Japan Hydrocarbons Accounting Solution Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Services), By Deployment Mode (On-premises and Cloud-based), By Application (Oil, Natural Gas, and Water), and Japan Hydrocarbons Accounting Solution Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyJapan Hydrocarbons Accounting Solution Market Insights Forecasts to 2035

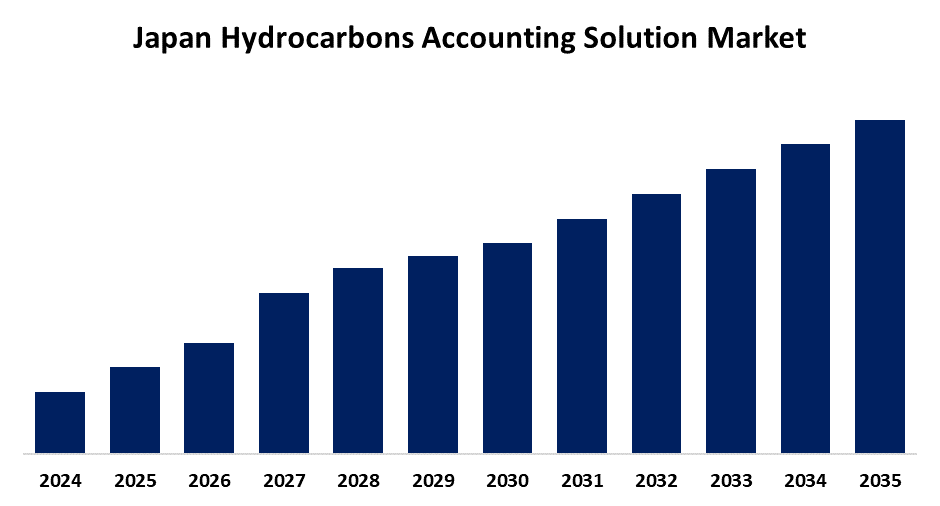

- The Japan Hydrocarbons Accounting Solution Market Size is Expected to Grow at a CAGR of 6.9% from 2025 to 2035

- The Japan Hydrocarbons Accounting Solution Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Hydrocarbons Accounting Solution Market Size is expected to hold a significant share by 2035, at a CAGR of 6.9% during the forecast period 2025-2035. The Japan hydrocarbon accounting solution market is growing as a result of more demand for effective and transparent hydrocarbon management, fueled by regulatory requirements, operational efficiency demands, and the upsurge of innovative technologies such as blockchain and AI.

Market Overview

The Japan hydrocarbons accounting solution market refers to expert software and systems used to monitor, assign, and report the production, movement, and sale of hydrocarbons like oil and natural gas. These solutions are crucial for regulatory compliance, optimizing production, and supporting accurate revenue distribution along the energy value chain. In Japan, the demand comes from the necessity of the country to utilize its limited domestic hydrocarbon resources optimally and import more LNG and other fuels. The chief strengths are Japan's advanced IT infrastructure, a strong emphasis on automation, and stringent requirements for data accuracy and reporting. Opportunities are in the convergence of hydrocarbon accounting systems with digital technologies such as AI, IoT, and cloud computing to increase operational transparency and efficiency. The market is also supported by Japan's focus on energy security, environmental standards, and government-initiated digital transformation in the energy sector. Government initiatives promoting smart energy management and enhanced reporting structures further increase adoption, positioning Japan to become a leader in digitalized energy accounting and operational excellence in the hydrocarbons sector.

Report Coverage

This research report categorizes the market for the Japan hydrocarbons accounting solution market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan hydrocarbons accounting solution market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan hydrocarbons accounting solution market.

Japan Hydrocarbons Accounting Solution Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.9% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component, By Deployment Mode, By Application |

| Companies covered:: | Quorum Business Solutions, Schlumberger, Fuji Oil Holdings Inc., P2 Energy Solutions, SAP SE, INPEX Corporation, CGI Group, Infosys, ENEOS Holdings, Inc., Pansoft, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan's hydrocarbons accounting solution market is fueled by strict environmental, emissions, and resource monitoring regulations that necessitate precise reporting and compliance. Sudden digitalization in the energy industry, ranging from cloud migration, AI, IoT, to analytics, is another prime driver, allowing real-time processing of data, operational efficiency, and cost reduction. Moreover, increased complexity in upstream operations and increasing hydrocarbon consumption fuel adoption are compelling energy companies to implement sophisticated accounting software for increased transparency, allocation, and decision-making.

Restraining Factors

The Japan hydrocarbons accounting solution market is constrained by the high cost of implementation, difficulty in migrating legacy systems, and low domestic hydrocarbon production. Further, the lack of skilled personnel and data security concerns are inhibiting wider adoption in the energy sector.

Market Segmentation

The Japan hydrocarbons accounting solution market share is classified into component, deployment mode, and application.

- The software segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydrocarbons accounting solution market is segmented by component into software and services. Among these, the software segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their offering the necessary platforms and tools for data acquisition, processing, analysis, and reporting. These software packages are capable of performing sophisticated functions, including monitoring hydrocarbon production, consumption, and losses, as well as having predictive analytics and real-time monitoring capabilities.

- The cloud-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydrocarbons accounting solution market is segmented by deployment mode into on-premises and cloud-based. Among these, the cloud-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to they are scalable, flexible, and cost-effective. In hydrocarbons accounting, cloud-based solutions provide real-time access to vital data and analytics anywhere, supporting remote monitoring and decision-making. They do away with the need for hefty on-premises infrastructure.

- The oil segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydrocarbons accounting solution market is segmented by application into oil, natural gas, and water. Among these, the oil segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to precise tracking and management of oil assets, from exploration and production through refining and distribution. The solutions help oil firms keep track of production volumes, evaluate reservoir performance, maximize refinery activities, and comply with ecological standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan hydrocarbons accounting solution market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Quorum Business Solutions

- Schlumberger

- Fuji Oil Holdings Inc.

- P2 Energy Solutions

- SAP SE

- INPEX Corporation

- CGI Group

- Infosys

- ENEOS Holdings, Inc.

- Pansoft

- Others

Recent Developments:

- In May 2025, Eneos Holdings, Japan's largest oil refiner, will invest 1.56 trillion yen ($10.7 billion) through March 2028, 740 billion yen of which goes to low-carbon fuels such as LNG and sustainable aviation fuel. It will slow its hydrogen ambitions, concentrating on renewables and carbon capture technologies instead.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan hydrocarbons accounting solution market based on the below-mentioned segments:

Japan Hydrocarbons Accounting Solution Market, By Component

- Software

- Services

Japan Hydrocarbons Accounting Solution Market, By Deployment Mode

- On-Premises

- Cloud-Based

Japan Hydrocarbons Accounting Solution Market, By Application

- Oil

- Natural Gas

- Water

Need help to buy this report?