Japan Hydrolyzed Wheat Protein Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Liquid and Powder), By Application (Cosmetics and Personal Care, Food and Beverages, Pharmaceuticals, Animal Feed, and Others), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, and Others), and Japan Hydrolyzed Wheat Protein Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesJapan Hydrolyzed Wheat Protein Market Insights Forecasts to 2035

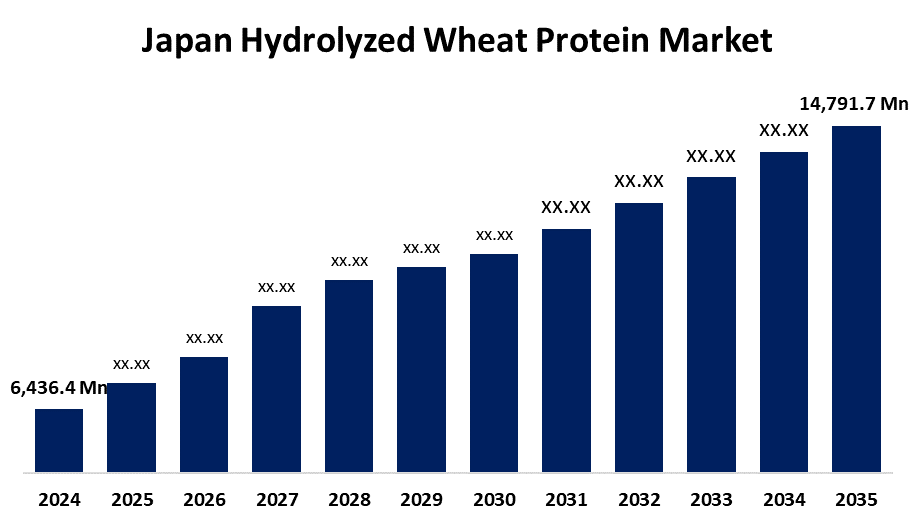

- The Japan Hydrolyzed Wheat Protein Market Size Was Estimated at USD 6,436.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.86% from 2025 to 2035

- The Japan Hydrolyzed Wheat Protein Market Size is Expected to Reach USD 14,791.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Hydrolyzed Wheat Protein Market Size is anticipated to reach USD 14,791.7 Million by 2035, growing at a CAGR of 7.86% from 2025 to 2035. The Japan hydrolyzed wheat protein market is increasing due to increased demand for allergen-free and plant-based foods, increased awareness of protein-enriched diets, and expanding applications in food and cosmetics.

Market Overview

The hydrolyzed wheat protein (HWP) in Japan refers to the enzymatically hydrolyzed wheat proteins broken down to peptides and amino acids. It is widely used in foods and beverages to add texture, water holding, and nutrition, and cosmetics for moisturizing and hair conditioning. Main applications are in bakery products, processed food, shampoos, and skin care, consistent with growing health-conscious consumer demands. Strengths consist of strong local manufacturing facilities, established distribution channels in offline retail, and sound quality regulation standards. Opportunities lie in new-age applications in elderly nutrition, hair care, pet food, and the expansion of liquid and HWP concentration forms. The online retailing sector is gaining momentum with ease of access and promotions. Market drivers are Japan's aging population wellness focus, growing plant-based meal trends, and advanced fermentation/hydrolysis technologies. Government support by farm development programs, food additive regulations, and the promotion of plant-based and clean-label foods is influencing industry growth.

Report Coverage

This research report categorizes the market for the Japan hydrolyzed wheat protein market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan hydrolyzed wheat protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan hydrolyzed wheat protein market.

Japan Hydrolyzed Wheat Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6,436.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.86% |

| 2035 Value Projection: | USD 14,791.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Distribution |

| Companies covered:: | Yantai Shuangta Food Co. Ltd., Roquette Freres, Nippn Corporation, Archer Daniels Midland Company, Fuji Oil Group, Glico Nutrition Co. Ltd., MGP Ingredients, Manildra Group, Nagata Group Holdings, Ltd., Cargill, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan hydrolyzed wheat protein market is fueled by greater awareness among consumers of health and expanding use of plant-based diets, which drives demand for sustainable protein substitutes. Growth of functional food, sports nutrition, and personal care, struggling to moisturize and condition properties, fuels consumption. The country's aging populace seeks well-being-focused products, and rising disposable incomes enable high-quality, clean-label ingredient purchases. Additionally, enzymatic processing technology promotes the reduction of allergenicity in order to meet gluten-sensitive consumer needs. Growing online distribution channels and sustainable production processes also provide additional drivers for market growth.

Restraining Factors

The Japan hydrolyzed wheat protein market is constrained by heavy production volumes owing to advanced hydrolysis, volatile wheat-gluten availability, and fierce competition with soy, pea, and rice proteins increases costs and slows adoption. Furthermore, allergen concerns—especially among gluten-intolerant consumers—and stringent regulatory compliance contribute to market barriers.

Market Segmentation

The Japan hydrolyzed wheat protein market share is classified into product type, application, and distribution channel.

- The liquid segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydrolyzed wheat protein market is segmented by product type into liquid and powder. Among these, the liquid segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. It's most commonly used in personal care items such as shampoos, conditioners, and lotions because of its ease to be added into formulas and greater moisturizing potential. Firms are focusing on optimizing the stability and shelf life of liquid hydrolyzed wheat proteins to meet the evolving needs of end consumers.

- The cosmetics and personal care segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydrolyzed wheat protein market is segmented by application into cosmetics and personal care, food and beverages, pharmaceuticals, animal feed, and others. Among these, the cosmetics and personal care segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is all due to its amazing moisturizing and film-forming abilities. It is widely used in products like shampoos, conditioners, and skin creams, where it stabilizes hair, prevents breakage, and enhances the skin's elasticity.

- The online stores segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydrolyzed wheat protein market is segmented by distribution channel into online stores, supermarkets/hypermarkets, specialty stores, and others. Among these, the online stores segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the booming e-commerce sector as well as customer desire for convenient shopping. Availability of products, favorable online prices, and doorstep delivery are some of the key drivers that boost the popularity of online retailers as a channel of distribution for hydrolyzed wheat protein.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan hydrolyzed wheat protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yantai Shuangta Food Co. Ltd.

- Roquette Freres

- Nippn Corporation

- Archer Daniels Midland Company

- Fuji Oil Group

- Glico Nutrition Co. Ltd.

- MGP Ingredients

- Manildra Group

- Nagata Group Holdings, Ltd.

- Cargill

- Others

Recent Developments:

- In December 2024, NIPPN CORPORATION, a Japanese total food manufacturer, is going global. For this purpose, it invested in Utah Flour Milling as its initial investment in a foreign flour mill business, and is trying to increase its competitiveness in North America.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan hydrolyzed wheat protein market based on the below-mentioned segments:

Japan Hydrolyzed Wheat Protein Market, By Product Type

- Liquid

- Powder

Japan Hydrolyzed Wheat Protein Market, By Application

- Cosmetics and Personal Care

- Food and Beverages

- Pharmaceuticals

- Animal Feed

- Others

Japan Hydrolyzed Wheat Protein Market, By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Need help to buy this report?