Japan Inventory Optimization Software and Services Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions [Barcode scanning system, Radio Frequency System (RFID), and Others] and Services [Professional Services and Managed/Outsourced Services]), By Industry Size (Small & Medium Enterprises and Large Enterprises), By Industry (IT & Telecom, Manufacturing, Consumer Goods, Food & Beverages, Retail, BFSI, Healthcare & Pharmaceuticals, Automotive, Transportation and Logistics, Oil & Gas, Life Sciences, and Others), and Japan Inventory Optimization Software and Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Inventory Optimization Software and Services Market Insights Forecasts to 2035

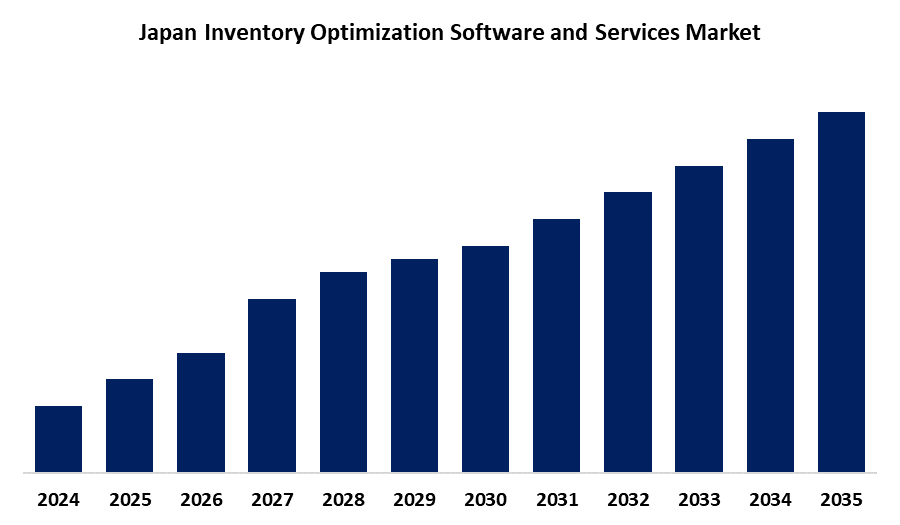

- The Japan Inventory Optimization Software and Services Market Size is Expected to Grow at a CAGR of around 14.5% from 2025 to 2035

- The Japan Inventory Optimization Software and Services Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Inventory Optimization Software and Services Market Size is Anticipated to Hold a Significant Share By 2035, Growing at a CAGR of 14.5% from 2025 to 2035. This is due to rising demand for real-time inventory tracking and the adoption of AI-driven supply chain solutions. Additionally, the expansion of e-commerce and increasing focus on operational efficiency are accelerating software adoption across industries.

Market Overview

The Japan inventory optimization software and services market refers to the segment of the technology and services industry in Japan that provides software solutions and professional services designed to enhance inventory planning, management, and control. These solutions use advanced analytics, artificial intelligence, and real-time data integration to help businesses optimize stock levels, reduce holding costs, prevent stockouts or overstocking, and improve overall supply chain efficiency. The market includes both software platforms and consulting or implementation services tailored to various sectors such as retail, manufacturing, logistics, and healthcare. The Japan inventory optimization software and services market offers significant opportunities driven by the rise of e-commerce, demand for real-time data analytics, and the push for supply chain efficiency. Growing adoption of AI, IoT, and cloud-based solutions enhances inventory accuracy and operational agility. As companies strive to reduce costs and meet dynamic consumer demands, investment in intelligent inventory systems is accelerating. Additionally, Japan’s focus on automation and digital transformation in logistics presents strong growth potential for solution providers.

Report Coverage

This research report categorizes the market for the Japan inventory optimization software and services market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan inventory optimization software and services market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan inventory optimization software and services market.

Japan Inventory Optimization Software and Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 14.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Component, By Industry Size, By Industry and COVID-19 Impact Analysis. |

| Companies covered:: | Works Applications Co., Ltd., Yokogawa Electric Corporation, Itochu Techno-Solutions Corporation (CTC), DIGI Group (Teraoka Seiko Co., Ltd.) and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The Japan inventory optimization software and services market is driven by several key factors, including the growing need for efficient inventory management across industries such as retail, manufacturing, and logistics. As companies strive to reduce operational costs and improve supply chain visibility, the adoption of advanced technologies like artificial intelligence (AI), machine learning, and Internet of Things (IoT) is accelerating. The rise of e-commerce and omnichannel retailing has intensified the demand for real-time inventory tracking and automation solutions. Additionally, Japan’s emphasis on lean operations and just-in-time inventory practices further supports the implementation of optimization tools. The increasing popularity of cloud-based platforms allows businesses to access scalable and flexible inventory solutions. Moreover, the government’s push for digital transformation across the industrial sector is also fueling market growth during the forecast period.

Restraining Factors

The Japan inventory optimization software and services market faces restraints such as high initial implementation costs, especially for small and medium enterprises, and the complexity of integrating new systems with legacy infrastructure. Additionally, limited technical expertise and resistance to digital transformation in traditional industries may hinder widespread adoption, slowing market growth despite increasing demand for advanced inventory solutions.

Market Segmentation

The Japan inventory optimization software and services market share is classified into component, enterprise size, and industry.

- The services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan inventory optimization software and services market is segmented by component into solutions and services. The solutions segment is divided into barcode scanning system, radio frequency system (RFID), and others. The services segment is divided into professional services and managed/outsourced services. Among these, the services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to rising demand for customization, integration, and support in implementing inventory optimization solutions. As businesses increasingly adopt cloud-based and AI-driven systems, the need for consulting, training, and maintenance services is expected to drive continued growth throughout the forecast period.

- The large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan inventory optimization software and services market is segmented by enterprise size into small & medium enterprises and large enterprises. Among these, the large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to their greater capacity to invest in advanced inventory optimization solutions. Their complex supply chains and focus on operational efficiency drive adoption. Continued digital transformation and demand for scalable, integrated systems will fuel further growth during the forecast period.

- The transportation & logistics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan inventory optimization software and services market is segmented by industry into IT & telecom, manufacturing, consumer goods, food & beverages, retail, BFSI, healthcare & pharmaceuticals, automotive, transportation and logistics, oil & gas, life sciences, and others. Among these, the transportation & logistics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its critical need for real-time inventory visibility, route optimization, and demand forecasting. Increasing e-commerce activity, globalization of supply chains, and emphasis on timely deliveries are driving adoption of inventory optimization tools, supporting robust growth through the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan inventory optimization software and services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Works Applications Co., Ltd.

- Yokogawa Electric Corporation

- Itochu Techno-Solutions Corporation (CTC)

- DIGI Group (Teraoka Seiko Co., Ltd.)

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan inventory optimization software and services market based on the below-mentioned segments:

Japan Inventory Optimization Software and Services Market, By Component

- Solutions

- Barcode scanning system

- Radio Frequency System (RFID)

- Others

- Services

- Professional Services

- Managed/Outsourced Services

Japan Inventory Optimization Software and Services Market, By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

Japan Inventory Optimization Software and Services Market, By Industry

- IT & Telecom

- Manufacturing

- Consumer Goods

- Food & Beverages

- Retail

- BFSI

- Healthcare & Pharmaceuticals

- Automotive

- Transportation and Logistics

- Oil & Gas

- Life Sciences

- Others

Need help to buy this report?