Japan Infrastructure Securitization Market Size, Share, and COVID-19 Impact Analysis, By Type (Public Infrastructure and Private Infrastructure), By Asset Class (Transportation, Energy, Water and Wastewater, Telecommunications, Social Infrastructure, and Others), and Japan Infrastructure Securitization Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialJapan Infrastructure Securitization Market Insights Forecasts to 2033

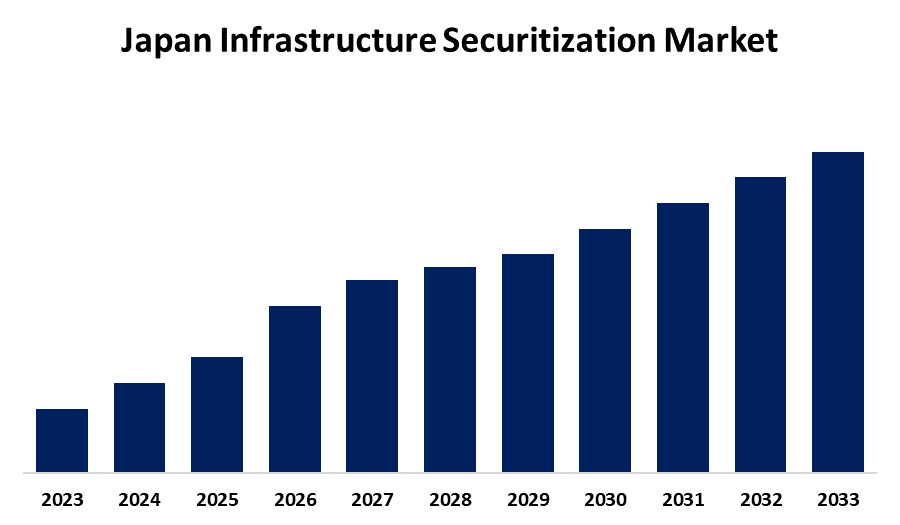

- The Japan Infrastructure Securitization Market Size is Growing at a CAGR of 8.2% from 2023 to 2033

- The Japan Infrastructure Securitization Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Japan Infrastructure Securitization Market Size is Anticipated to hold a significant share By 2033, Growing at a CAGR of 8.2% from 2023 to 2033.

Market Overview

The Japan infrastructure securitization market refers to the financial framework in Japan where infrastructure assets, such as transportation networks, energy facilities, and public utilities, are securitized to attract investment. Institutional investors' growing interest in and participation in infrastructure projects is another important growth factor. Institutional investors, including sovereign wealth funds, insurance providers, and pension funds, are always looking for steady, long-term investment prospects. Infrastructure investments are a profitable choice for these investors due to their appealing risk-adjusted returns. In Japan, institutional investors have been actively engaging in infrastructure projects, leveraging securitization to optimize investment strategies. To make it even more attractive, the securitization process provides a systematic way to reduce risks. The market is expanding as a result of the growing demand for securitized infrastructure assets. The market for infrastructure securitization has grown significantly as a result of creative structuring methods and the development of financial technologies.

Report Coverage

This research report categorizes the market for the Japan infrastructure securitization based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan infrastructure securitization market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan infrastructure securitization market.

Japan Infrastructure Securitization Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type, By Asset Class and COVID-19 Impact Analysis |

| Companies covered:: | MAEDA ROAD CONSTRUCTION Co. Ltd, Maeda Kosen Co. Ltd, Nippon Densetsu Kogyo Co. Ltd, Totetsu Kogyo Co. Ltd, Taihei Dengyo Kaisha Ltd, RAIZNEXT Corp, Sumitomo Mitsui Trust Bank, Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for infrastructure development in both developed and emerging nations is one of the main key factors propelling the infrastructure securitization industry. Governments everywhere, including Japan, are putting more effort into improving both public and private infrastructure, including water systems, energy grids, and transportation networks. With issuance rising by 6% to almost ¥6.1 trillion in 2024, securitization has had a renaissance in Japan, primarily due to asset-backed securities. Japan's strategic approach to funding infrastructure projects in the face of shifting economic conditions is shown in this pattern. The necessity for securitization as a financial tool to effectively pool and allocate resources has increased due to the rising need for large capital projects. Furthermore, traditional sources of funding are less feasible due to the fiscal restrictions that many governments, including Japan, confront, which further stimulates the market.

Restraining Factors

The political and regulatory landscape is one of the main restraints. The regulatory environment for securitization activities might be complicated by regional variations. The market may also be impacted by political unrest and changes in policy, especially in areas where government assistance is crucial for infrastructure projects.

Market Segmentation

The Japan infrastructure securitization market share is classified into type and asset class.

- The public infrastructure segment is expected to hold a significant market share through the forecast period.

The Japan infrastructure securitization market is segmented by type into public infrastructure and private infrastructure. Among these, the public infrastructure segment is expected to hold a significant market share through the forecast period. Public infrastructure securitization has become increasingly popular as governments search for new ways to finance infrastructure development in response to the growing demand.

- The transportation segment is expected to hold a significant market share through the forecast period.

The Japan infrastructure securitization market is segmented by asset class into transportation, energy, water and wastewater, telecommunications, social infrastructure, and others. Among these, the transportation segment is expected to hold a significant market share through the forecast period. Roads, bridges, railroads, and airports are all part of the transportation infrastructure, which is one of the biggest components. Significant investments and ensuing securitization activities in this sector are driven by the critical need for modern, efficient transportation networks in both developed and emerging nations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan infrastructure securitization market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MAEDA ROAD CONSTRUCTION Co. Ltd

- Maeda Kosen Co. Ltd

- Nippon Densetsu Kogyo Co. Ltd

- Totetsu Kogyo Co. Ltd

- Taihei Dengyo Kaisha Ltd

- RAIZNEXT Corp

- Sumitomo Mitsui Trust Bank, Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Infrastructure Securitization Market based on the below-mentioned segments:

Japan Infrastructure Securitization Market, By Type

- Public Infrastructure

- Private Infrastructure

Japan Infrastructure Securitization Market, By Asset Class

- Transportation

- Energy

- Water and Wastewater

- Telecommunications

- Social Infrastructure

- Others

Need help to buy this report?