Japan Insurance Agency Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Life Insurance, Auto Insurance, Accident and Health Insurance, Home Insurance, Property & Casualty Insurance, Travel Insurance, and Others), By Deployment (On-Premises and Cloud), By End-User (Small Business, Medium-Sized Business, and Large Business), and Japan Insurance Agency Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Insurance Agency Software Market Insights Forecasts to 2035

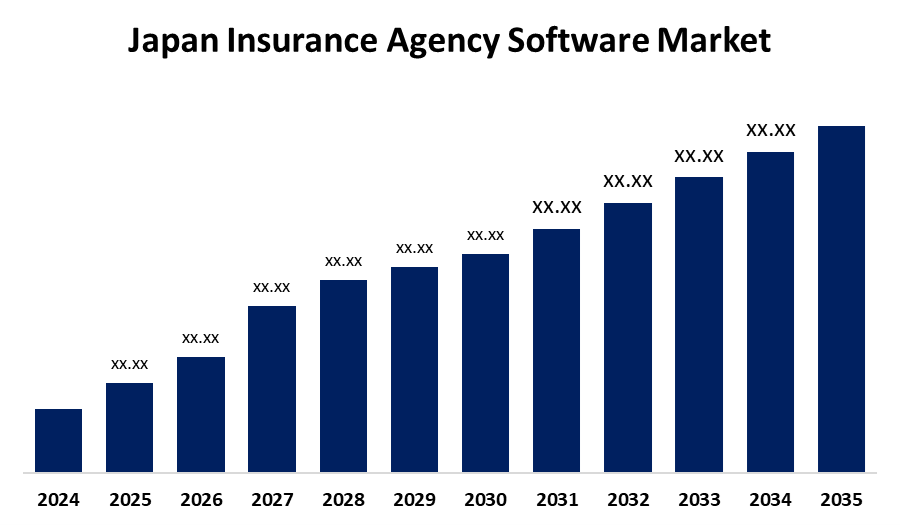

- The Japan Insurance Agency Software Market Size is Expected to Grow at a CAGR of around 5.78% from 2025 to 2035

- The Japan Insurance Agency Software Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Insurance Agency Software Market Size is Anticipated to hold a significant share by 2035, growing at a CAGR of 5.78% from 2025 to 2035. The growth is fueled by Japan’s accelerating digital transformation in the insurance sector and the rising demand for cloud-based, automated policy and claims management systems. Additionally, an aging population is driving increased insurance adoption, boosting the need for efficient agency software solutions.

Market Overview

The Japan insurance agency software market encompasses digital solutions designed to streamline and enhance the operations of insurance agencies across the country. These software platforms facilitate various functions, including premium calculation, underwriting, customer relationship management, claims processing, and compliance with regulatory standards. By leveraging technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics, these tools aim to improve efficiency, accuracy, and customer service within the insurance sector. The Japan insurance agency software market presents strong opportunities driven by the country's aging population, increasing demand for digital transformation in the insurance sector, and the growing adoption of cloud-based solutions. Enhanced data analytics, automation of policy management, and regulatory compliance tools are enabling agencies to streamline operations and improve customer experience. Integration with AI and mobile platforms further boosts market potential, while partnerships between tech firms and insurers open avenues for innovative, scalable solutions tailored to Japan’s unique market needs.

Report Coverage

This research report categorizes the market for the Japan insurance agency software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan insurance agency software market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan insurance agency software market.

Japan Insurance Agency Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.78% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 139 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By Deployment, and COVID-19 Impact Analysis |

| Companies covered:: | Applied Systems, Vertafore, Sapiens International Corporation, Zywave, XDimensional Technologies, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan insurance agency software market is being driven by several key factors, including the increasing digital transformation across the insurance sector and a growing need for automation in policy management, claims processing, and customer service. Rising consumer expectations for faster, more personalized services are prompting insurers to adopt advanced software solutions. Additionally, Japan's aging population and complex regulatory environment require robust compliance and data management tools, further fueling demand for specialized software. Integration of technologies such as artificial intelligence, machine learning, and cloud computing is enhancing operational efficiency and enabling real-time data analytics. The shift toward mobile-friendly platforms and the emergence of insurtech startups are also contributing to market growth. Moreover, heightened cybersecurity awareness is encouraging agencies to upgrade to secure, scalable software systems that meet evolving industry standards.

Restraining Factors

The Japan insurance agency software market faces restraints such as stringent regulatory compliance requirements, which increase development complexity and costs. Additionally, the high initial investment for integrating advanced technologies and legacy system compatibility issues slows adoption. Data security concerns and limited awareness among smaller agencies about software benefits further hinder market growth, restricting widespread implementation and innovation within the sector.

Market Segmentation

The Japan insurance agency software market share is classified into type, deployment, and end-user.

- The life insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan insurance agency software market is segmented by type into life insurance, auto insurance, accident and health insurance, home insurance, property & casualty insurance, travel insurance, and others. Among these, the life insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to rising awareness about financial security and increasing disposable income. Growing demand for long-term savings and protection products, coupled with favorable government policies and technological advancements in underwriting and claims processing, is expected to drive its substantial CAGR during the forecast period.

- The on-premises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan insurance agency software market is segmented by deployment into on-premises and cloud. Among these, the on-premises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its enhanced data security, control, and customization capabilities. Many organizations prefer on-premises solutions to comply with strict regulatory requirements and safeguard sensitive information, which is expected to drive steady growth and a strong CAGR during the forecast period.

- The large business segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan insurance agency software market is segmented by end-user into small business, medium-sized business, and large business. Among these, the large business segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its extensive resources and complex insurance needs. Demand for advanced, scalable software solutions to manage large volumes of policies and compliance requirements is increasing, driving adoption and fueling substantial CAGR growth throughout the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan insurance agency software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Applied Systems

- Vertafore

- Sapiens International Corporation

- Zywave

- XDimensional Technologies

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan insurance agency software market based on the below-mentioned segments:

Japan Insurance Agency Software Market, By Type

- Life Insurance

- Auto Insurance

- Accident and Health Insurance

- Home Insurance

- Property & Casualty Insurance

- Travel Insurance

- Others

Japan Insurance Agency Software Market, By Deployment

- On-Premises

- Cloud

Japan Insurance Agency Software Market, By End-User

- Small Business

- Medium-Sized Business

- Large Business

Need help to buy this report?