Japan Investor Relationship Management Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment Type (Cloud-Based, On-Premises, and SaaS), By Application (Large Enterprises, Medium Enterprises, and Small Enterprises), and Japan Investor Relationship Management Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Investor Relationship Management Software Market Size Insights Forecasts to 2035

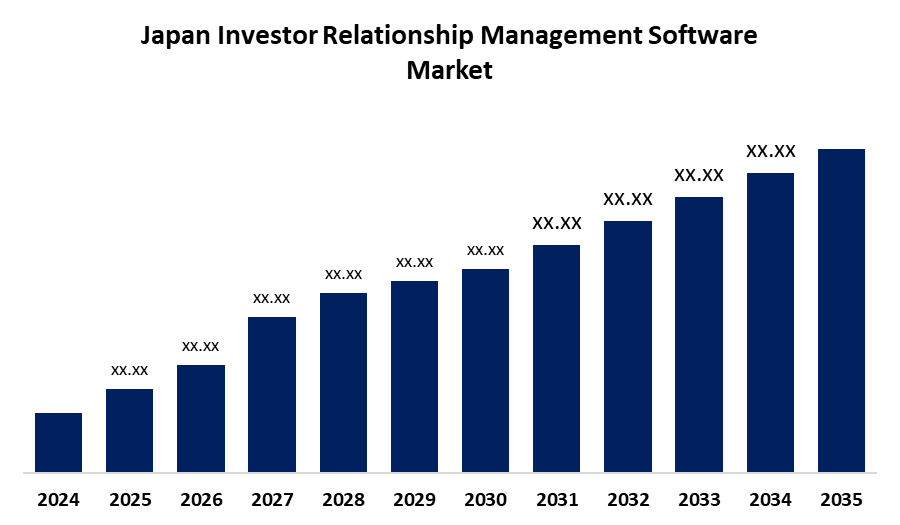

- The Japan Investor Relationship Management Software Market Size is Expected to Grow at a CAGR of around 11.4% from 2025 to 2035

- The Japan Investor Relationship Management Software Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Investor Relationship Management Software Market Size is Anticipated to hold a significant share by 2035, growing at a CAGR of 11.4% from 2025 to 2035. This is due to increasing adoption of digital tools for investor engagement and the rising demand for transparent, real-time financial communication. Additionally, regulatory emphasis on corporate governance is driving the need for efficient IRM solutions.

Market Overview

The Japan investor relationship management (IRM) software market refers to the sector encompassing digital platforms and tools used by Japanese companies to manage communications and relationships with their investors. These software solutions help streamline tasks such as shareholder engagement, financial reporting, regulatory compliance, and investor analytics, enhancing transparency, trust, and operational efficiency in investor relations practices within Japan’s corporate environment. The Japan investor relationship management software market presents significant opportunities driven by the digital transformation of corporate communication and growing investor demand for real-time, transparent engagement. As Japanese companies increasingly focus on ESG reporting and regulatory compliance, IRM software offers streamlined solutions for data management and stakeholder communication. Additionally, the rise of shareholder activism and global investment inflows into Japan are pushing firms to adopt advanced tools for relationship management, creating a favorable environment for market expansion and innovation.

Report Coverage

This research report categorizes the market for the Japan investor relationship management software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan investor relationship management software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan investor relationship management software market.

Japan Investor Relationship Management Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.4% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Deployment Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Altvia Solutions - AIM, Quaestor, Cybozu - Kintone, Works Applications - AI Works, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan investor relationship management (IRM) software market is driven by several key factors. Growing demand for streamlined communication between publicly listed companies and their investors is encouraging firms to adopt advanced IRM solutions. The increasing emphasis on corporate transparency, regulatory compliance, and good governance practices further propels the need for efficient investor management tools. Additionally, Japan’s aging corporate structure and globalization of investment are pushing companies to modernize their investor engagement strategies. The rise in digital transformation across the financial and corporate sectors, coupled with the integration of AI and data analytics in IRM platforms, enhances the ability to manage investor relationships proactively. Furthermore, expanding adoption of cloud-based software and mobile platforms supports flexible, real-time interactions, making IRM tools essential for maintaining a competitive advantage in Japan’s evolving corporate environment.

Restraining Factors

The Japan investor relationship management software market faces restraining factors such as high implementation costs and limited awareness among small and medium enterprises. Additionally, concerns over data security and integration challenges with existing legacy systems hinder adoption. Resistance to change within traditional corporate structures also slows the transition to digital investor management platforms, impacting overall market growth.

Market Segmentation

The Japan investor relationship management software market share is classified into deployment type and application.

- The SaaS segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan investor relationship management software market is segmented by deployment type into cloud-based, on-premises, and SaaS. Among these, the SaaS segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its scalability, cost-effectiveness, and ease of deployment. Businesses favor SaaS for real-time data access, reduced IT overhead, and automatic updates. Its flexibility supports remote investor engagement, driving strong adoption and projected CAGR growth throughout the forecast period in the IRM software market.

- The large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan investor relationship management software market is segmented by application into large enterprises, medium enterprises, and small enterprises. Among these, the large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to their complex investor relations needs and larger budgets for advanced IRM solutions. Their demand for comprehensive, scalable, and integrated software to manage extensive investor networks drives adoption. This trend is expected to continue, fueling strong CAGR growth during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan investor relationship management software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Altvia Solutions – AIM

- Quaestor

- Cybozu – Kintone

- Works Applications – AI Works

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan investor relationship management software market based on the below-mentioned segments

Japan Investor Relationship Management Software Market, By Deployment Type

- Cloud-Based

- On-Premises

- SaaS

Japan Investor Relationship Management Software Market, By Application

- Large Enterprises

- Medium Enterprises

- Small Enterprises

Need help to buy this report?