Japan GIS-Insulated Substations Market Size, Share, and COVID-19 Impact Analysis, By Voltage Type (Medium, High, and Extra High), By Installation (Indoor and Outdoor), By End-User (Power Transmission Utility, Distribution Utility, and Generation Utility), and Japan GIS-Insulated Substations Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan GIS-Insulated Substations Market Insights Forecasts to 2035

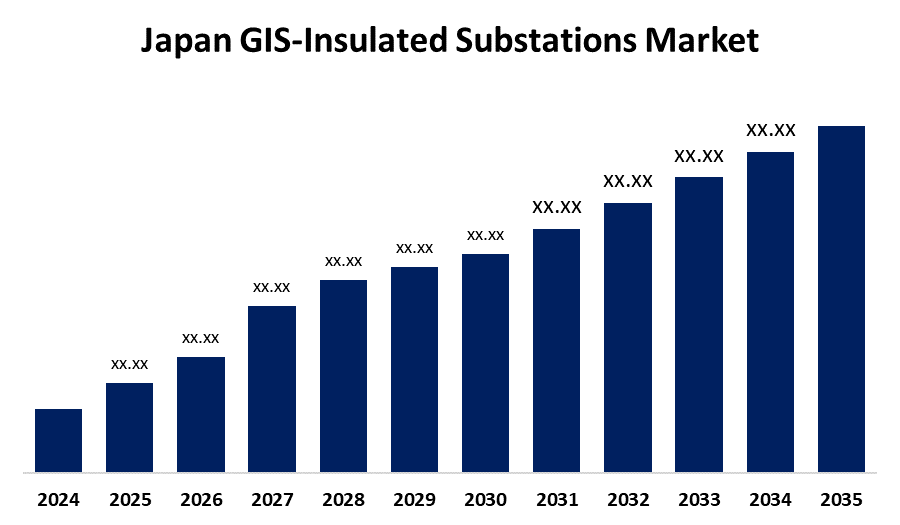

- The Japan GIS-Insulated Substations Market Size is Expected to Grow at a CAGR of around 5.4% from 2025 to 2035

- The Japan GIS-Insulated Substations Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan GIS-Insulated Substations Market Size is Anticipated to hold a significant share by 2035, Growing at a CAGR of 5.4% from 2025 to 2035. This is driven by several key factors. Japan’s ongoing efforts to modernize its aging electrical infrastructure and enhance grid reliability amid growing electricity demand are major contributors. The compact design and high efficiency of GIS technology make it ideal for space-constrained urban environments. Additionally, increased integration of renewable energy sources, government investments in smart grid development, and the need for disaster-resilient energy systems further accelerate market growth.

Market Overview

The Japan gas-insulated substations (GIS) market covers the design, production, installation, and servicing of GIS systems in Japan. GIS technology insulates high-voltage equipment using sulfur hexafluoride (SF6) gas, allowing for compact and secure substation designs. The Japan GIS (Gas Insulated Substation) market offers valuable opportunities fueled by the aging power infrastructure in Japan, urbanization, and growing demand for compact and reliable energy solutions. Government efforts to upgrade the grid and connect renewable power sources further increase market potential. Technological innovation and Japan's susceptibility to natural disasters also increase the attractiveness of GIS due to its space-saving and disaster-resistant capabilities. Foreign investments and strategic alliances in smart grid schemes also provide domestic and overseas players with growth opportunities.

Report Coverage

This research report categorizes the market for the Japan GIS-insulated substations market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan GIS-insulated substations market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan GIS-insulated substations market.

Japan GIS-Insulated Substations Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.4% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Voltage Type, By Installation and By End-User |

| Companies covered:: | Mitsubishi Electric Corporation, Toshiba Corporation, Fuji Electric Co., Ltd., Hitachi Energy (formerly Hitachi ABB Power Grids), Nissin Electric Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese GIS (gas-insulated substations) market is fueled mainly by the nation's rising demand for efficient and space-saving power infrastructure, particularly in cities where land is scarce and expensive. Urbanization and the necessity to upgrade aging electric grids are driving the use of GIS technology, which benefits from its compact design, safety, and low maintenance. Government support to increase energy security, combine renewable energy inputs, and make the grid more efficient also plays a key role in market development. The natural disaster vulnerability of Japan also means that resilient electrical infrastructure is necessary, further driving GIS substation deployment. Advances in technology and investments in smart grid solutions are driving market growth at a faster pace, as favorable regulatory environments and environmental pressures are motivating the transition from traditional air-insulated to gas-insulated substations for improved performance and a lower environmental footprint.

Restraining Factors

The Japan GIS (gas-insulated substations) market is also subject to restraints like high initial investment, complicated maintenance, and scarce availability of skilled personnel. Stringent environmental laws and lengthy approval periods can also slow down projects. Competition from other substation technologies and low awareness among small utilities regarding the long-term advantages of GIS systems also slow down market growth.

Market Segmentation

The Japan GIS-insulated substations market share is classified into voltage type, installation, and end-user.

- The medium segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan GIS-insulated substations market is segmented by voltage type into medium, high, and extra high. Among these, the medium segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its optimal balance between cost and performance, making it suitable for urban and industrial applications. Its compact size, enhanced safety, and adaptability to space-constrained environments drive demand, supporting strong growth prospects throughout the forecast period.

- The indoor segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan GIS-insulated substations market is segmented by installation into indoor and outdoor. Among these, the indoor segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to increasing urbanization and the need for space-efficient substation solutions. Its advantages, including enhanced safety, reduced environmental impact, and suitability for densely populated areas, make it a preferred choice, driving its strong growth potential over the forecast period.

- The generation utility segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan GIS-insulated substations market is segmented by end-user into power transmission utility, distribution utility, and generation utility. Among these, the generation utility segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to rising energy demand and the modernization of aging power infrastructure. Increasing investments in renewable energy projects and the need for reliable, high-capacity substations to ensure efficient power generation and transmission are expected to drive strong growth during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan GIS-insulated substations market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Hitachi Energy (formerly Hitachi ABB Power Grids)

- Nissin Electric Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan GIS-insulated substations market based on the below-mentioned segments:

Japan GIS-Insulated Substations Market, By Voltage Type

- Medium

- High

- Extra High

Japan GIS-Insulated Substations Market, By Installation

- Indoor

- Outdoor

Japan GIS-Insulated Substations Market, By End-User

- Power Transmission Utility

- Distribution Utility

- Generation Utility

Need help to buy this report?