Japan Health Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type of Insurance Provide (Public and Private), By Premium Type (Regular Premium and Single Premium), and Japan Health Insurance Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareJapan Health Insurance Market Insights Forecasts to 2035

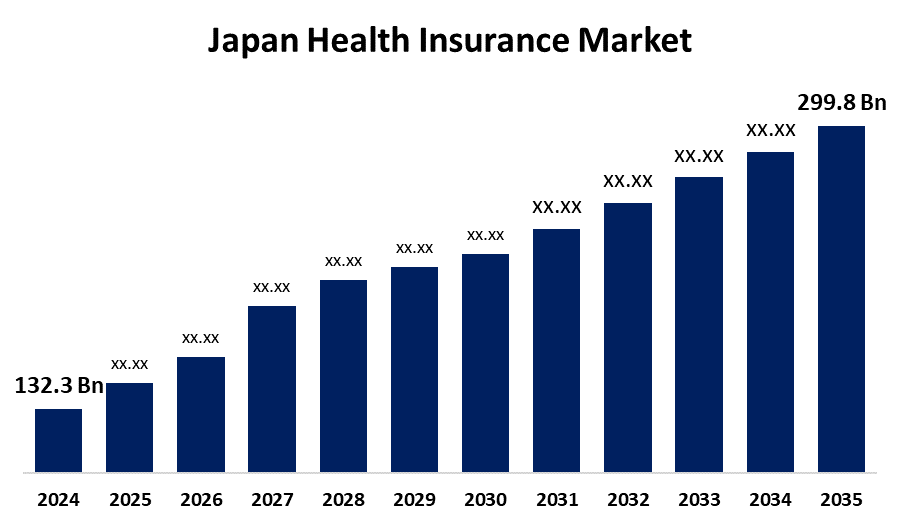

- The Japan Health Insurance Market Size was estimated at USD 132.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.52% from 2025 to 2035

- The Japan Health Insurance Market Size is Expected to Reach USD 299.8 Billion by 2035

Get more details on this report -

The Japan Health Insurance Market Size is Anticipated to reach USD 299.8 Billion by 2035, Growing at a CAGR of 8.52% from 2025 to 2035. Demographics with increasing number of aging consumer, increasing health expenditures, ease of access of universal healthcare system, increasing numbers of chronic ailments, technological upgradations in medicine, proliferation of telemedicine, increasing usage of corporate insurance, and growth of foreign nationals with need of healthcare coverage are a few contributing factors to market expansion.

Market Overview

Japan health insurance market means the business providing financial protection against medical costs via insurance plans. It consists of both private and public providers offering different plans like medical insurance, critical illness insurance, and family floater health insurance. Additionally, the growing convergence of digital platforms for healthcare services is one of the major market trends. Insurers are utilizing telemedicine, mobile applications, and electronic records to streamline service delivery, which is further supporting the market growth. Further, the expanding utilization of data analytics to make insurance policies more customized, such as a tailored coverage plan for a person based on their health information, is promoting the market growth. According to this, the growing per capita income has increased the demand for faster and more extensive services via private health insurance, which is also driving the market growth further. Moreover, Japan's universal health insurance system (UHI) guarantees that every resident has access to healthcare services through employer-based or national health insurance schemes. The government has an important role in regulating the industry, ensuring price controls on medical services to keep them affordable and preventing excessive charges by healthcare providers.

Report Coverage

This research report categorizes the market for the Japan health insurance market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan health insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan health insurance market.

Japan Health Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 132.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.52% |

| 2035 Value Projection: | USD 299.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Type of Insurance Provide, By Premium Type and COVID-19 Impact Analysis |

| Companies covered:: | AXA Life Insurance Co., Ltd., MetLife Insurance Co., Ltd., AIG General Insurance Co., Ltd., Meiji Yasuda Life Insurance Company, MS&AD Insurance Group Holdings, Inc., National Mutual Insurance Federal Agricultural Cooperation, Nippon Life Insurance Company, Pacific Prime Insurance Brokers Limited, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan boasts one of the world's oldest populations, with more than 29% of its population aged 65 and older. This population shift is largely driving the need for healthcare services, resulting in increased dependence on the nation's health insurance system. With life expectancy increasing, the incidence of chronic diseases like diabetes, cardiovascular disease, and cancer is also on the rise. Old consumers need regular medical examinations, long-term care, and specific treatments, which burden public and private health insurance funds. Furthermore, the government of Japan has put into place a number of programs meant to advance digital health solutions and enhance healthcare effectiveness. Initiatives such as "Health Japan 21" and "Medical DX Reiwa Vision 2030" have set goals of upgrading health outcomes, minimizing expenditure, and enhancing preventive care using digital health measures. Such policies set the environment ripe for expansion of the health insurance market.

Restraining Factors

The Japanese health insurance industry is controlled by a small number of large firms, which can restrict competition and innovation. This concentration can lead to increased prices for consumers and less variety in the marketplace. Furthermore, strict regulations can hinder new players from entering the market, further solidifying the control of the current players.

Market Segmentation

The Japan health insurance market share is classified into type of insurance provide and premium type.

- The private segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan health insurance market is segmented by type of insurance provide into public and private. Among these, the private segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The private health insurance (PHI) is on the rise as consumers look for more coverage of advanced treatments and quality care. Behind this growth are gaps in public coverage, where patients are out-of-pocket paying for sophisticated treatments, dental work, and private hospital stays, making PHI a necessary financial safeguard. Private insurers are also increasingly providing more individualized health plans, such as cancer insurance, critical illness policies, and long-term care coverage, targeting Japan's aging population.

- The regular premium segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan health insurance market is segmented by premium type into regular premium and single premium. Among these, the regular premium segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The universal system of coverage operated in the country and a universal demand for level, long-term insurance policies. Both private insurers and public providers issue mainly policy plans with stable, periodic premiums that guarantee cost predictability by the policy holder. Employees' Health Insurance and National Health Insurance receive contributions both from employers and individuals through steady deductions, with private insurers delivering personalized long-term coverage with predictable premiums. This model is preferred because of affordability, organized financial planning, and full coverage. With Japan's aging population increasing, regular premium policies continue to be necessary for guaranteeing sustainable healthcare funding and accessibility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan health insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA Life Insurance Co., Ltd.

- MetLife Insurance Co., Ltd.

- AIG General Insurance Co., Ltd.

- Meiji Yasuda Life Insurance Company

- MS&AD Insurance Group Holdings, Inc.

- National Mutual Insurance Federal Agricultural Cooperation

- Nippon Life Insurance Company

- Pacific Prime Insurance Brokers Limited

- Others.

Recent Developments:

- In August 2024, Japan's Dai-ichi Life Insurance invested USD 40 million in DigitalBridge Partners III, a fund managed by U.S.-based DigitalBridge Investment Management. The fund focused on digital infrastructure assets, including data centers and cell towers.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan health insurance market based on the below-mentioned segments:

Japan Health Insurance Market, By Type of Insurance Provide

- Public

- Private

Japan Health Insurance Market, By Premium Type

- Regular Premium

- Single Premium

Need help to buy this report?