Japan Gym Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cardiovascular Equipment, Strength Training Equipment, and Others), By Type of Facility (Residential Fitness, Gyms/Fitness Centers, Health Clubs/Spas, Hotels/Hospitality, and Corporates/Workplaces), By Distribution Channel (Online and Offline), and Japan Gym Equipment Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsJapan Gym Equipment Market Insights Forecasts to 2035

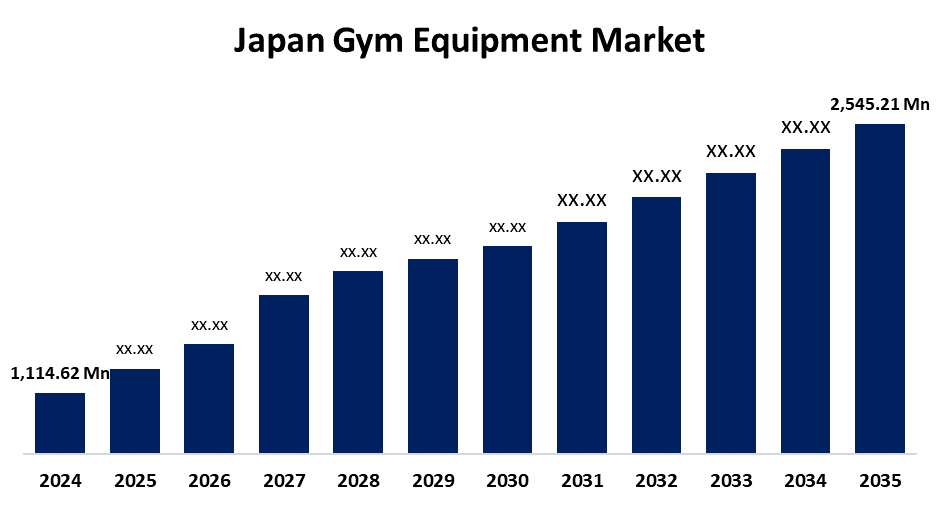

- The Japan Gym Equipment Market Size Was Estimated at USD 1,114.62 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.8% from 2025 to 2035

- The Japan Gym Equipment Market Size is Expected to Reach USD 2,545.21 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Gym Equipment Market Size is anticipated to reach USD 2,545.21 Million by 2035, growing at a CAGR of 7.8% from 2025 to 2035. The Japan market for gym equipment is growing as a result of rising health consciousness, the growth in fitness centers, and technological improvements. The aging population, government policies, and social media presence are also driving this growth.

Market Overview

The Japan gym equipment market refers to a variety of physical exercise machines and devices to be utilized in commercial fitness centers, homes, and rehabilitation facilities. These offerings consist of treadmills, stationary bikes, rowing machines, weight machines, and free weights, addressing emerging trends in health and wellness. The country's highly urbanized population, combined with technological advancements in smart and connected gym equipment, makes the sector robust. Chances are in the growing home fitness market, AI and IoT integration for customized training, and partnerships with fitness personalities and online platforms. Demand is fueled by increasing lifestyle disease awareness, an aging population in search of solutions for active aging, and more participation in fitness activities among all demographics. The government facilitates the fitness segment through programs for active living, including "Health Japan 21," to minimize lifestyle diseases and promote physical activity. In addition, local government initiatives and subsidies to upgrade community sports facilities are anticipated to contribute to market growth, positioning Japan as an attractive market for gym equipment suppliers.

Report Coverage

This research report categorizes the market for the Japan gym equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan gym equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan gym equipment market.

Japan Gym Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,114.62 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.8% |

| 2035 Value Projection: | USD 2,545.21 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Type of Facility, By Distribution Channel |

| Companies covered:: | Life Fitness, Brunswick Corporation, Mizuno Corporation, Precor, Matrix Fitness, Amer Sports, Cybex, Technogym, Johnson Health Tech, Nortus Fitness, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan market for gym equipment is based on rising health awareness, an expanding elderly population looking for active lives, and growing lifestyle-related disease concerns. Urban life and busy working schedules have contributed to increased demand for home fitness solutions, while technological innovation in smart and connected equipment draws technology-savvy consumers. Moreover, government health schemes and local community health initiatives also foster exercise, driving market growth. The trend of fitness and social media also drives consumers to spend on personal health and fitness.

Restraining Factors

The Japan gym equipment market is restrained by costly equipment, tight living quarters for home gyms, and a growing population with uneven fitness demands. Lastly, the saturation of gym memberships within urban pockets constrains new business opportunities for commercial equipment sales.

Market Segmentation

The Japan gym equipment market share is classified into product type, type of facility, and distribution channel.

- The cardiovascular equipment segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gym equipment market is segmented by product type into cardiovascular equipment, strength training equipment, and others. Among these, the cardiovascular equipment segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to treadmills, elliptical trainers, stationary bicycles, rowing machines, stair climbers, and a variety of other equipment designed to improve heart health and stamina account for a large part of the fitness equipment industry. Increased demand for home-based exercise solutions and cardiovascular awareness are propelling steady revenue growth in this market.

- The gyms/fitness centers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gym equipment market is segmented by type of facility into residential fitness, gyms/fitness centers, health clubs/spas, hotels/hospitality, and corporates/workplaces. Among these, the gyms/fitness centers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The requirement for equipment increases as the number of gym members increases due to a higher focus on physical fitness and well-being. Awareness-raising campaigns promoting gym membership based on the benefits of regular exercise, including improved mental well-being and weight control, increase membership.

- The offline segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gym equipment market is segmented by distribution channel into online and offline. Among these, the offline segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the growing need for concrete experience. Consumers like to directly check and use gym equipment before they buy it, particularly for expensive products such as treadmills and strength equipment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan gym equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Life Fitness

- Brunswick Corporation

- Mizuno Corporation

- Precor

- Matrix Fitness

- Amer Sports

- Cybex

- Technogym

- Johnson Health Tech

- Nortus Fitness

- Others

Recent Developments:

- In February 2024, REP Fitness joined hands with Uchinogym, one of Japan's leading distributors, to increase the availability of high-quality fitness equipment. Through the agreement, the company provided a full selection of products such as power racks, benches, barbells, and weight plates to assist people with all levels of fitness in reaching their training and health aspirations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan gym equipment market based on the below-mentioned segments:

Japan Gym Equipment Market, By Product Type

- Cardiovascular Equipment

- Strength Training Equipment

- Others

Japan Gym Equipment Market, By Type of Facility

- Residential Fitness

- Gyms/Fitness Centers

- Health Clubs/Spas

- Hotels/Hospitality

- Corporates/Workplaces

Japan Gym Equipment Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?