Japan Insurance Policy Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment (On-Premise and Cloud-Based), By End-User (Brokers, Agencies, and Insurance Companies), and Japan Insurance Policy Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Insurance Policy Software Market Insights Forecasts to 2035

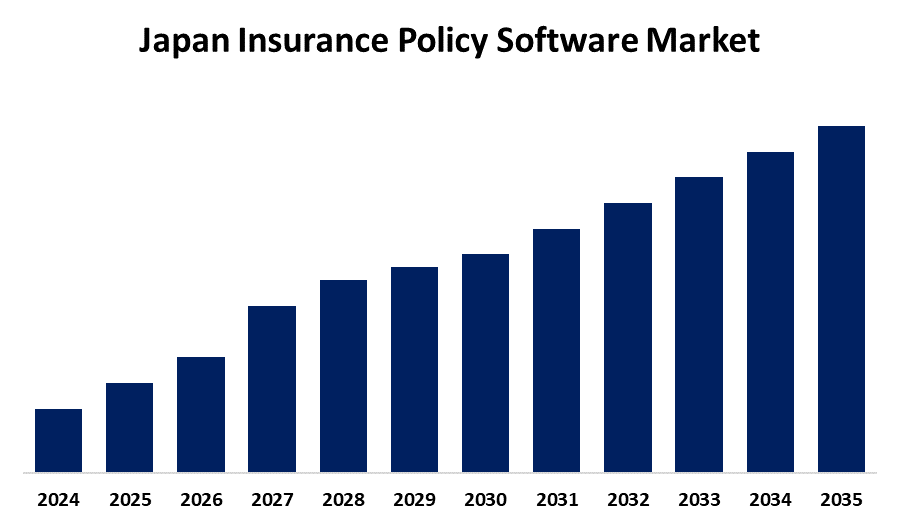

- The Japan Insurance Policy Software Market Size is Expected to Grow at a CAGR of around 9.5% from 2025 to 2035

- The Japan Insurance Policy Software Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Insurance Policy Software Market Size is Anticipated to hold a significant share by 2035, Growing at a CAGR of 9.5% from 2025 to 2035. This is due to the increasing digitalization across the insurance sector, the rising demand for efficient policy administration, and the need to enhance the customer experience. Regulatory compliance and automation are also driving the adoption of advanced software solutions.

Market Overview

The Japan insurance policy software market refers to the segment of the software industry focused on providing digital solutions for the creation, management, issuance, and administration of insurance policies within Japan. These software systems are used by insurers, brokers, and agencies to streamline policy lifecycle processes, ensure compliance with local regulations, enhance operational efficiency, and improve customer service. The Japan insurance policy software market presents significant opportunities driven by the digital transformation of the insurance sector. Rising demand for automated policy administration, regulatory compliance, and customer-centric services is pushing insurers to adopt advanced software solutions. Integration of AI, cloud computing, and analytics enables real-time policy management and personalized offerings. Additionally, the growth of life and health insurance segments, along with an aging population seeking digital insurance services, creates strong potential for software providers to expand their footprint and innovate.

Report Coverage

This research report categorizes the market for the Japan insurance policy software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan insurance policy software market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan insurance policy software market.

Japan Insurance Policy Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Deployment, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Guidewire Software, Duck Creek Technologies, Pegasystems, InsuredMine, Sapiens International Corporation, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Japan insurance policy software market is poised for significant growth between 2025 and 2035, driven by several key factors. Foremost is the digital transformation sweeping the insurance industry, with insurers increasingly adopting advanced technologies like AI, machine learning, and big data analytics to enhance operational efficiency and customer service. The shift towards cloud-based solutions offers scalability, cost-effectiveness, and flexibility, enabling insurers to manage large data volumes and ensure seamless operations. Additionally, Japan's aging population necessitates innovative insurance products tailored to long-term care and retirement needs, prompting insurers to leverage technology for product development and service delivery. Regulatory compliance also plays a crucial role, as stringent guidelines require insurers to adopt software solutions that ensure accurate reporting and data security. Collectively, these factors contribute to the robust expansion of the insurance policy software market in Japan during the forecast period.

Restraining Factors

The Japan insurance policy software market faces restraining factors such as high implementation costs, especially for small and mid-sized insurers, and resistance to change from traditional legacy systems. Additionally, concerns over data privacy and cybersecurity hinder broader adoption. Limited technical expertise and the complexity of integrating new software with existing infrastructure further challenge market growth.

Market Segmentation

The Japan insurance policy software market share is classified into deployment and end-user.

- The on-premises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan insurance policy software market is segmented by deployment into on-premise and cloud-based. Among these, the on-premises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to insurers’ preference for greater control over data security, system customization, and compliance with local regulations. Many traditional insurance firms continue to rely on legacy infrastructure, which supports sustained demand and drives notable growth throughout the forecast period.

- The insurance companies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan insurance policy software market is segmented by end-user into brokers, agencies, and insurance companies. Among these, the insurance companies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to their increasing investment in digital transformation to streamline policy management, improve customer service, and ensure regulatory compliance. The growing demand for scalable, automated policy software solutions is expected to drive continued adoption and strong CAGR growth during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan insurance policy software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Guidewire Software

- Duck Creek Technologies

- Pegasystems

- InsuredMine

- Sapiens International Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan insurance policy software market based on the below-mentioned segments:

Japan Insurance Policy Software Market, By Deployment

- On-Premise

- Cloud-Based

Japan Insurance Policy Software Market, By End-user

- Brokers

- Agencies

- Insurance Companies

Need help to buy this report?