Japan Industrial Robotics Market Size, Share, and COVID-19 Impact Analysis, By Type (Articulated, Cartesian, SCARA, Cylindrical, Others), By Function (Soldering & Welding, Materials Handling, Assembling & Disassembling, Painting & Dispensing, Milling, Cutting, Others), By End User (Automotive, Electrical & Electronics, Chemical Rubber & Plastics, Manufacturing, Food & Beverages, Others), and Japan Industrial Robotics Market Insights, Industry Trend, Forecasts to 2032

Industry: Electronics, ICT & MediaJapan Industrial Robotics Market Insights Forecasts to 2032

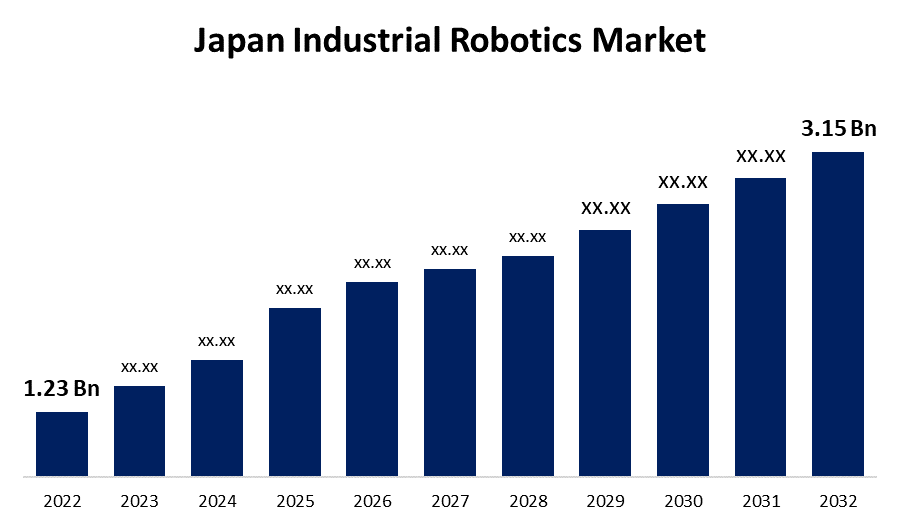

- The Japan Industrial Robotics Market Size was valued at USD 1.23 Billion in 2022.

- The Market is Growing at a CAGR of 9.86% from 2022 to 2032.

- The Japan Industrial Robotics Market Size is expected to reach USD 3.15 Billion By 2032.

Get more details on this report -

The Japan Industrial Robotics Market Size is expected to reach USD 3.15 Billion by 2032, at a CAGR of 9.86% during the forecast period 2022 to 2032.

Market Overview

The term "industrial robotics" describes the application of programmable, automated devices made to carry out diverse tasks in manufacturing and industrial environments. These robots can perform precise and repetitive tasks with a high degree of accuracy and efficiency because they are outfitted with mechanical parts, control systems, and sensors. Numerous industries, including the manufacture of automobiles, electronics, pharmaceuticals, and food, use industrial robots. They can perform tasks like material handling, welding, painting, assembling, and quality checking. Industrial robotics can handle tasks that could be dangerous for humans, which increases productivity, improves product quality, lowers labour costs, and improves workplace safety. Furthermore, industrial robots are used extensively in the automotive, electronics, and precision engineering sectors in Japan to perform tasks like assembly, welding, and quality control. In addition, new opportunities for human-robot collaboration are being created by the development of collaborative robots, or cobots, especially in smaller and medium-sized businesses. With a focus on innovation and research and strong government support, the Japanese industrial robotics market is predicted to grow and continue to shape manufacturing automation globally as well as domestically.

Report Coverage

This research report categorizes the market for Japan's industrial robotics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japanese industrial robotics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japanese industrial robotics market.

Japan Industrial Robotics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.23 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.86% |

| 2032 Value Projection: | USD 3.15 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Function, By End User, and COVID-19 Impact Analysis. |

| Companies covered:: | Fanuc Corporation, Nachi-Fujikoshi Corp., Mitsubishi Electric Corporation, Takatsu Corporation, Denso, Kawasaki Heavy Industries, Ltd., Seiko Epson Corporation and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is a growing need for these robots in sectors like equipment, consumer electronics, automotive, pharmaceuticals, and packaging. However, this requirement is anticipated for the kind of robots they will need to install across their sites to maximize industrial activity and reduce expenses. Collaborative robots could be used more quickly by companies in the consumer electronics sector, for instance, to boost production flexibility. Furthermore, the incorporation of machine learning and artificial intelligence technologies in industrial robots is positively influencing the business sector. The introduction of 5G technology is also expected to encourage the use of robotics in the manufacturing sector. The low latency of the 5G network allows instantaneous communication between the systems for efficient coordination and connectivity.

Restraining Factors

It could be challenging for organizations with small to no relevant experience to make the initial investment. Large capital investments are required for several reasons, including procurement, integration, programming, accessories, and maintenance. This could hamper market growth.

Market Segment

- In 2022, the articulated segment accounted for the largest revenue share over the forecast period.

Based on the type, the Japan industrial robotics market is segmented into articulated, cartesian, scara, cylindrical, and others. Among these, the articulated segment has the largest revenue share over the forecast period. The mechanical design and movement of articulated robots closely mimic that of a human arm. The majority of articulated robots have four or six axes. Assembly, arc welding, material handling, machine tending, and packaging are typical uses for articulated robots.

- In 2022, the materials handling segment accounted for the largest revenue share over the forecast period.

Based on function, the Japan industrial robotics market is segmented into soldering & welding, materials handling, assembling & disassembling, painting & dispensing, milling, cutting, and others. Among these, the materials handling segment has the largest revenue share over the forecast period. Helping to keep down high labour costs and Improving productivity. Due to these reason, materials handling will boost the market growth in the forecast period.

- In 2022, the manufacturing segment is expected to hold the largest share of the Japan industrial robotics market during the forecast period.

Based on the end user, the Japan industrial robotics market is classified into automotive, electrical & electronics, chemical rubber & plastics, manufacturing, food & beverages, and others. Among these, the manufacturing segment is expected to hold the largest share of the Japan industrial robotics market during the forecast period. In the manufacturing industry robots are required to pick up parts from one conveyor and place them on another. Other transfer operations are more complex, such as placing parts onto pallets in an arrangement that must be calculated by the robot. applications include spot welding, continuous arc welding, and spray painting. Spot welding of automobile bodies is one of the most common applications of industrial robots.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan industrial robotics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fanuc Corporation

- Nachi-Fujikoshi Corp.

- Mitsubishi Electric Corporation

- Takatsu Corporation

- Denso

- Kawasaki Heavy Industries, Ltd.

- Seiko Epson Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On May 2023, Yaskawa Electric Corporation Electric Corporation and Oishii Farm Corporation, an American start-up producing strawberries, have announced a financial and business partnership. The partnership aimed to position Yaskawa Electric Corporation as a global leader in agricultural and food automation by supplying Oishii with automation systems based on Yaskawa Electric Corporation's "i3-Mechatronics" solution concept.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan industrial robotics market based on the below-mentioned segments:

Japan Industrial Robotics Market, By Type

- Articulated

- Cartesian

- SCARA

- Cylindrical

- Others

Japan Industrial Robotics Market, By Function

- Soldering & Welding

- Materials Handling

- Assembling & Disassembling

- Painting & Dispensing

- Milling

- Cutting

- Others

Japan Industrial Robotics Market, By End User

- Automotive

- Electrical & Electronics

- Chemical Rubber & Plastics

- Manufacturing

- Food & Beverages

- Others

Need help to buy this report?