Japan I2C Bus Market Size, Share, and COVID-19 Impact Analysis, By Type (Bidirectional I2C Bus and Unidirectional I2C Bus), By Mode (Standard Mode, Fast-Mode, Fast-Mode Plus, High-speed Mode, and Ultra-Fast-Mode), By Application (System Management (SMBus), Power Management (PMBus), Intelligent Platform Management Interface (IPMI), Display Data Channel (DDC), and Advanced Telecom Computing Architecture (ATCA)), and Japan I2C Bus Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan I2C Bus Market Insights Forecasts to 2035

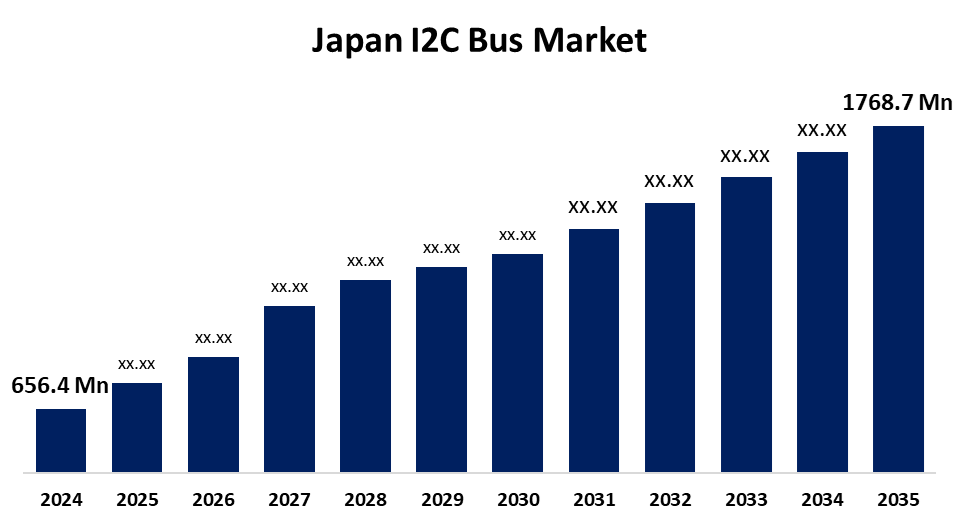

- The Japan I2C Bus Market Size Was Estimated at USD 656.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.43% from 2025 to 2035

- The Japan I2C Bus Market Size is Expected to Reach USD 1768.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan I2C Bus Market Size is anticipated to Reach USD 1768.7 Million by 2035, Growing at a CAGR of 9.43% from 2025 to 2035. The Japan I2C bus market is growing due to the increasing demand for consumer electronics, automotive, and industrial automation, which requires intelligent, networked devices. Demand is driven by the adoption of IoT, smart infrastructure initiatives, and advancements in silicon technology that require efficient data communication.

Market Overview

The Japan I2C (inter-integrated circuit) Bus Market Size refers to the base on a commonly applied communication standard used to interface low-speed peripheral devices to processors and microcontrollers within embedded systems. This protocol is crucial in electronics for facilitating effective data transfer among components in consumer electronics, automotive electronics, industrial automation, and IoT devices. The simplicity of the I2C bus, low cost, and scalability make it a choice for most applications, further deepening its market hold. Opportunities are created by the growing IoT ecosystem, increasing demand for connected devices, and developments in semiconductor technology. Market growth is fueled by the rapid uptake of smart devices, automotive electronics, and industrial automation solutions that need to depend on reliable and low energy communication protocols. Furthermore, government efforts in Japan encouraging Industry 4.0, smart manufacturing, and digital transformation enable embedded system adoption with I2C technology.

Report Coverage

This research report categorizes the market for the Japan I2C bus market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan I2C bus market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan I2C bus market.

Japan I2C Bus Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 656.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.43% |

| 2035 Value Projection: | USD 1768.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Toshiba Corporation, Sony Semiconductor Solutions Group, Mitsubishi Electric Corporation, Murata Manufacturing Co., Ltd., Omron Corporation, Kyocera Corporation, ROHM Co., Ltd., Fujitsu Semiconductor Limited, Kioxia Holdings Corporation, Panasonic Corporation, Advantest Corporation, NEC Corporation, Renesas Electronics Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan I2C bus industry is fuelled by increasing demands for low-power communication protocols in consumer electronics, automotive systems, and industrial automation. The proliferation of IoT devices and smart technologies necessitates low-power data transfer applications such as I2C. Its simplicity, affordability, and scalability make it increasingly attractive for widespread adoption. Moreover, the focus of Japan on Industry 4.0 and digital transformation, with the support of government policies, hastens the adoption of I2C in embedded systems across industries, driving market growth.

Restraining Factors

The Japan I2C bus market is constrained by competition from faster communication interfaces such as SPI and UART. Further, data transfer speed and distance limitations, as well as the increasing sophistication of contemporary electronics, test I2Cs applicability across all uses, slowing down market growth.

Market Segmentation

The Japan I2C bus market share is classified into type, mode, and application.

- The bidirectional I2C bus segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan I2C bus market is segmented by type into bidirectional I2C bus and unidirectional I2C bus. Among these, the bidirectional I2C bus segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its low wiring complexity, versatility, and applicability to sensor-dense settings. Bidirectional I²C buses enable multiple ICs to have access to a two-wire interface. With increasing demand in Japan for compact smart electronics, I²C enhances cost and space efficiency in miniature electronic modules.

- The ultra-fast-mode segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan I2C bus market is segmented by mode into standard mode, fast-mode, fast-mode plus, high-speed mode, and ultra-fast-mode. Among these, the ultra-fast-mode segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to its extensive applications in consumer electronics, automotive, and industrial control. Backed by key players such as Sony and Panasonic, it strikes the balance between quick data transfer and backward compatibility, perfectly suited for LCDs, EEPROMs, sensors, and other applications.

- The system management (SMBus) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan I2C bus market is segmented by application into system management (SMBus), power management (PMBus), intelligent platform management interface (IPMI), display data channel (DDC), and advanced telecom computing architecture (ATCA). Among these, the system management (SMBus) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. SMBus is crucial to monitoring and controlling system health for systems in computers, servers, and battery systems. Fueled by increasing thermal and voltage management requirements in data centers and laptops, Intel and ON Semiconductor are among the companies that integrate SMBus into power ICs. Its compatibility with I²C makes it more useful for augmenting I²C applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan I2C bus market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toshiba Corporation

- Sony Semiconductor Solutions Group

- Mitsubishi Electric Corporation

- Murata Manufacturing Co., Ltd.

- Omron Corporation

- Kyocera Corporation

- ROHM Co., Ltd.

- Fujitsu Semiconductor Limited

- Kioxia Holdings Corporation

- Panasonic Corporation

- Advantest Corporation

- NEC Corporation

- Renesas Electronics Corporation

- Others

Recent Developments:

- In March 2024, Renesas acquired Altium Limited and Transphorm to boost its SoC and power semiconductor strengths. Altiums PCB design skills and Transphorms GaN technology enhance I²C-based systems, solidifying Renesass role in delivering efficient, integrated solutions for future electronic and industrial innovations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan I2C bus market based on the below-mentioned segments:

Japan I2C Bus Market, By Type

- Bidirectional I2C Bus

- Unidirectional I2C Bus

Japan I2C Bus Market, By Mode

- Standard Mode

- Fast-Mode

- Fast-Mode Plus

- High-Speed Mode

- Ultra-Fast-Mode

Japan I2C Bus Market, By Application

- System Management (SMBus)

- Power Management (PMBus)

- Intelligent Platform Management Interface (IPMI)

- Display Data Channel (DDC)

- Advanced Telecom Computing Architecture (ATCA)

Need help to buy this report?