Japan Glass Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Bottles, Jars, Ampules & Vials, Others), By End User (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Others), and Japan Glass Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingJapan Glass Packaging Market Insights Forecasts to 2035

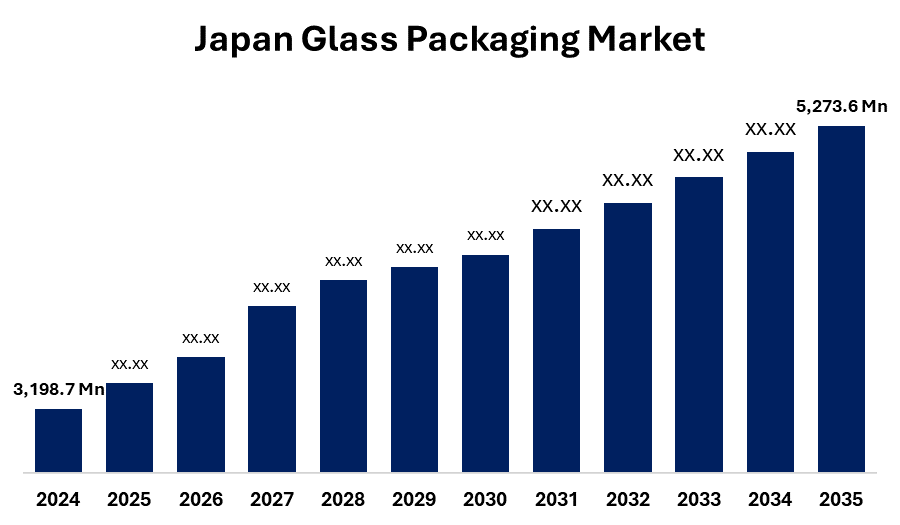

- The Japan Glass Packaging Market Size was Estimated at USD 3,198.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.65% from 2025 to 2035

- The Japan Glass Packaging Market Size is Expected to Reach USD 5,273.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Glass Packaging Market Size is anticipated to reach USD 5,273.6 Million by 2035, growing at a CAGR of 4.65% from 2025 to 2035. The market for glass packaging in Japan is expanding, due to several factors from both the consumers side, sparked by environmental awareness and pride in making sustainable choices, to the governments side with its stance on recycling policies, environmental protection, and taxes, as well as, the attributes of glass itself in terms of its recyclability and being a natural preservative.

Market Overview

The landscape of diverse types of glass containers that address packaging needs for any product, exterior and interior, food, drink, medicine, or personal care products, can be understood as the glass packaging market. Glass, and the unique traits that lend themselves to the importance of this market, can help products retain quality for longer, is inert, and is recyclable. The increasing interest in sustainable packaging from consumers is playing a role in driving this market up, and although newer innovative sustainable packaging options are coming to market in Japan, there continues to be strong demand for glass products that address waste and have a recycling aspect. In Japan, where the culture is steeped in recycling and waste prevention, glass packaging is positive due to glass being 100% recyclable. As an outcome of the strong interest in alcoholic beverages that are sometimes seen as 'luxury drinks' in Japan, like sake, and craft beer is increasingly popular, organizations are responding by spending on high-end glass packaging designs to attract market interest. There is an opportunity for glass packaging in Japan, especially in the food and beverage markets, as the current trend is towards greener alternatives. Each company offering aesthetically pleasing and customizable glass containers can only help to disrupt the competitive market. Combined with the growing health-mindedness of Japanese consumers in leaning toward glass versus plastic because they consider it to be safer and purer, hence Japanese companies are using cutting-edge technology to produce lighter and stronger glass products. Glass packaging is also expected to gain popularity as a packaging option, in large part due to the recycling and pro-environment efforts being made by the Japanese government.

Report Coverage

This research report categorizes the market for the Japan glass packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan glass packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan glass packaging market.

Japan Glass Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3,198.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.65% |

| 2035 Value Projection: | USD 5,273.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 237 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product and By End User |

| Companies covered:: | Hoya Corporation, Toyo Glass, Daiko Glass, Seiko Glass, Nihon Yamamura Glass, Shinagawa Glass, Nippon Shokubai, Chuo Sangyo, Asahi Glass, AGC Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is growing emphasis on sustainability and eco-friendly packaging options, leading to an increasing trend in the Japanese glass packaging market. Glass packaging entails regulations that are becoming increasingly attractive with respect of the Japanese government’s policies to reduce plastic use. Technological advancements in glass manufacturing processes have further compelled a significant impact on the growth of the glass packaging market in Japan. Japanese companies are increasingly enhancing the strength, lightweight features, and versatility within the design of glass bottles and containers through these developments within the manufacturing process. The industry is expanding in Japan as more options embrace glass packaging as a focused and specific approach to manufacturing efficiencies, while also allowing approximate designs and containers to fit frequently stipulated parameters. The growing beverage industry, especially in the premium alcohol, soft drinks, and bottled water segments, is expected to positively influence the glass packaging industry in Japan. Consumer trends and growing health considerations have immediately elevated glass packaged products like juice and functional drinks. The adoption of glass packaging has also been favorable as it usually carries an upscale, premium image, which has become as attractive for high-end skincare and fragrance products. Major companies such as Kirin Holdings Company, Limited and Sapporo Holdings Limited also began to release glass bottles more often, to enhance product quality and enhance the customer's perception. This has now increased demand for packaged glass in a way, supporting the worldwide shift to more sustainable packaging options.

Restraining Factors

Excessive production and shipping costs are the main factors negatively impacting the market. Overall production costs are relatively higher because glass is more expensive and heavier than plastics and flexible packaging. Therefore, because raw materials like soda ash and silica sand fluctuate in price, the competitiveness of the market can vary throughout time. Due to the brittle nature of glass, it must be stored and handled with care, presenting additional risk for loss and transportation costs, which hinder the market growth in the forecasted period. It is difficult to establish a reliable and productive recycling program because of the idiosyncrasies of recycling in every region in Japan. Also, while attempts to automate glass bottle fill lines continue, labor costs are likely to elevate the total cost of production more than glass packaging in Japan. Glass packaging competes against several other sustainable packaging options, including biodegradable packaging, especially in markets centered around sustainability.

Market Segmentation

The Japan Glass Packaging Market share is classified into product and end user.

- The bottles segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan glass packaging market is segmented by product into bottles, jars, ampules & vials, and others. Among these, the bottles segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Bottles are outweighing their previous limitations and will be utilized more consistently in new markets. The rising demand for recyclable materials in food and beverages is likely to continue creating expansion for the bottles category over the forecast period. Disposable income has also played a role in growing the bottles category, which has given consumers more confidence to purchase luxurious items, i.e., higher-end wine, spirits, and cosmetics, which are generally packaged in glass bottles.

- The food & beverages segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan glass packaging market is segmented by end user into food & beverages, pharmaceuticals, personal care & cosmetics, and others. Among these, the food & beverages segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing trend of glass packaging for alcoholic beverages is impacting segmental growth. Companies are focusing on glass materials as a way to keep the visual aspect of their bottles. The movement for high-quality, eco-friendly bottled beverages aligns well with Japan's commitment to reducing plastic bottles. Glass helps to maintain food safety and food quality, while being a preferred option for health-conscious consumers, captive to packaging media.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan glass packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hoya Corporation

- Toyo Glass

- Daiko Glass

- Seiko Glass

- Nihon Yamamura Glass

- Shinagawa Glass

- Nippon Shokubai

- Chuo Sangyo

- Asahi Glass

- AGC Inc.

- Others

Recent Developments:

- In March 2024, KOA Glass and Groupe Pochet has announced the signing of a partnership to merge some of their production and development capacity and share glass knowledge to meet the needs of the beauty market. By joining together in the development and manufacturing of products across different geographical locations and sharing decades of knowledge and experience in working with hot glass and decorative processes, the Pochet Group and KOA Glass have decided to further strengthen their relationship.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Glass Packaging Market based on the below-mentioned segments:

Japan Glass Packaging Market, By Product

- Bottles

- Jars

- Ampules & Vials

- Others

Japan Glass Packaging Market, By End User

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

Need help to buy this report?