Japan Investor (ESG) Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Services [Training, Integration, and Other Services]), By Enterprise Size (SMEs and Large Enterprises), and Japan Investor (ESG) Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Investor (ESG) Software Market Insights Forecasts to 2035

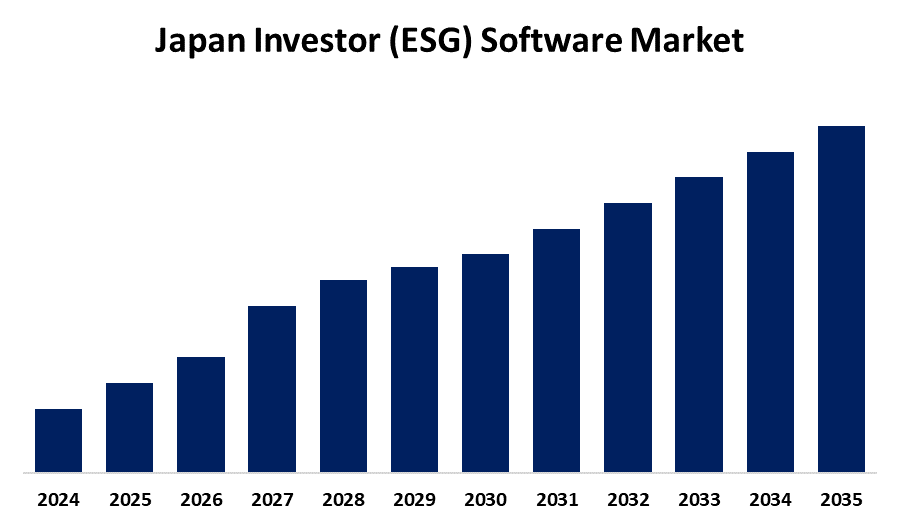

- The Japan Investor (ESG) Software Market Size is Expected to Grow at a CAGR of around 12.6% from 2025 to 2035

- The Japan Investor (ESG) Software Market Size is Expected to hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Investor (ESG) Software Market Size is Anticipated to Hold a Significant Share by 2035, Growing at a CAGR of 12.6% from 2025 to 2035. This is due to increasing regulatory pressure for ESG disclosures, growing investor demand for transparent and ethical practices, and the widespread adoption of AI-driven analytics to manage ESG data effectively across investment portfolios.

Market Overview

The Japan investor environmental, social, and governance (ESG) software market refers to the segment of the software industry in Japan that provides digital solutions designed to help investors and financial institutions analyze, manage, and report on ESG-related data. These tools support investment decisions by offering insights into companies’ sustainability performance, regulatory compliance, risk exposure, and alignment with ESG goals. The Japan investor (ESG) software market presents strong growth opportunities driven by increasing regulatory mandates, investor demand for transparency, and corporate commitments to sustainability. With the rise of ESG-focused investing, companies are seeking advanced software solutions for accurate reporting, data analytics, and risk assessment. The integration of AI and machine learning enhances efficiency, offering competitive advantages. Additionally, Japan’s green growth strategy and net-zero targets are prompting organizations to invest in ESG tools, creating significant demand across financial, manufacturing, and technology sectors.

Report Coverage

This research report categorizes the market for the Japan investor (ESG) software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan investor (ESG) software market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan investor (ESG) software market.

Japan Investor (ESG) Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 12.6% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Component, By Enterprise Size and COVID-19 Impact Analysis. |

| Companies covered:: | GRCS Inc., Geoscience Enterprise Inc., Investor Communications Japan (ICJ), Inc and Others Key Vendors. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The Japan investor (ESG) software market is being driven by several key factors. Increasing regulatory pressure from the Japanese government and international bodies is compelling companies to improve transparency and align with ESG standards. Institutional investors are demanding more comprehensive ESG disclosures to assess long-term risks and sustainability performance, boosting the adoption of ESG software tools. Furthermore, Japan’s commitment to carbon neutrality and the promotion of sustainable finance under its green growth strategy are accelerating market growth. The rise of stakeholder capitalism and heightened awareness of environmental and social responsibility are pushing organizations to integrate ESG into core business strategies. Additionally, advancements in AI, big data, and cloud technologies are enhancing the capabilities of ESG software, making it easier for businesses to collect, analyze, and report ESG data effectively and in compliance with evolving global standards.

Restraining Factors

The Japan investor (ESG) software market faces restraining factors such as high implementation costs, especially for SMEs, and limited availability of standardized ESG data. Additionally, varying ESG reporting frameworks and regulatory uncertainty create complexities for software providers and users. Resistance to change and a lack of in-house expertise further hinder widespread adoption across traditional investment sectors.

Market Segmentation

The Japan investor (ESG) software market share is classified into component and enterprise size.

- The software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan investor (ESG) software market is segmented by component into software and services. The services segment is divided into training, integration, and other services. Among these, the software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the increasing adoption of digital tools for efficient case tracking, data analysis, and compliance management. Rising cyber threats, regulatory requirements, and demand for real-time insights are fueling investment in investigation management software, driving its strong growth during the forecast period.

- The SMEs segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan investor (ESG) software market is segmented by enterprise size into SMEs and large enterprises. Among these, the SMEs segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The SMEs segment held a significant share in 2024 as more small and medium businesses recognize the importance of investigation management to mitigate risks and ensure compliance. Affordable, scalable software solutions and growing awareness about fraud prevention are driving increased adoption and robust growth in this segment during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan investor (ESG) software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GRCS Inc.

- Geoscience Enterprise Inc.

- Investor Communications Japan (ICJ), Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan investor (ESG) software market based on the below-mentioned segments:

Japan Investor (ESG) Software Market, By Component

- Software

- Services

- Training

- Integration

- Other Services]

Japan Investor (ESG) Software Market, By Enterprise Size

- SMEs

- Large Enterprise

Need help to buy this report?