Japan Insurance Fraud Detection Software Market Size, Share, and COVID-19 Impact Analysis, By Type (On-Premises and Cloud), By Application (Life Insurance, Health Care Insurance, Automobile Insurance, Property Insurance, and Others), and Japan Insurance Fraud Detection Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Insurance Fraud Detection Software Market Insights Forecasts to 2035

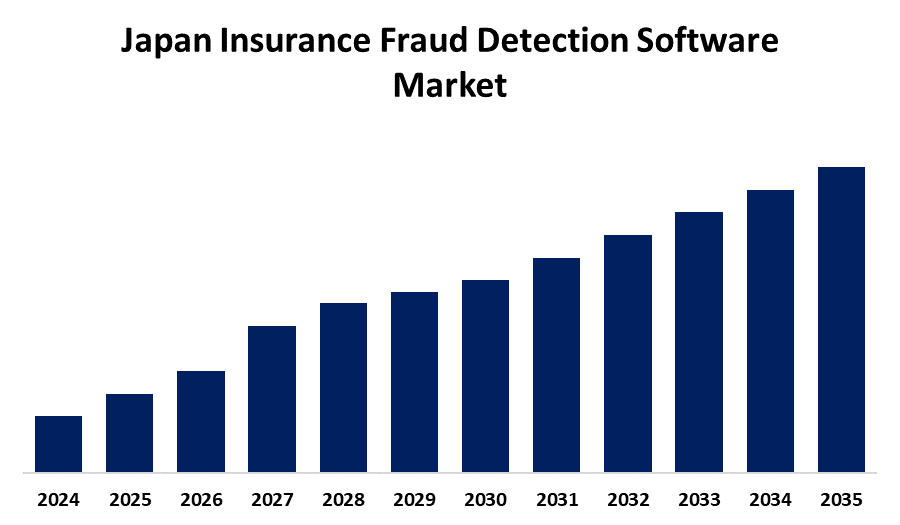

- The Japan Insurance Fraud Detection Software Market Size is Expected to Grow at a CAGR of around 25.7% from 2025 to 2035

- The Japan Insurance Fraud Detection Software Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Insurance Fraud Detection Software Market Size is Anticipated to hold a significant share by 2035, Growing at a CAGR of 25.7% from 2025 to 2035. This is due to increasing fraud cases, stringent regulatory requirements, and the rising need for real-time analytics. Advanced technologies like AI and machine learning are enabling faster, more accurate fraud detection, driving market demand.

Market Overview

The Japan insurance fraud detection software market refers to the segment of the Japanese insurance technology industry focused on developing, providing, and implementing software solutions designed to identify, prevent, and manage fraudulent activities across various insurance processes. These solutions use advanced technologies such as artificial intelligence (AI), machine learning (ML), data analytics, and predictive modeling to detect suspicious patterns, automate risk assessments, and enhance the accuracy of fraud investigations. The market serves life, health, auto, and property insurance sectors, helping insurers minimize financial losses, ensure regulatory compliance, and improve operational efficiency. The Japan insurance fraud detection software market presents significant opportunities driven by the increasing prevalence of fraudulent claims and rising regulatory scrutiny. As insurers seek to reduce financial losses and improve operational efficiency, demand for AI-powered and analytics-based fraud detection tools is surging. Integration of machine learning, big data, and real-time monitoring capabilities enhances accuracy and responsiveness. Additionally, the growing adoption of digital insurance platforms and government support for technology-driven risk management are expected to further accelerate market expansion.

Report Coverage

This research report categorizes the market for the Japan insurance fraud detection software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan insurance fraud detection software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan insurance fraud detection software market.

Japan Insurance Fraud Detection Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 25.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Sompo Japan Insurance Inc., Tokio Marine Nichido, Mitsui Sumitomo Insurance Group (MSIG), and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Japan insurance fraud detection software market is driven by the growing incidence of fraudulent claims, which significantly impact insurers' profitability and operational efficiency. As fraud schemes become more sophisticated, there is an increasing need for advanced technologies such as artificial intelligence, machine learning, and predictive analytics to detect anomalies and prevent losses. The rising adoption of digital insurance platforms and the shift toward automated claims processing have further amplified the demand for fraud detection solutions. Additionally, strict regulatory frameworks and compliance requirements in Japan are encouraging insurers to invest in robust fraud detection systems. The increasing availability of big data and integration of cloud-based solutions also enhance the scalability and effectiveness of these tools, making them essential for modern insurers aiming to reduce risk, improve accuracy, and streamline operations in a competitive market.

Restraining Factors

The Japan insurance fraud detection software market faces restraints such as high implementation costs and integration complexities with existing legacy systems. Limited awareness and adoption among smaller insurers, along with data privacy concerns and strict regulatory compliance requirements, also hinder market growth. Additionally, the evolving sophistication of fraudulent activities challenges the effectiveness of detection technologies, slowing widespread acceptance across the industry.

Market Segmentation

The Japan insurance fraud detection software market share is classified into type and application.

- The on-premises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan insurance fraud detection software market is segmented by type into on-premises and cloud. Among these, the on-premises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its ability to provide enhanced data security, system control, and compliance with local regulations. Many insurance firms prefer on-premises solutions to protect sensitive client data, which is expected to sustain demand and drive strong CAGR growth during the forecast period.

- The automobile insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan insurance fraud detection software market is segmented by application into life insurance, health care insurance, automobile insurance, property insurance, and others. Among these, the automobile insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the high incidence of vehicle-related claims and increasing vehicle ownership. Growing adoption of telematics, AI-driven fraud detection, and regulatory mandates for motor insurance are expected to drive continued investment and strong CAGR growth in this segment during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan insurance fraud detection software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sompo Japan Insurance Inc.

- Tokio Marine Nichido

- Mitsui Sumitomo Insurance Group (MSIG)

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan insurance fraud detection software market based on the below-mentioned segments:

Japan Insurance Fraud Detection Software Market, By Type

- On-Premises

- Cloud

Japan Insurance Fraud Detection Software Market, By Application

- Life Insurance

- Health Care Insurance

- Automobile Insurance

- Property Insurance

- Others

Need help to buy this report?