Japan Horticulture Film Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Polyethylene, Polypropylene, PVC, and Others), By Thickness (Up to 100 Microns, 100-150 Microns, and Above 150 Microns), By Application (Greenhouse, Mulching, Silage, and Others), and Japan Horticulture Film Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Horticulture Film Market Insights Forecasts to 2035

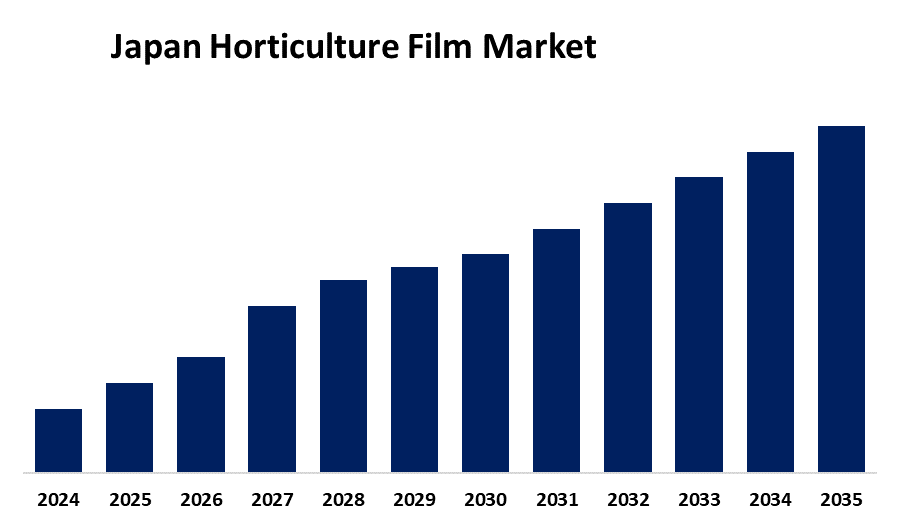

- The Japan Horticulture Film Market Size is Expected to Grow at a CAGR of 5.8% from 2025 to 2035

- The Japan Horticulture Film Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan horticulture film market is expected to hold a significant share by 2035, at a CAGR of 5.8% during the forecast period 2025-2035. The Japan horticulture film market is increasing due to the increased demand for food security, year-round crop production, and green agriculture. New technology in film production and the increasing awareness of environmentally friendly agricultural practices are also increasing the market.

Market Overview

The Japan horticulture film market refers to specializes in plastic films that include greenhouse cover, mulch films, and tunnel films that are applied to optimize agricultural production. They manage microclimates, conserve water in the soil, suppress weeds, and protect crops from adverse weather, hence increasing quality and yield. Horticulture films enable perpetual production, maximum resource utilization, and tolerance to climate change, which makes them an integral part of sustainable agriculture. Opportunities in the market are biodegradable and UV-stable films that resonate with environmentally conscious consumers and complement environmental regulations. Further, advancements in smart films with better light diffusion and anti-condensation properties are also able to improve crop yields. The drivers primarily include Japan's aging farmer population, the growing demand for quality produce, and the adoption of advanced farming practices like greenhouse cultivation. The Japanese government has vowed to spend an additional 12.5% more on agricultural film technology over the course of the next five years, targeting technologies such as biodegradable films and special greenhouse covering products.

Report Coverage

This research report categorizes the market for the Japan horticulture film market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan horticulture film market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan horticulture film market.

Japan Horticulture Film Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.8% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Material Type, By Thickness, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Rengo Co., Ltd., Polystar Plastics, Nippon Gohsei Co., Ltd., Argus Control System Ltd., Sumitomo Chemical Co., Ltd., Trioplast, Asahi Kasei Corporation, Toray Industries Inc, Hexcel Corporation, Agra Tech Inc., Gaga Corporation., Kuraray Co., Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Japan horticulture film market is spurred on by increased application of mulching and greenhouse films as well as labor-saving techniques like these, alongside increased demand for high-value fruits and fruit and vegetables, and optimal use of resources. With aging in agriculture in Japan, solutions like greenhouse films and mulching are gaining traction. Climate change and unpredictable weather patterns have also driven demand for crop protection films that ensure stable returns throughout the year.

Restraining Factors

The Japanese horticulture film market is limited by the high cost of sophisticated and biodegradable films, the slow adoption rate among small farmers, the shortages of labor due to the aging agricultural population, and greater environmental pressure for plastic disposal and sustainability.

Market Segmentation

The Japan horticulture film market share is classified into material type, thickness, and application.

- The polyethylene segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan horticulture film market is segmented by material type into polyethylene, polypropylene, PVC, and others. Among these, the polyethylene segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its affordability, strength, and flexibility. Polyethylene films are used due to their high tensile strength, good mechanical behavior, and flexibility, which make them ideal for many agricultural applications, e.g., mulching and greenhouse films.

- The up to 100 microns segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan horticulture film market is segmented by thickness into up to 100 microns, 100-150 microns, and above 150 microns. Among these, the up to 100 microns segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to being most widely used in applications requiring flexibility and lightness, such as mulching. Such films are inexpensive and easy to manage and, therefore, would be utilized extensively in agriculture. Their lifespan could, however, be shorter than that of thicker films, necessitating repeated renewal, thereby making a contribution to constant demand and influencing market behavior.

- The greenhouse segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan horticulture film market is segmented by application into greenhouse, mulching, silage, and others. Among these, the greenhouse segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to their key role in controlling climatic conditions to attain optimal growth for plants. Greenhouse films help maintain the temperature, humidity, and light levels suitable for various horticulture crops, hence extending the crop season. Increased use of greenhouses in urban agriculture and business farming will continue to sustain the market for greenhouse films.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan horticulture film market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rengo Co., Ltd.

- Polystar Plastics

- Nippon Gohsei Co., Ltd.

- Argus Control System Ltd.

- Sumitomo Chemical Co., Ltd.

- Trioplast

- Asahi Kasei Corporation

- Toray Industries Inc

- Hexcel Corporation

- Agra Tech Inc.

- Gaga Corporation.

- Kuraray Co., Ltd.

- Others

Recent Developments:

- In April 2023, Kuraray Co., Ltd. in Japan focused on expanding its bio-based and recyclable resin technologies within the horticulture film market, particularly with its PLANTIC™ EP resin for paper coating. They also highlighted EVAL™ EVOH, a bio-circular resin with strong barrier properties. Additionally, Kuraray showcased its commitment to sustainability by conducting Life Cycle Assessments (LCAs) for several products, including PVB film.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan horticulture film market based on the below-mentioned segments:

Japan Horticulture Film Market, By Material Type

- Polyethylene

- Polypropylene

- PVC

- Others

Japan Horticulture Film Market, By Thickness

- Up to 100 Microns

- 100-150 Microns

- Above 150 Microns

Japan Horticulture Film Market, By Application

- Greenhouse

- Mulching

- Silage

- Others

Need help to buy this report?