Japan Green Packaging Market Size, Share, and COVID-19 Impact Analysis, By Type (Recycled Content Packaging, Reusable Packaging, and Degradable Packaging), By Application (Food & Beverages, Consumer Products, Shipping, Chemicals, and Others), and Japan Green Packaging Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsJapan Green Packaging Market Size Insights Forecasts to 2035

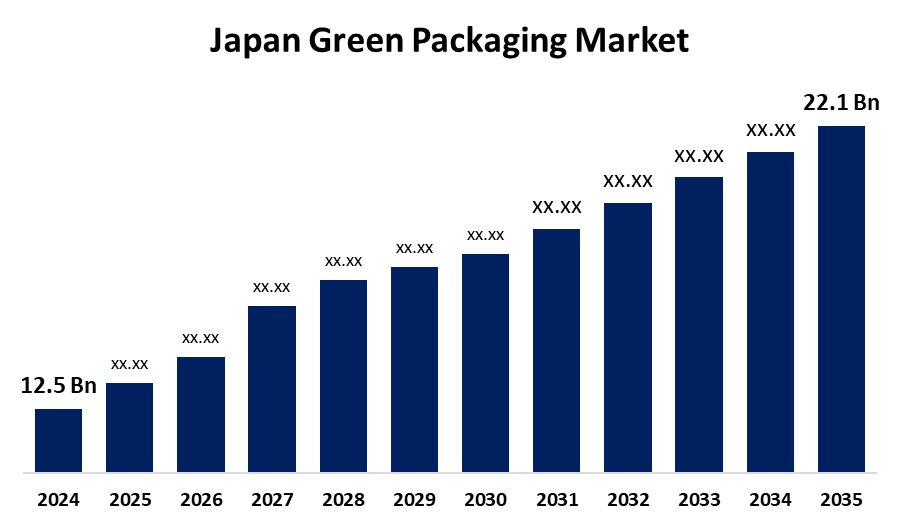

- The Japan Green Packaging Market Size was Estimated at USD 12.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.32% from 2025 to 2035

- The Japan Green Packaging Market Size is Expected to Reach USD 22.1 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Green Packaging Market is anticipated to reach USD 22.1 Billion by 2035, growing at a CAGR of 5.32% from 2025 to 2035. The Japan Green Packaging Market is growing strongly, boosted by green regulations, higher consumer consciousness, and the embrace of sustainable packaging. The drivers of this growth include the Plastic Resource Circulation Strategy by the Japanese government, seeking to recycle plastic packaging completely by 2030, as well as the rising demand for environmentally friendly products.

Market Overview

The Green Packaging Market in Japan refers to the eco-friendly packaging solutions aimed at reducing environmental driven by using biodegradable, recyclable, or renewable raw materials. These solutions are implemented across food and beverage, personal care, and healthcare sectors with the goal of decreasing waste and carbon footprints. Japan's high degree of environmental awareness, due to its scarce land resources and natural disaster susceptibility, encourages a culture of sustainability. Moreover, Japanese consumers go out of their way to purchase products with less packaging, recyclable contents, and environmentally friendly labels, compelling businesses to invest in green packaging solutions. There is future growth potential in the production of bio-based and biodegradable plastics and the increasing use of recovered plastics in the auto and electronics sectors. The exponential expansion of e-commerce offers the promise of green packaging solutions, as businesses look to reduce packaging waste and improve the overall sustainability of supply chains. The market is driven by strict environmental legislation, increasing demand by consumers for sustainable goods, and business resolutions to decrease carbon footprints. Inventions in sustainable materials and recycling machinery further drive adoption. Increased consciousness about plastic waste and government support also persuades industries to switch over to eco-friendly packaging solutions. Ambitious targets have been outlined by the Japanese government, including cutting single-use plastic emissions by 25% by 2030 and bringing in 2 million tons of bio-based plastics by that year.

Report Coverage

This research report categorizes the market for the Japan green packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan green packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan green packaging market.

Japan Green Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.32% |

| 2035 Value Projection: | USD 22.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 148 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Nippon Paper Industries Co., Ltd., Rengo Co., Ltd., Daibochi Plastic & Packaging Industry Co., Ltd., Tetra Pak Japan Ltd., Asahi Kasei Corporation, Sealed Air Corporation, Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Corporation, Ito En Co., Ltd., Kirin Holdings Company, Limited, Sappi Lanaken Mill (Sappi Japan), Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan green packaging market is fueled by robust environmental laws, heightened consumer pressure for green products, and rising business commitments towards carbon footprint reduction. Technological development in green materials, including biodegradable plastic and recoverable packaging, also propels growth. Increased sensitivity towards pollution by plastic, government subsidies, and legislation prompts businesses to opt for greener packaging alternatives. Besides, the transition to e-commerce fuels demand for green packaging to lower waste and improve supply chain sustainability.

Restraining Factors

The Japan green packaging market is restrained by increased production costs of environmentally friendly materials, insufficient availability of sustainable packaging, and consumer hesitation to switch to new packaging formats. Moreover, technological constraints and the nature of recycling processes are inhibitive towards wide-scale adoption.

Market Segmentation

The Japan green packaging market share is classified into type and application.

- The recycled content packaging segment dominated the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Japan green packaging market is segmented by type into recycled content packaging, reusable packaging, and degradable packaging. Among these, the recycled content packaging segment dominated the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is owing to its environmentally friendly characteristics. It helps reduce waste that ends up in landfills and saves precious resources. Aside from its environmental advantage, recycled content packaging also appeals to consumers who are interested in being pro-sustainability.

- The food & beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan green packaging market is segmented by application into food & beverages, consumer products, shipping, chemicals, and others. Among these, the food & beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they are easily portable, have long shelf lives, and are easy to produce. Convenience foods include frozen foods, snacks, finger foods, drinks, and others. The foods are most likely taken a shorter time and are served in ready-to-use hot containers. High demand due to the busy life of consumers, as well as the aged population, has led to intensive utilization of convenience food.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan green packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Paper Industries Co., Ltd.

- Rengo Co., Ltd.

- Daibochi Plastic & Packaging Industry Co., Ltd.

- Tetra Pak Japan Ltd.

- Asahi Kasei Corporation

- Sealed Air Corporation

- Sumitomo Chemical Co., Ltd.

- Mitsubishi Chemical Corporation

- Ito En Co., Ltd.

- Kirin Holdings Company, Limited

- Sappi Lanaken Mill (Sappi Japan)

- Others

Recent Developments:

- In November 2023, Neste, Mitsui Chemicals, and Prime Polymer joined forces to produce renewable food packaging for JCCU's CO-OP brand. The packaging for the seaweed snack, produced from bio-based polypropylene with Neste RE feedstock, replaces fossil materials and minimizes carbon footprint. The same quality and performance are achieved with this packaging, which carries the Japanese Eco Mark certification, in supporting the shift towards sustainable plastics.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan green packaging market based on the below-mentioned segments:

Japan Green Packaging Market, By Type

- Recycled Content Packaging

- Reusable Packaging

- Degradable Packaging

Japan Green Packaging Market, By Application

- Food & Beverages

- Consumer Products

- Shipping

- Chemicals

- Others

Need help to buy this report?