Japan Graphite Market Size, Share, and COVID-19 Impact Analysis, By Form (Natural Graphite and Synthetic Graphite), By End Use (Electrodes, Refractories, Lubricants, Battery Production, and Others), and Japan Graphite Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Graphite Market Insights Forecasts to 2035

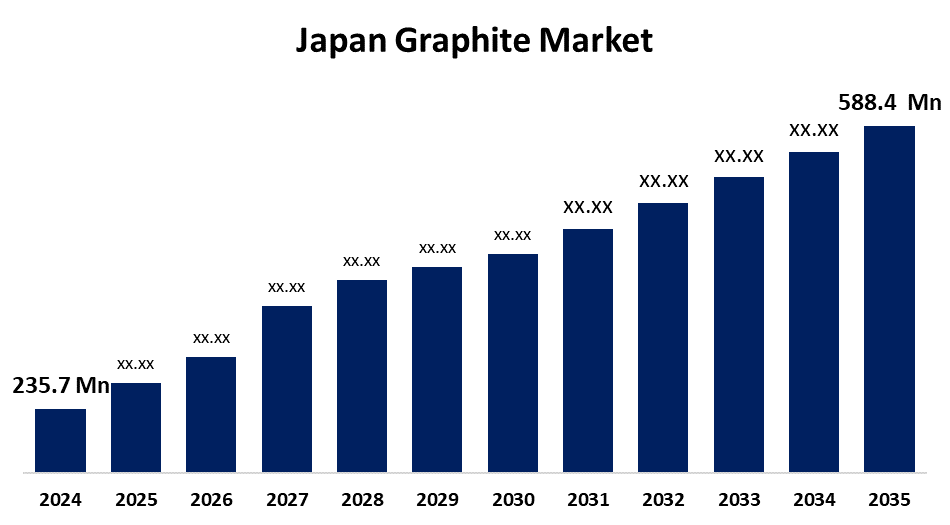

- The Japan Graphite Market Size Was Estimated at USD 235.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.67 % from 2025 to 2035

- The Japan Graphite Market Size is Expected to Reach USD 588.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Graphite Market Size is anticipated to reach USD 588.4 million by 2035, growing at a CAGR of 8.67 % from 2025 to 2035. The graphite market in Japan is driven by various factors, including growing demand in the battery industry, advancements in energy storage technologies, and increased applications in electronics.

Market Overview

Graphite is a black, soft, lustrous, and opaque form of carbon that is the most stable crystalline allotrope of carbon at standard conditions. Graphite is a naturally occurring form of carbon characterized by its unique layered, crystalline structure. It is available in two forms, such as natural graphite and synthetic graphite. Graphite is essential for batteries, industrial processes, and electronics because of its exceptional electrical and thermal conductivity, high heat resistance, and natural lubrication. Its adaptability to a wide range of applications is enhanced by its chemical stability and lightweight strength. The rising demand for electric vehicles is one of the major contributors to this market. Since graphite is an essential component of EV batteries, the Japanese government's aim to see 20–30% of new car sales be EVs by 2030 is driving a substantial rise in graphite demand. By 2025, more than one million EVs would be produced annually, according to the Japan Automobile Manufacturers Association (JAMA). The industry is also expanding more quickly because of government grants and incentives that support environmentally friendly transportation. All of these elements work together to highlight the rising need for high-purity graphite, which is fueling the expansion of the Japanese graphite market. Opportunities in the graphite sector are being enhanced by Japan's environmental initiative. In relation to rising environmental consciousness, producers who prioritize recycled and environmentally friendly graphite sourcing can increase their market share.

Report Coverage

This research report categorizes the market for the Japan graphite market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan graphite market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan graphite market.

Japan Graphite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 235.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.67% |

| 2035 Value Projection: | USD 588.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Form, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Tanso Co., Ltd., Tokai Carbon Co., Ltd., Showa Denko K.K., Nippon Carbon Co., Ltd., Hitachi Chemical, Mitsubishi Materials Corporation, GrafTech International, SGL Carbon, Imerys, Syrah Resources Limited, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing production and adoption of EVs boosts demand for high-quality and synthetic graphite is one of the notable driving factors for this market. The need for graphite in energy storage is rising as a result of the expansion of renewable energy projects, including wind and solar, which is bolstering market expansion overall. Additionally, higher demand for premium graphite is being driven by developments in R&D and battery technology, as enhanced lithium-ion batteries need better graphite materials to operate more effectively.

Restraining Factors

The fluctuations in the prices of natural graphite and petroleum coke are increasing the production cost, which further limits the market expansion. Additionally, market expansion is constrained by the limited supply of graphite, which drives up prices and intensifies competition across sectors, particularly in EVs and energy storage.

Market Segmentation

The Japan graphite market share is classified into form and end use.

- The synthetic graphite segment held the largest market share in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan graphite market is segmented by form into natural graphite and synthetic graphite. Among these, the synthetic graphite segment held the largest market share in 2024 and is expected to grow at a rapid CAGR during the forecast period. This segmental growth is attributed to its exceptional purity, uniform structures and ability to deliver consistence performance in high temperatures. Additionally, its technical qualities make it ideally suited for applications that need accuracy and dependability.

- The electrodes segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan graphite market is segmented by end use into electrodes, refractories, lubricants, battery production, and others. Among these, the electrodes segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to graphite electrodes are essential to the electric arc furnace (EAF) steelmaking industry, which is expanding quickly since it uses less energy and produces fewer carbon emissions than conventional blast furnaces.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan graphite market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tanso Co., Ltd.

- Tokai Carbon Co., Ltd.

- Showa Denko K.K.

- Nippon Carbon Co., Ltd.

- Hitachi Chemical

- Mitsubishi Materials Corporation

- GrafTech International

- SGL Carbon

- Imerys

- Syrah Resources Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan graphite market based on the below-mentioned segments:

Japan Graphite Market, By Form

- Natural Graphite

- Synthetic Graphite

Japan Graphite Market, By End Use

- Electrodes

- Refractories

- Lubricants

- Battery Production

Need help to buy this report?