report categorizes the market for the Japan liquefied petroleum gas (LPG) vehicles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan liquefied petroleum gas (LPG) vehicles market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan liquefied petroleum gas (LPG) vehicles Market.

Japan Liquefied Petroleum Gas (LPG) Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Fuel Type, By Vehicle Type, By Sales Channel and COVID-19 Impact Analysis |

| Companies covered:: | Nissan Motor Corporation, ExxonMobil, ENEOS Globe Corporation, BP PLC, Suzuki Motor Corporation, Royal Dutch Shell, Honda Motor Company, Kawasaki Kisen Kaisha, Ltd., Ford Motor Company, Vehicle Energy Japan Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased public cognizance regarding the benefits associated with the substitution of fossil fuel with LPG and the rapid adoption of cleaner, greener sources of energy in developed countries, as well as emerging economies, are two drivers most likely to push the market size of LPG. Moreover, factors of technology coupled with the rise in government policies to educate rural people to change from LPG to traditional cooking fuels such as kerosene, wood, and coal are expected to contribute significantly towards the growth of the industry. The market will grow as a result of increasing population and increased demand for liquefied petroleum gas as an automobile emission gas. In particular, the high penetration of LPG for domestic and commercial purposes and as a petrochemical feedstock fuel drives the market. Moreover, the growing focus on sustainable energy solutions and the aspiration to decrease carbon footprints drive the market further. The rise in the number of cars that are produced and converted to use LPG, especially in those countries with tougher emissions controls, drives demand for the automobile market.

Restraining Factors

The key constraining factors in the Japanese LPG automotive market are safety, competition from substitute fuels such as electric and natural gas, and possible constraining issues relating to infrastructure and costs of logistics. These aspects are capable of preventing the Japanese LPG automobile market from expanding. Import and export restrictions, combined with trade restrictions, can restrict the supply and affordability of LPG, inhibiting market growth

Market Segmentation

The Japan liquefied petroleum gas (LPG) vehicles market share is classified into fuel type, vehicle type, and sales channel

- The bio-fuel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan liquefied petroleum gas (LPG) vehicles market is segmented by fuel type into bio-fuel LPG and mono LPG. Among these, the bio-fuel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Bio-Fuel LPG is gaining traction due to increasing environmental concerns and government incentives promoting renewable energy sources. The bio-fuel LPG is obtained from renewable biological materials, including plant and animal products. It is considered more environmentally friendly due to its lower carbon footprint compared to conventional LPG.

- The light commercial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan liquefied petroleum gas (LPG) vehicles market is segmented by vehicle type into passenger, light commercial, and heavy commercial. Among these, the light commercial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. LCVs include vans and small trucks, which are used to carry goods and services. LPG-based LCVs are preferred by companies due they provide cost efficiency and environmental friendliness, particularly in urban locations with high standards for emissions.

- The OEM segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan liquefied petroleum gas (LPG) vehicles market is segmented by sales channel into OEM and aftermarket. Among these, the OEM segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Japan has a well-developed LPG refueling station network, which enables the extensive usage of LPG vehicles. This infrastructure complements the OEM channel of sales by providing consumers with convenient access to refueling. The vehicles sold through OEM channels tend to be backed by guarantees and warranties of quality, making them attractive to consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan liquefied petroleum gas (LPG) vehicles market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nissan Motor Corporation

- ExxonMobil

- ENEOS Globe Corporation

- BP PLC

- Suzuki Motor Corporation

- Royal Dutch Shell

- Honda Motor Company

- Kawasaki Kisen Kaisha, Ltd.

- Ford Motor Company

- Vehicle Energy Japan Inc.

- Others

Recent Developments:

- In September 2022, Nissan Motor Co., Ltd. announced to acquisition of shares in Vehicle Energy Japan Inc., a company engaged in the automotive lithium-ion batteries business. Nissan will acquire the shares after the completion of regulatory procedures, including necessary approvals and permissions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan liquefied petroleum gas (LPG) vehicles market based on the below-mentioned segments

Japan Liquefied Petroleum Gas (LPG) Vehicles Market, By Fuel Type

- Bio-Fuel LPG

- Mono LPG

Japan Liquefied Petroleum Gas (LPG) Vehicles Market, By Vehicle Type

- Passenger

- Light Commercial

- Heavy Commercial

Japan Liquefied Petroleum Gas (LPG) Vehicles Market, By Sales Channel

- OEM

- Aftermarket

Need help to buy this report?