Japan Grid Modernization Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Application (Residential, Commercial, and Industrial), and Japan Grid Modernization Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerJapan Grid Modernization Market Insights Forecasts to 2035

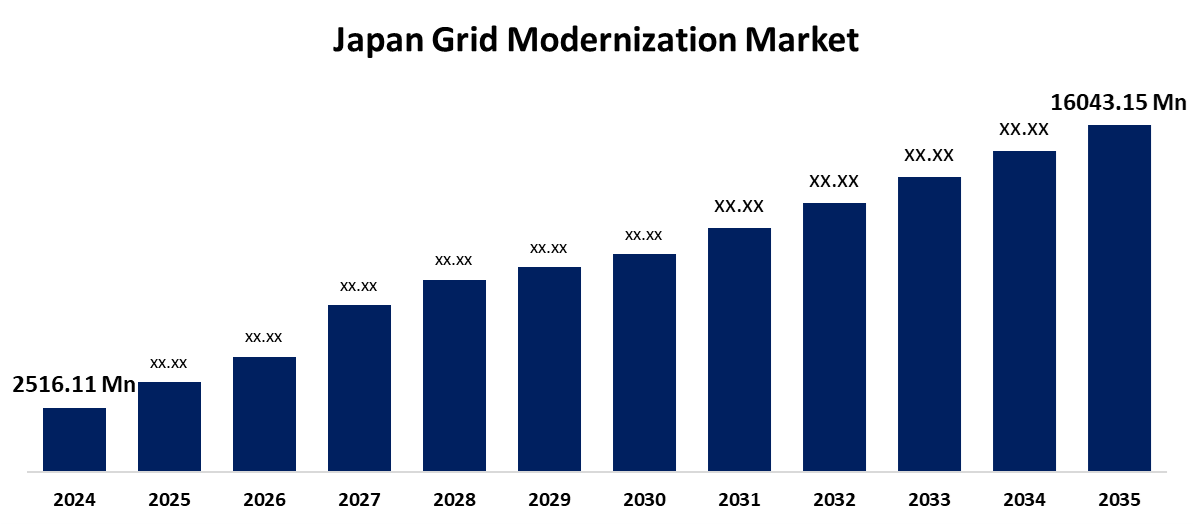

- The Japan Grid Modernization Market Size was Estimated at USD 2,516.11 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.34% from 2025 to 2035

- The Japan Grid Modernization Market Size is Expected to Reach USD 16,043.15 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Grid Modernization Market Size is anticipated to reach USD 16,043.15 Million by 2035, Growing at a CAGR of 18.34% from 2025 to 2035. The Japan Grid Modernization Market Size is driven by disaster-resilient infrastructure investments, carbon neutrality mandates, and renewable energy integration.

Market Overview

The Japan Grid Modernization Market Size focuses on upgrading the country's electrical grid with smart technologies, automation, and renewable energy integration to enhance efficiency and resilience. One of the main forces behind Japan's grid upgrading is the rising demand for energy efficiency. Solutions that use less energy are becoming more popular as the nation looks to improve its energy security and lessen its reliance on fossil fuels. A key factor in accomplishing these objectives is the use of smart grids, which have the capacity to track and optimize energy usage in real time. A more efficient energy system is made possible by these networks, which also decrease energy waste, enhance overall grid stability, and facilitate better load management.

Report Coverage

This research report categorizes the market size for the Japan grid modernization market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan grid modernization market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan grid modernization market.

Japan Grid Modernization Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,516.11 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 18.34% |

| 2035 Value Projection: | USD 16,043.15 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Component, By Application |

| Companies covered:: | ABB Ltd., Siemens AG, Schneider Electric SE, Hitachi Energy, General Electric Japan, Alstom SA, Toshiba Japan, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan's emphasis on energy efficiency, sustainability, and the integration of renewable energy sources are some of the major reasons propelling the country's grid modernization market. In addition to the need for more robust and dependable electrical networks, the government's commitment to decarbonization is driving investments in grid modernization technologies. Digitalization, sophisticated metering infrastructure, and smart grid technologies are all contributing to improved grid performance, real-time monitoring, and operational efficiency. Additional factors driving the need for improved grid infrastructure include the growing popularity of electric vehicles and the desire for energy storage devices. In order to optimize energy distribution and cut costs, key trends include the increasing use of AI, IoT, and automation in grid operations.

Restraining Factors

The high initial cost of updating grid infrastructure is one of the main obstacles to Japan's grid modernization initiatives. Making large investments in cutting-edge technologies like energy storage systems, smart meters, and sensors is necessary to modernize the grid.

Market Segmentation

The Japan grid modernization market share is classified into component and application.

- The hardware segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan grid modernization market is segmented by component into hardware, software, and services. Among these, the hardware segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing use of smart meters, sensors, transformers, and energy storage devices to improve grid efficiency and stability has led to a sizable share of the hardware market.

- The residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan grid modernization market is segmented by application into residential, commercial, and industrial. Among these, the residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing use of smart meters, home energy management systems, and decentralized energy sources like rooftop solar and battery storage is driving substantial growth in the residential sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan grid modernization market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Hitachi Energy

- General Electric Japan

- Alstom SA

- Toshiba Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan grid modernization market based on the below-mentioned segments:

Japan Grid Modernization Market, By Component

- Hardware

- Software

- Services

Japan Grid Modernization Market, By Application

- Residential

- Commercial

- Industrial

Need help to buy this report?