Japan Gummy Market Size, Share, and COVID-19 Impact Analysis, By Product (Vitamins, Minerals, Dietary Fibers, and Others), By Ingredient (Gelatin and Plant-Based Gelatin Substitutes), and Japan Gummy Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Gummy Market Insights Forecasts to 2035

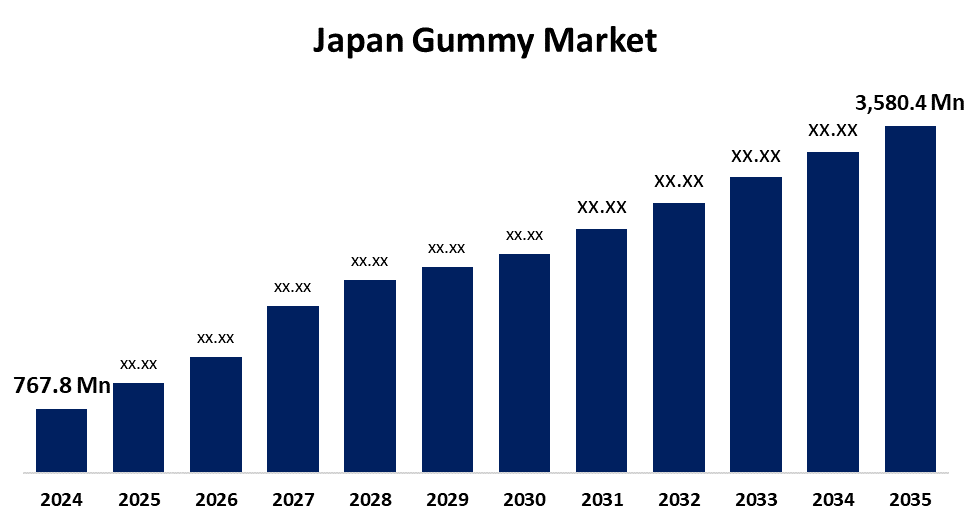

- The Japan Gummy Market Size Was Estimated at USD 767.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 15.02% from 2025 to 2035

- The Japan Gummy Market Size is Expected to Reach USD 3,580.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Gummy Market Size is Anticipated to Reach USD 3,580.4 Million by 2035, Growing at a CAGR of 15.02% from 2025 to 2035. The Japan gummy market is the fastest-growing market due to several factors, including rising consumer preferences towards healthy ingredients, demand for functional foods, rising health awareness, and demand for convenient consumption.

Market Overview

The gummies are soft, chewable products prepared with gelatin, sugar, and flavoring agents. The gummies are available in various shapes, colors, and flavors. Gummies offer a convenient way to consume a variety of active ingredients. They contain vitamins, minerals, and essential nutrients, making them popular among health-conscious individuals. Several gummies contain omega-3 fatty acids, which are beneficial for heart health. The gummies contain vitamins and minerals that support the immune system. The gummies, which contain probiotics and prebiotics, are beneficial for gut health. People are demanding plant-based wellness products, and easy-to-use supplements are key trends in the Japanese gummies market. The change in dietary preferences presents an opportunity for vegan, sugar-free, and natural gummies to cater health health-conscious individuals.

Report Coverage

This research report categorizes the market for the Japan gummy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan gummy market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan gummy market.

Japan Gummy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 767.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 15.02% |

| 2035 Value Projection: | USD 3,580.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Product, By Ingredient and COVID-19 Impact Analysis. |

| Companies covered:: | Ezaki Glico, Kabaya Foods, Nestle Health Science, Kasugai, Meiji, Kanro, Hi-Chew and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan gummy market is driven by several factors. One of the primary driving factors is that gummies are convenient and easy to use. Gummies provide a convenient delivery format for various active ingredients such as vitamins, minerals and supplements. The gummies help in boosting the immune system, are beneficial for heart health and gut health, making them popular among health-conscious people. The individuals are not looking for products that are good in taste but also provide health benefits, which raises the demand for functional and fortified gummies. Additionally, gummies provide a convenient and tasty alternative to traditional pills and capsules, which is driving the growth of the market.

Restraining Factors

Despite the positive growth factors, the Japanese gummy market has several challenges. The shortage of ingredients like gelatin, pectin and natural sweeteners disturbs the supply chain. The change in the prices of raw materials makes the final product expensive, which limits the expansion of the market.

Market Segmentation

The Japan gummy market share is classified into product and ingredient.

- The vitamins segment held the dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gummy market is segmented by product into vitamins, minerals, dietary fibers, and others. Among these, the vitamins segment held the dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increased prevalence of vitamin-deficient people. These vitamin gummies give an easy way to supplement these nutrients.

- The gelatin segment held the largest share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The Japan gummy market is segmented by ingredient into gelatin and plant-based gelatin substitutes. Among these, the gelatin segment held the largest share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This segmental growth is attributed to its versatility, cost-effectiveness, availability, and compatibility with other ingredients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan gummy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ezaki Glico

- Kabaya Foods

- Nestle Health Science

- Kasugai

- Meiji

- Kanro

- Hi-Chew

- Other

Recent Developments

- In April 2024, Issei Mochi Gummies rolled out at world market stores the country reaching more than 2000 locations are all natural, gluten-free and shelf stable, offering a unique chewy texture and diverse flavors to meet rising health-conscious demand.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan gummy market based on the below-mentioned segments:

Japan Gummy Market, By Product

- Vitamins

- Minerals

- Dietary Fibers

- Others

Japan Gummy Market, By Ingredient

- Gelatin

- Plant-based Gelatin substitutes

Need help to buy this report?