Japan Hydrogen Bus Market Size, Share, and COVID-19 Impact Analysis, By Bus Type (Single Deck and Articulated Deck), By Power Output (Below 100 kW and 100-200 kW), By Cell Technology (Proton Exchange Membrane Fuel Cell, Solid Oxide Fuel Cell and Alkaline Fuel Cell), and Japan Hydrogen Bus Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationJapan Hydrogen Bus Market Insights Forecasts to 2035

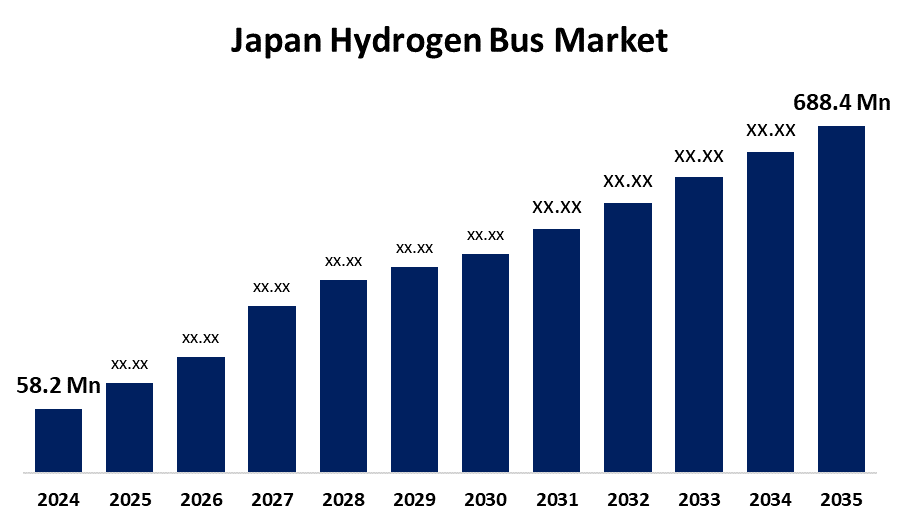

- The Japan Hydrogen Bus Market Size was estimated at USD 58.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 25.18% from 2025 to 2035

- The Japan Hydrogen Bus Market Size is Expected to Reach USD 688.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Hydrogen Bus Market Size is Anticipated to reach USD 688.4 Million By 2035, Growing at a CAGR of 25.18% from 2025 to 2035. The market for hydrogen bus in Japan is increasing with government policy, environmental issues, and technological innovation. Japan's energy insecurity and a keen focus on clean energy are also strong drivers, most notably the establishment of hydrogen infrastructure.

Market Overview

The Japan hydrogen bus market refers to the creation and deployment of fuel cell buses that run on hydrogen, promoting clean, zero-emission public transportation across the country. Japan's hydrogen bus market is the backbone of its plan to reach net-zero emissions by 2050. Hydrogen buses use fuel cell technology to transform hydrogen into electricity, producing only water vapor, and thus are well-suited for city and intercity public transportation. Their main strengths are increased range (300–600 km on a refueling), short refueling times (5–15 minutes), and high payload. There are opportunities to be seized in developing hydrogen refueling infrastructure, bringing renewable energy into hydrogen production for green hydrogen, and encouraging public-private partnerships. Japan's forward-looking strategy makes it the world's leader in hydrogen mobility, with prospects for hydrogen technology and solution exports. The demand is stimulated by strict emissions regulations, increasing public interest in sustainable mobility, and Japanese leadership in fuel cell technology. Moreover, the Tokyo Metropolitan Government has raised its budget for hydrogen-related projects to improve support for spreading commercial fuel cell vehicles like trucks and buses. Government policies are decisive, with the basic hydrogen strategy and green growth strategy offering financial support, grants, and tax incentives to promote hydrogen adoption.

Report Coverage

This research report categorizes the market for the Japan hydrogen bus market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan hydrogen bus market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan hydrogen bus market.

Japan Hydrogen Bus Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 58.2 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 25.18% |

| 2035 Value Projection: | USD 688.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Bus Type, By Power Output and COVID-19 Impact Analysis |

| Companies covered:: | Kawasaki Heavy Industries, Toyota Motor Corporation, Hyundai Motor Japan, Mitsui & Co., Ltd., Honda Motor Co., Ltd., Iwatani Corporation, Ballard Power Systems, Hino Motors, J-Bus Ltd., Tokyo Gas Co., Ltd., Air Liquide Japan, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan automakers and energy firms are leading the way in fuel cell development, making hydrogen buses more efficient and affordable. The country is also expanding very quickly the network of hydrogen refuelling stations, particularly in urban areas, to support the growing number of hydrogen buses. With its strong target for 2050 carbon neutrality, Japan is presently seeking sustainable transportation technology to reduce greenhouse gas emissions and improve air quality. Cooperation among carmakers, energy firms, and local governments is propelling the development and acceptance of hydrogen buses to make a united drive towards clean transportation. The government of Japan has brought out policies such as the Basic Hydrogen Strategy and the Green Growth Strategy that provide subsidies and financial incentives to encourage the implementation of hydrogen-fuelled buses.

Restraining Factors

Japan hydrogen bus market is constrained by high production and infrastructure prices, few hydrogen refuelling stations, and hydrogen storage and transport difficulties. Competition from electric buses and sluggish public uptake also restrains quicker market growth.

Market Segmentation

The Japan hydrogen bus market share is classified into bus type, power output, and cell technology.

- The single deck segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Japan hydrogen bus market is segmented by bus type into single deck and articulated deck. Among these, the single deck segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The single deck is due to increasing incentives to promote the use of hydrogen fuel cell vehicles and rising environmental policies and funding programs.

- The below 100 kW segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The Japan hydrogen bus market is segmented by power output into below 100 kW and 100-200 kW. Among these, the below 100 kW segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to increasing demand for below 100 kW hydrogen buses in urban environments, increasing adoption of low-capacity transportation services, and growing demand for micro-transit and shuttle services.

- The proton exchange membrane fuel cell segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Japan hydrogen bus market is segmented by cell technology into proton exchange membrane fuel cell, solid oxide fuel cell, and alkaline fuel cell. Among these, the proton exchange membrane fuel cell segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the continuous innovation in proton exchange membrane (PEM) fuel cell technology, rising R&D funding for PEMFC technology, and growing government initiatives to deploy proton exchange membrane fuel cell (PEMFC) buses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan hydrogen bus market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kawasaki Heavy Industries

- Toyota Motor Corporation

- Hyundai Motor Japan

- Mitsui & Co., Ltd.

- Honda Motor Co., Ltd.

- Iwatani Corporation

- Ballard Power Systems

- Hino Motors

- J-Bus Ltd.

- Tokyo Gas Co., Ltd.

- Air Liquide Japan

- Others

Recent Developments:

- In September 2024, Kawasaki Heavy Industries announced it would partner with local governments to develop a network of hydrogen fuelling stations across northern Japan to serve the expanding number of hydrogen-fueled buses.

- In April 2024, Ballard Power Systems agreed to partner with a prominent Japanese transit company to supply hydrogen fuel cell stacks for a new hydrogen bus fleet.

- In January 2024, Toyota announced the introduction of a new fleet of hydrogen buses in Tokyo as a major milestone in the transition to using hydrogen buses in the city.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan hydrogen bus market based on the below-mentioned segments

Japan Hydrogen Bus Market, By Bus Type

- Single Deck

- Articulated Deck

Japan Hydrogen Bus Market, By Power Output

- Below 100 kW

- 100-200 kW

Japan Hydrogen Bus Market, By Cell Technology

- Proton Exchange Membrane Fuel Cell

- Solid Oxide Fuel Cell

- Alkaline Fuel Cell

Need help to buy this report?