Japan Hip Replacement Implants Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Total Hip, Partial Femoral Head, Hip Resurfacing, and Revision Hip), By Material (Metal-on-Metal, Metal-on-Polyethylene, Ceramic-on-Polyethylene, Ceramic-on-Metal, and Ceramic-on-Ceramic), By End-use (Hospitals & Surgery Centers, Orthopedic Clinics, and Others), and Japan Hip Replacement Implants Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Hip Replacement Implants Market Insights Forecasts to 2035

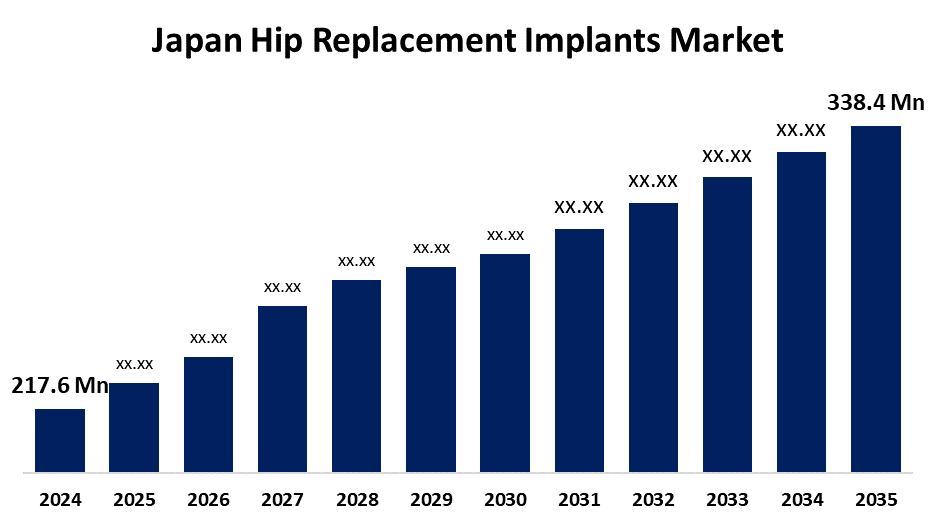

- The Japan Hip Replacement Implants Market Size Was Estimated at USD 217.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.1% from 2025 to 2035

- The Japan Hip Replacement Implants Market Size is Expected to Reach USD 338.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Hip Replacement Implants Market Size is anticipated to Reach USD 338.4 Million by 2035, Growing at a CAGR of 4.1% from 2025 to 2035. The Japan hip replacement implants market is increasing due to an aging population, growing cases of orthopedic disease, and advances in medical technology. Healthcare-supporting government initiatives further increase demand, promoting market growth and improved patient access to innovative hip replacement.

Market Overview

The Japan Hip Replacement Implants Market Size refers to the surgical installation of prostheses, including total, partial, resurfacing, and revision hips, to replace injured hip joints, restoring mobility and reducing pain. These products are applied mainly in hospitals, operating centers, and orthopedic clinics. Strengths are Japan's strong healthcare infrastructure, R&D funded by the government, and robotics and electronic medical records integration. Opportunities are personalized 3D-printed implants and increasing demand for revision procedures. The market is spurred by Japan's ageing population, with more than 28% being 65+, and rising incidences of osteoarthritis and fracture, thereby fueling demand for joint replacements. Advances in technology with implant materials (ceramic, metal, polymer) and design customized to Asian anatomy have consolidated the market. The PMDA and JOA provide government backing that upholds rigorous safety regulations, promotes the development of innovative medical devices, and streamlines the regulatory approval process.

Report Coverage

This research report categorizes the market for the Japan hip replacement implants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan hip replacement implants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan hip replacement implants market.

Japan Hip Replacement Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 217.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.1% |

| 2035 Value Projection: | USD 338.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By Material |

| Companies covered:: | Zimmer Biomet, DePuy Synthes, Kyocera Medical Technologies, Stryker Corporation, Exactech, Medtronic, Smith & Nephew, B. Braun Melsungen, Medacta Group, MicroPort Scientific Corporation, LimaCorporate, Nakanishi Inc., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan hip replacement implants market is influenced by a rapidly growing aging population, increasing incidences of osteoarthritis and hip fractures, and a growing demand for increased mobility and pain mitigation. Advances in implant technology and surgical methods, such as minimally invasive and robotics-based surgery, improve patient outcomes. Further driving market growth in Japan's orthopedic market are expanding awareness regarding joint care, improved healthcare infrastructure, and government initiatives in medical innovation and research.

Restraining Factors

The safety concerns, limited implant lifespan, and high prices hinder the Japan hip replacement implants market. Delays in the regulatory process and a shortage of trained surgeons in advanced and robotic procedures hinder access and slow the pace of market expansion and technology adoption.

Market Segmentation

The Japan hip replacement implants market share is classified into product type, material, and end-use.

- The total hip segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hip replacement implants market is segmented by product type into total hip, partial Femoral Head, Hip Resurfacing, and Revision Hip. Among these, the total hip segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Total hip replacement is a frequent surgical procedure for fractures, degenerative hip disease, and end-stage arthritis, primarily among older patients. It is very effective in eliminating pain and returning function, with a long history of success. Such established reliability spurs both patients and surgeons to select the procedure increasingly.

- The metal-on-polyethylene segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hip replacement implants market is segmented by material into metal-on-metal, metal-on-polyethylene, ceramic-on-polyethylene, ceramic-on-metal, and ceramic-on-ceramic. Among these, the metal-on-polyethylene segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their efficacy and affordability over ceramic or metal-on-metal implants. Highly cross-linked polyethylene (HXLPE) adds wear resistance and strength, minimizing the risk of osteolysis and increasing the lifespan of the implant, bringing these implants within the reach of and affordability for patients.

- The hospitals & surgery centers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hip replacement implants market is segmented by end-use into hospitals & surgery centers, orthopedic clinics, and others. Among these, the hospitals & surgery centers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to they offer integrated care, preoperative examination, surgery, postoperative care, and rehabilitation, making them the first option for hip replacement. Equipped with modern technology and expert surgeons, they guarantee safer procedures, improved quality, and optimal results, supporting the common practice of hip replacement surgery.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan hip replacement implants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zimmer Biomet

- DePuy Synthes

- Kyocera Medical Technologies

- Stryker Corporation

- Exactech

- Medtronic

- Smith & Nephew

- B. Braun Melsungen

- Medacta Group

- MicroPort Scientific Corporation

- LimaCorporate

- Nakanishi Inc.

- Others

Recent Developments:

- In September 2020, Stryker has introduced Mako® Total Hip 4.0, featuring SmartRobotics™ with advanced CT-based 3D modeling and planning tools. The new software enables approach-specific pelvic registration and considers pelvic tilt in various positions. Surgeons can now visualize femur-to-pelvis alignment, helping identify potential impingement risks and improve implant positioning.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan hip replacement implants market based on the below-mentioned segments:

Japan Hip Replacement Implants Market, By Product Type

- Total Hip

- Partial Femoral Head

- Hip Resurfacing

- Revision Hip

Japan Hip Replacement Implants Market, By Material

- Metal-on-Metal

- Metal-on-Polyethylene

- Ceramic-on-Polyethylene

- Ceramic-on-Metal

- Ceramic-on-Ceramic

Japan Hip Replacement Implants Market, By End-use

- Hospitals & Surgery Centers

- Orthopedic Clinics

- Others

Need help to buy this report?