Japan Internet Data Center (IDC) Market Size, Share, and COVID-19 Impact Analysis, By Services (Colocation, Hosting, CDN, and Others), By Deployment (Public, Private, and Hybrid), and Japan Internet Data Center (IDC) Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Internet Data Center (IDC) Market Insights Forecasts to 2035

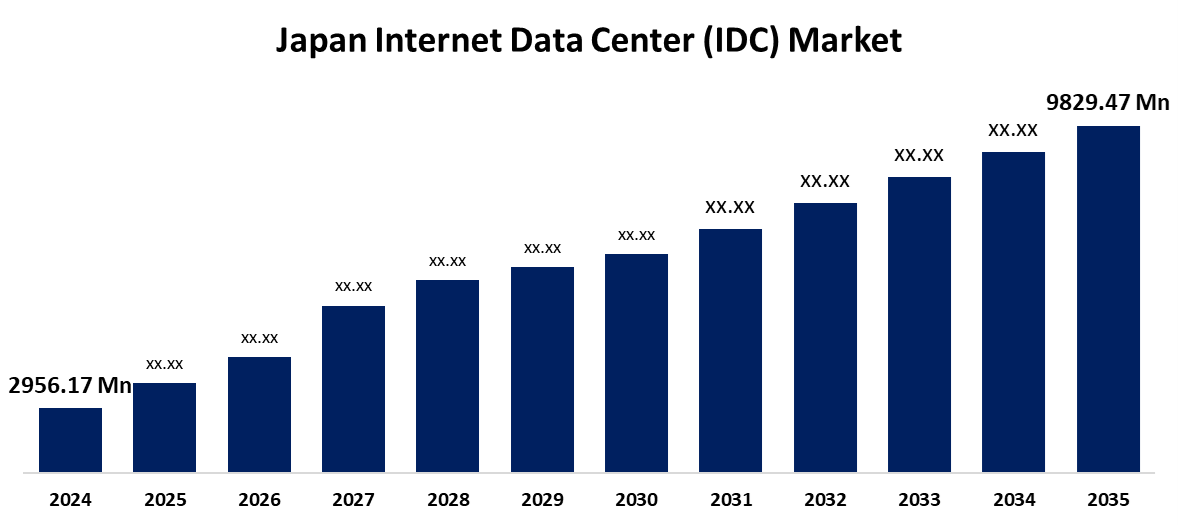

- The Japan Internet Data Center (IDC) Market Size was Estimated at USD 2,956.17 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.54% from 2025 to 2035

- The Japan Internet Data Center (IDC) Market Size is Expected to Reach USD 9,829.47 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Internet Data Center (IDC) Market Size is anticipated to reach USD 9,829.47 Million by 2035, Growing at a CAGR of 11.54% from 2025 to 2035. Japan's Internet Data Center (IDC) market is driven by rapid digital transformation, increasing cloud adoption, and the expansion of 5G networks. The demand for edge computing and data sovereignty compliance is pushing investments in advanced infrastructure and energy-efficient solutions.

Market Overview

The Japan Internet Data Center (IDC) Market Size refers to the industry focused on data storage, processing, and management infrastructure that supports cloud computing, enterprise IT services, and digital transformation The Internet Data Center (IDC) market in Japan actively embraces energy-saving and sustainable practices to reduce environmental impact. Japanese operators integrate renewable energy sources into their power supply portfolios, helping meet business sustainability goals while lowering carbon emissions. In Japan, data centers optimize energy use through sophisticated cooling technologies, ensuring efficient operations. Additionally, Japanese providers seek green financing to fund eco-friendly infrastructure upgrades, aligning with the country’s commitment to sustainability. Stakeholders in Japan closely monitor performance metrics to enhance resource efficiency and drive progress toward a greener digital ecosystem.

Report Coverage

This research report categorizes the market for the Japan internet data center (IDC) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan internet data center (IDC) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan internet data center (IDC) market.

Japan Internet Data Center (IDC) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,956.17 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.54% |

| 2035 Value Projection: | USD 9,829.47 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Services, By Deployment |

| Companies covered:: | NTT Communications Corporation, Internet Initiative Japan Inc., KDDI Corporation, Fujitsu Limited, Equinix Japan, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of 5G networks and edge computing infrastructure is highly advantageous for the Internet Data Center (IDC) market in Japan. In Japan, fast mobile connectivity enables real-time data processing at the network edge, supporting low-latency applications such as AR/VR services and autonomous systems. To reduce latency and congestion, providers establish mini data centers near metropolitan hotspots across Japan. Additionally, Japanese telecom carriers collaborate with data center companies to deliver integrated edge solutions, driving demand for specialized equipment and decentralized facilities in the country.

Restraining Factors

The market for Internet data centers (IDCs) in Japan is constrained by expensive infrastructure and operating costs. Providers make significant investments in power, cooling, and land. For dense compute racks to be supported, a dependable electrical supply must be secured. It lengthens project schedules and increases capital expenditure. Energy prices continue to be high and cause erratic price swings. Operators negotiate long-term utility contracts and put cost management measures into action.

Market Segmentation

The Japan internet data center (IDC) market share is classified into services and deployment.

- The colocation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan internet data center (IDC) market is segmented by services into colocation, hosting, CDN, and others. Among these, the colocation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to businesses looking for managed power and expandable rack space, colocation is the industry leader. People that want to convert capital expenditures into predictable operating expenses are drawn to it.

- The public segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan internet data center (IDC) market is segmented by deployment into public, private, and hybrid. Among these, the public segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its affordable, on-demand infrastructure, which public deployment controls a sizable proportion. Businesses without legacy data centers and those advancing digital initiatives quickly will find it appealing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan internet data center (IDC) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NTT Communications Corporation

- Internet Initiative Japan Inc.

- KDDI Corporation

- Fujitsu Limited

- Equinix Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan internet data center (IDC) market based on the below-mentioned segments:

Japan Internet Data Center (IDC) Market, By Services

- Colocation

- Hosting

- CDN

- Others

Japan Internet Data Center (IDC) Market, By Deployment

- Public

- Private

- Hybrid

Need help to buy this report?