Japan Inulin Market Size, Share, and COVID-19 Impact Analysis, By Source (Chicory Inulin, Jerusalem Artichoke Inulin, and Agave Inulin), By Form (Liquid and Powder), and Japan Inulin Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Inulin Market Insights Forecasts to 2035

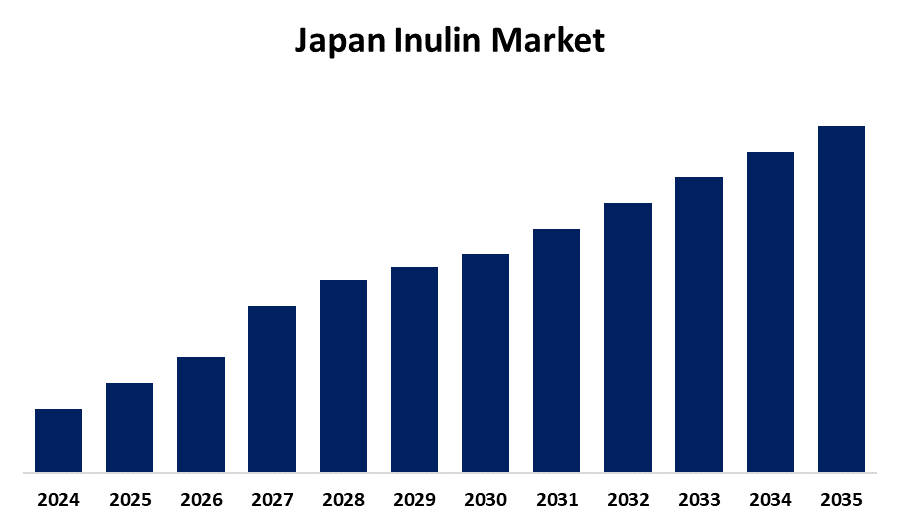

- The Japan Inulin Market Size is Expected to Grow at a CAGR of around 4.3% from 2025 to 2035

- The Japan Inulin Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Inulin Market is anticipated to hold a significant share by 2035, growing at a CAGR of 4.3% from 2025 to 2035. The Japan inulin market is driven by various factors, including increasing awareness about health benefits associated with inulin, rising geriatric population, rising demand for low-calorie and sugar-free products, and increased utilization in the food and beverage industry.

Market Overview

The Japan inulin market refers to the production, processing, and sale of inulin. Inulin is a naturally occurring polysaccharide made from fructose molecules with a terminal glucose unit. It is commonly found in various plants such as chicory root, wheat, onions, and artichokes. Inulin is available in two forms such as liquid and powder. Inulin acts as a prebiotic, which stimulates the growth of beneficial gut bacteria. It is also well-known for its ability to act as a low-calorie sweetener or fat substitute in meals, enhance digestive health, and help regulate blood sugar and cholesterol. It is widely used in various industries such as food & beverages, dietary supplements, and animal feed additives. Japan has one of the largest aging populations, which leads to a rising prevalence of digestive disorders and chronic diseases. Inulin has several health benefits, making it a favorable ingredient in supplements and functional foods for older adults. The rising demand for clean-label and natural products is a key trend in this market. As the demand for nutraceuticals and functional foods increases, inulin has become more well-known as a component of supplements intended to promote weight loss, digestive health, and general well-being, presenting a potential opportunity for growth.

Report Coverage

This research report categorizes the market for the Japan inulin market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan inulin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan inulin market.

Japan Inulin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.3% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Source, By Form and COVID-19 Impact Analysis |

| Companies covered:: | Tate and Lyle Japan KK, Fuji Nihon Seito Corporation, BENEO, Cosucra, Other. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The people are becoming aware of the health benefits associated with inulin, especially for gut health and digestive wellness is one of the major contributors to the market growth. The rising inclination towards plant-based diets creates the demand for natural and plant-derived ingredients, and inulin is perfectly fit for this demand, which further fuels the market growth. The people are becoming health-conscious, which raises the demand for low-calorie, sugar-free products. Inulin has a low glycaemic index, making it an ideal sugar substitute in various products.

Restraining Factors

One of the notable restraints is the limited availability of raw materials for inulin production, which has led to price volatility and supply chain disruption. Additionally, excessive consumption of inulin leads to gastrointestinal discomfort, including bloating, gas, and diarrhoea, which further limits the market expansion.

Market Segmentation

The Japan inulin market share is classified into source and form.

- The chicory inulin segment held the dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan inulin market is segmented by source into chicory inulin, Jerusalem artichoke inulin, and agave inulin. Among these, the chicory inulin segment held the dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to rising awareness about health benefits and increasing consumer awareness. Additionally, they help to improve digestive health and overall well-being.

- The powder segment held the highest share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The Japan inulin market is segmented by form into liquid and powder. Among these, the powder segment held the highest share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This segmental growth is attributed to its versatility and convenience in various applications. Additionally, their stability and long shelf life make them a favorable option for manufacturers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan inulin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tate & Lyle Japan KK

- Fuji Nihon Seito Corporation

- BENEO

- Cosucra

- Other

Recent Developments

- In April 2025, Ito Kanpo Pharmaceutical Co., Ltd. has launched Inulin Fiber Lactic Acid Bacteria PLUS, a new powder combining water-soluble dietary fiber inulin and lactic acid bacteria

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan inulin market based on the below-mentioned segments:

Japan Inulin Market, By Source

- Chicory Inulin

- Jerusalem Artichoke Inulin

- Agave Inulin

Japan Inulin Market, By Form

- Liquid

- Powder

Need help to buy this report?