Japan Instant Coffee Market Size, Share, and COVID-19 Impact Analysis, By Type (Freeze-Dried Instant Coffee, Spray-Dried Instant Coffee, Others), By Distribution Channel (Offline (Foodservice, Retail (Supermarket/Hypermarket, Convenience Stores, Others)), Online), and Japan Instant Coffee Market Insights Forecasts to 2032

Industry: Food & BeveragesJapan Instant Coffee Market Insights Forecasts to 2032

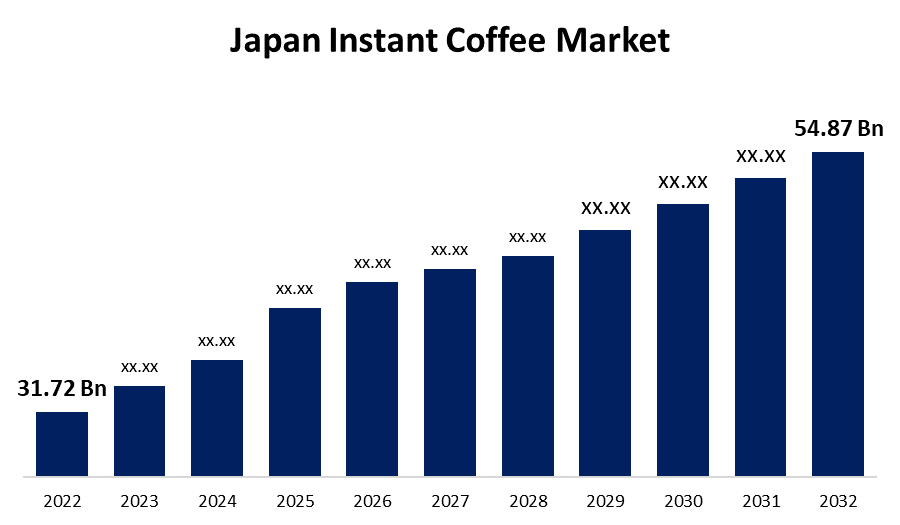

- The Japan Instant Coffee Market Size was valued at USD 31.72 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.63% from 2022 to 2032.

- The Japan Instant Coffee Market Size is expected to reach USD 54.87 Billion by 2032.

- Japan is expected to grow the fastest during the forecast period.

Get more details on this report -

The Japan Instant Coffee Market Size is expected to reach USD 54.87 Billion by 2032, at a CAGR of 5.63% during the forecast period 2022 to 2032.

Market Overview

Japanese tea is the traditional and most widely consumed beverage in Japan, according to the proportion of the population who consumes it regularly. Coffee is the second most popular beverage in much of Japan after tea. Japanese coffee is usually served with sugar and milk, however, the milk used is only sometimes fresh. Alternative to fresh milk, as is common in a majority of North America and Europe, the Japanese prefer "coffee fresh." Coffee fresh is a form of processed cream that is widely available across the country.

Japan has a tradition of drinking coffee that has developed throughout history in response to the needs of society. Coffee shops now function as an exclusive sector within metropolitan cultures. The majority of Japanese adolescents favor instant coffee. In terms of home consumption, the vast majority of coffee is consumed outside of the home, in drinking establishments and restaurants. Nestle (Japan), Ajinomoto/General Foods, and Suzuki Coffee lead the instant coffee market in Japan. AGF is still the leading instant coffee supplier in Japan, but UCC and Kuki also offer well-known instant coffee brands.

Report Coverage

This research report categorizes the market for Japan Instant Coffee Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Instant Coffee Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Instant Coffee Market.

Japan Instant Coffee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 31.72 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.63% |

| 2032 Value Projection: | USD 54.87 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Distribution Channel, |

| Companies covered:: | Starbucks Corporation, Nestle (Japan), Ajinomoto/General Foods, Suzuki Coffee, Asahi Group Holdings Ltd., Coco-Cola Company, Lotte Chilsung Beverage Co., Unilever, Pokka Group, SUNTORY HOLDINGS LIMITEDG |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan stands as the fifth-largest consumer of coffee and coffee-related items in the world. The rising emphasis on special, genuine flavors and diverse functional characteristics of coffee has contributed to the premiumization of the Japanese instant coffee industry. Companies like Nestle and AGF are progressively employing flavors that cater to regional taste preferences.

When compared to freshly brewed coffee, instant coffee contains a lesser amount of caffeine and more antioxidants. The majority of individuals drink instant coffee frequently, which increases metabolism, improves digestion, and enhances cognitive performance. As a result of these advantages, instant coffee is increasing in popularity in the local Japanese market, particularly among working-class individuals.

Furthermore, Japan's enormous workforce has contributed to the rise of consumer demand for capsule refreshments. It is a tea-drinking country, and the market demand for tea capsules is growing due to the accompanying benefits. Young Japanese, on the other hand, are becoming more inclined to coffee, resulting in increasing the usage of coffee capsules. The need for fast and simple preparation in a short amount of time is critical to the rise in the instant coffee industry's income. In Japan, high antioxidant content will boost the market growth.

Market Segment

- In 2022, the spray-dried instant coffee segment accounted for the largest revenue share of more than 60% over the forecast period.

On the basis of type, the Japan Instant Coffee Market is segmented into freeze-dried instant coffee, spray-dried instant coffee, and others. Among these, the spray-dried instant coffee segment is dominating the market with the largest revenue share of 60% over the forecast period. Spraying liquid coffee droplets in hot and dry air prepares spray-dried instant coffee. Spray-dried coffee is among the most common instant coffee because it has a simpler manufacturing method and is less expensive than free-dried instant coffee. Because of the low cost of spray-dried instant coffee, it is more cost-effective for the majority of customers which makes it more lucrative for the maker.

- In 2022, The offline segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of distribution channel, the Japan Instant Coffee Market is segmented into online and offline. Among these, the offline segment is dominating the market with the largest revenue share of 65% over the forecast period. The offline segment is further sub-segmented as food service, retail, supermarket/hypermarket, convenience stores, and others. The consumer preference for buying at a one-stop store, which easily offers numerous brands and their corresponding products in one location, is a contributing factor to its continued popularity. Furthermore, supermarkets and hypermarkets are larger, more widely accessible, and have a greater customer base than other types of stores. The segment's growth will be aided by increasing population growth and rising retail businesses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Instant Coffee Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Starbucks Corporation

- Nestle (Japan)

- Ajinomoto/General Foods

- Suzuki Coffee

- Asahi Group Holdings Ltd.

- Coco-Cola Company

- Lotte Chilsung Beverage Co.

- Unilever

- Pokka Group

- SUNTORY HOLDINGS LIMITEDG

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On February 2023, Coca-Cola Bottlers Japan constructs an aseptic coffee production plant. To address the increased demand for small PET bottle products, CCBJ has enlarged the factory. Once operational, the fifth production line at the factory will be capable of producing around 900 tiny PET bottles per minute.

- In September 2021, Louis Dreyfus Company Asia (LDC) has formed a joint venture (JV) with specialty coffee retailer Zephyr Japan to provide premium coffee to Japanese consumers.

- In February 2021, Nestle Japan launched a variety of Nescafe lattes produced with plant-based ingredients in response to Japan's growing interest in plant-based meals. In Japan, the Nescafe plant-based latte line includes ready-to-drink beverages that can be enjoyed on the go or at home, soluble mixes that can be made with just hot water, and capsules for the famed Nescafé Dolce Gusto technology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Instant Coffee Market based on the below-mentioned segments:

Japan Instant Coffee Market, By Type

- Freeze-Dried Instant Coffee

- Spray-Dried Instant Coffee

- Others

Japan Instant Coffee Market, By Flavoring Type

- Flavored Instant Coffee

- Unflavored Instant Coffee

Japan Instant Coffee Market, By Distribution Channel Type

- Offline

- Foodservice

- Retail

- Supermarket/Hypermarket

- Convenience Stores

- Others

- Online

Need help to buy this report?