Japan Gin Market Size, Share, and COVID-19 Impact Analysis, By Type (London Dry Gin, Old Tom Gin, Plymouth Gin, and Others), By Price Point (Standard, Premium, and Luxury), and Japan Gin Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Gin Market Size Insights Forecasts to 2035

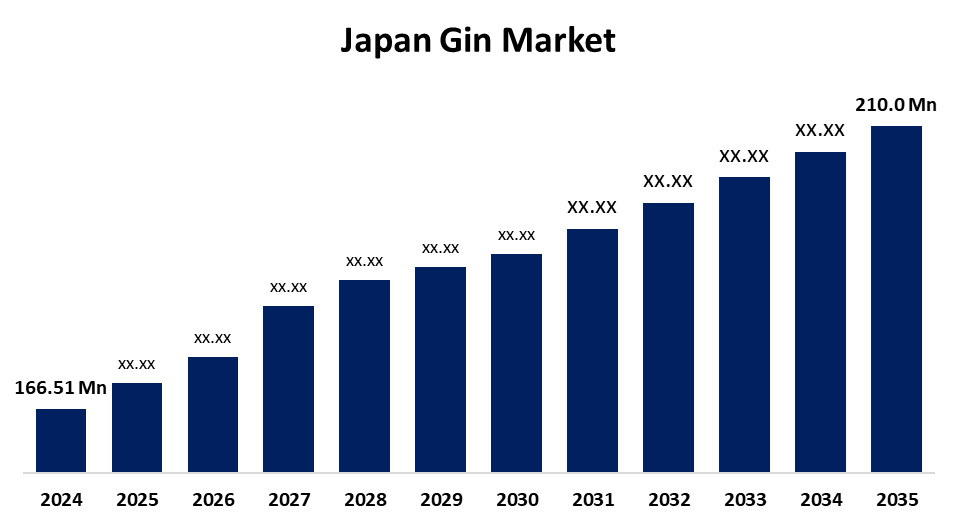

- The Japan Gin Market Size Was Estimated at USD 166.51 million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.13 % from 2025 to 2035

- The Japan Gin Market Size is Expected to Reach USD 210.0 million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Gin Market Size is anticipated to reach USD 210.0 million by 2035, growing at a CAGR of 2.13 % from 2025 to 2035. The gin market in Japan is driven by various factors, including the rising popularity of gin-based cocktails, growth in low alcohol and non-alcoholic gin options, and rising demand for premium and craft gin.

Market Overview

Gin is a distilled alcoholic beverage that derives its predominant flavor from juniper berries. The Japan gin market refers to the production, distribution, and sale of gin. This market includes various types of gin, such as London dry gin, old tom gin, Plymouth gin, and others. The Japan gin market is experiencing a notable rise, driven by rising demand for premium and craft spirits with the increasing popularity of gin-based cocktails. The people are becoming health-conscious, and they are seeking low-alcohol and non-alcoholic gin alternatives that still offer a rich, botanical flavor experience is one of the major contributors to this market. Opportunities in the Japan gin market include partnering with local restaurants and bars to create exclusive gin-based cocktails, which can help boost brand recognition and strengthen customer engagement. The Japanese gin market is experiencing increased demand for gin-infused treats like chocolates and desserts, while growing international investment provides domestic brands with opportunities to expand and improve production.

Report Coverage

This research report categorizes the market for the Japan gin market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan gin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan gin market.

Japan Gin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 166.51 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.13 % |

| 2035 Value Projection: | USD 210.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 158 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Type, By Price Point and COVID-19 Impact Analysis |

| Companies covered:: | Kirin Holdings, GINZA Distillery, Suntory Holdings, Nikka Whisky, Asahi Group Holdings, Yamazaki Distillery, Mizunara Distillery, Tokyo Distillery, Shinsei Distillery, Chichibu Distillery, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan's gin market is growing with rising demand for craft spirits, especially among millennials and Gen Z. The number of distilleries has doubled, and local botanicals like yuzu and sansho boost preference for domestic gins. Japan’s rising cocktail culture is driving gin demand, with more bars offering gin-based drinks. Gin’s versatility makes it a favorite in modern mixology. Health-conscious consumers in Japan are driving gin market growth by favoring low-calorie, natural alcohol options. Gin’s lower calorie content makes it appealing, especially among adults aged 20–40. This trend is pushing brands to develop low-calorie and organic gin variants.

Restraining Factors

Fluctuation in the prices of raw materials impacts the overall production is hindering the growth of this market. Additionally, high competition within alcoholic beverages and direct competition from other spirits further limit the market expansion.

Market Segmentation

The Japan gin market share is classified into type and price point.

- The London dry gin segment held the largest market share in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan gin market is segmented by type into London dry gin, old tom gin, Plymouth gin, and others. Among these, London dry gin held the largest market share in 2024 and is expected to grow at a rapid CAGR during the forecast period. This segmental growth is attributed to its established reputation for quality and consistency. Additionally, its versatility in cocktails and widespread recognition contribute to the market growth.

- The premium segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gin market is segmented by price point into standard, premium, and luxury. Among these, the premium segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to rising preferences for premium quality spirits with unique flavors and superior ingredients. Additionally, the rising trend of craft cocktails and mixology raises the demand for premium gin.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan gin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kirin Holdings

- GINZA Distillery

- Suntory Holdings

- Nikka Whisky

- Asahi Group Holdings

- Yamazaki Distillery

- Mizunara Distillery

- Tokyo Distillery

- Shinsei Distillery

- Chichibu Distillery

- Others

Recent Developments

- In January 2024, Mercian Corporation began exporting its Japan-made craft gin, YATSU BOSHI, produced in Kumamoto Prefecture, to Australia. The gin is also shipped to Singapore, Malaysia, and South Korea

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan gin market based on the below-mentioned segments:

Japan Gin Market, By Type

- London Dry Gin

- Old Tom Gin

- Plymouth Gin

- Others

Japan Gin Market, By Price Point

- Standard

- Premium

- Luxury

Need help to buy this report?