Japan Genomic Medicine Market Size, Share, and COVID-19 Impact Analysis, By Products and Services (Instruments and Equipment, Consumables, and Services) By Technology (Next-Generation Sequencing [NGS], Polymerase Chain Reaction [PCR], Microarray, Sanger Sequencing, and Others), By Application (Oncology, Cardiology, Paediatrics, Endocrinology, Respiratory Medicine, Rare Genetic Disorders, Infectious Diseases, and Other Applications), and Japan Genomic Medicine Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Genomic Medicine Market Insights Forecasts to 2035

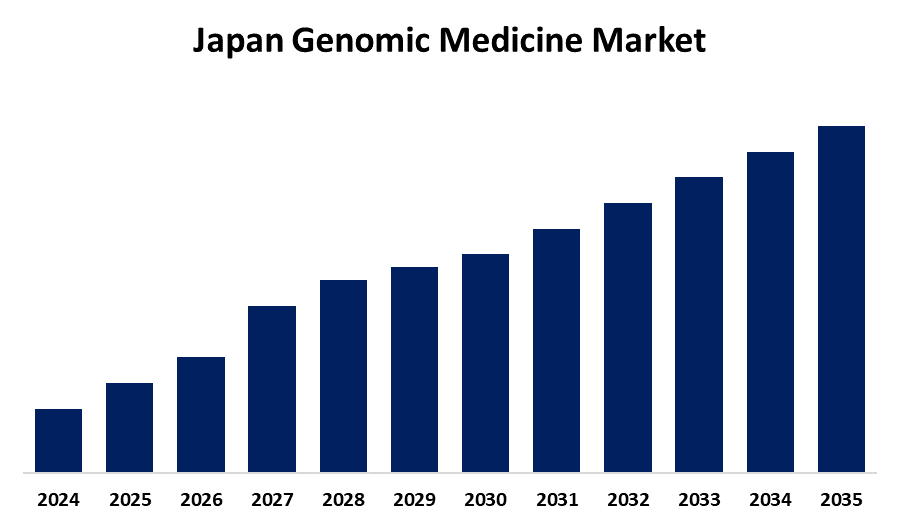

- The Japan Genomic Medicine Market Size is Expected to Grow at a CAGR of 14.6% from 2025 to 2035

- The Japan Genomic Medicine Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Genomic Medicine Market Size is Expected to Hold a Significant Share by 2035, at a CAGR of 14.6% during the forecast period 2025-2035. The genomic medicine market in Japan is expanding rapidly, driven by some significant forces. There is increased recognition of personalized medicine, increased sequencing technology, and government encouragement, which are driving the market growth.

Market Overview

The Japan genomic medicine market refers to genomics to find out disease mechanisms, enabling precision diagnostics, targeted therapies, and personalized medicine. This approach has implications across oncology, rare genetic illnesses, cardiology, infectious disease prevention, and gene therapy. Japan's forte lies in possessing robust infrastructure with enormous genomic repositories (e.g., Tohoku Medical Megabank), extremely advanced research organizations such as RIKEN, and collaboration between pharma, university, and biotech industry. Opportunities abound in precise oncology, cardiology, diagnosis of rare disease, pharmaceutical development, and augmenting hospital usage of genomic assessment. Market growth is fueled by the growing prevalence of chronic illnesses like cancer and cardiovascular diseases in the aging population, boosting the demand for tailored treatments. The Japanese government provides strong support in the form of significant funding in the form of AMED and METI, initiatives like the Sakigake drug designation to give go-ahead approvals quicker, regulatory support in data-sharing and genomic infrastructure, and public–private partnerships to drive innovation.

Report Coverage

This research report categorizes the market for the Japan genomic medicine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan genomic medicine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan genomic medicine market.

Japan Genomic Medicine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 14.6% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Products, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Takara Bio Inc., OriCiro Genomics, Macrogen Japan Corp., Astellas Pharma Inc., GeneQuest Inc., Genomic Health Japan Corporation, SRL, Inc., Mitsubishi Chemical Medience Corporation, QIAGEN K.K., Fujifilm Wako Pure Chemical Corporation, Daiichi Sankyo Company, Limited and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of Japan's genomic medicine market is fueled by an increasing prevalence of chronic and genetic diseases, particularly among the country’s elderly population. Advances in next-generation sequencing (NGS), bioinformatics, and personalized medicine lowered the cost and improved access to genomic testing. Support from the government in the form of grants, regulatory incentives like the Sakigake designation, as well as government programs such as the Tohoku Medical Megabank, propel growth. Academic-biotech-pharmaceutical alliances also drive innovation and advance genomics into the clinic faster.

Restraining Factors

The Japan genomic medicine market is limited by the prohibitive cost of testing, insurance coverage limitations, patient privacy concerns, and the unavailability of well-trained genetic professionals. These constraints hinder the access of patients and impede the widespread use of genomic technologies in medicine.

Market Segmentation

The Japan genomic medicine market share is classified into products and services, technology, and application.

- The consumables segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan genomic medicine market is segmented by products and services into instruments and equipment, consumables, and services. Among these, the consumables segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to growing usage, non-returnable, and growing genomic study initiatives. Growing utilization of custom medicine and molecular diagnosis products, especially in cancer and orphan genetic diseases, has further fuelled demand for consumables. Biotech and pharmaceutical corporations also invest constantly in high-throughput genomic screening, which keeps driving strong demand for consumables in the clinical and research environments.

- The next-generation sequencing [NGS] segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan genomic medicine market is segmented by technology into next-generation sequencing [NGS], polymerase chain reaction [PCR], microarray, sanger sequencing, and others. Among these, the next-generation sequencing [NGS] segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its unmatched capability to deliver low-cost, high-throughput, and fast genomic analysis. NGS transformed precision medicine, oncology diagnosis, and rare disease diagnosis by allowing deep sequencing of whole genomes, exomes, and transcriptomes with very high accuracy.

- The oncology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan genomic medicine market is segmented by application into oncology, cardiology, paediatrics, endocrinology, respiratory medicine, rare genetic disorders, infectious diseases, and other applications. Among these, the oncology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the ability to deliver precision oncology therapy, including biomarker-based therapies and liquid biopsies that enable the identification of particular mutations like BRCA1/BRCA2 in breast cancer or EGFR in lung cancer. Secondly, pharma companies are more involved in genome-guided drug discovery for cancer, resulting in more FDA-approved targeted and immunotherapies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan genomic medicine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takara Bio Inc.

- OriCiro Genomics

- Macrogen Japan Corp.

- Astellas Pharma Inc.

- GeneQuest Inc.

- Genomic Health Japan Corporation

- SRL, Inc.

- Mitsubishi Chemical Medience Corporation

- QIAGEN K.K.

- Fujifilm Wako Pure Chemical Corporation

- Daiichi Sankyo Company, Limited

- Others

Recent Developments:

- In September 2024, Takara Bio USA launched the SmartChip ND™ Real-Time PCR System, a high-throughput automated qPCR platform for monitoring antimicrobial resistance (AMR). For research purposes, the system is designed to facilitate environmental safety and sustainability with customizable configurations for extensive surveillance panels.

- In June 2024, FUJIFILM Wako Pure Chemicals announced two new test kits: LumiMAT™, a next-generation monocyte activation test for the detection of pyrogen, and PYROSTAR™ Neo+, a recombinant reagent for the detection of bacterial endotoxin. Both of these substitutes for conventional tests are set to roll out in July 2024 worldwide.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan genomic medicine market based on the below-mentioned segments:

Japan Genomic Medicine Market, By Products and Services

- Instruments and Equipment

- Consumables

- Services

Japan Genomic Medicine Market, By Technology

- Next-Generation Sequencing [NGS]

- Polymerase Chain Reaction [PCR]

- Microarray

- Sanger Sequencing

- Others

Japan Genomic Medicine Market, By Application

- Oncology

- Cardiology

- Paediatrics

- Endocrinology

- Respiratory Medicine

- Rare Genetic Disorders

- Infectious Diseases

- Other Applications

Need help to buy this report?