Japan Gaming Hardware Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Consoles, Gaming PCs, Accessories, and VR Headsets), By Platform (PC, Console, and Mobile), By End-User (Casual Gamers and Professional Gamers), and Japan Gaming Hardware Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Gaming Hardware Market Insights Forecasts to 2035

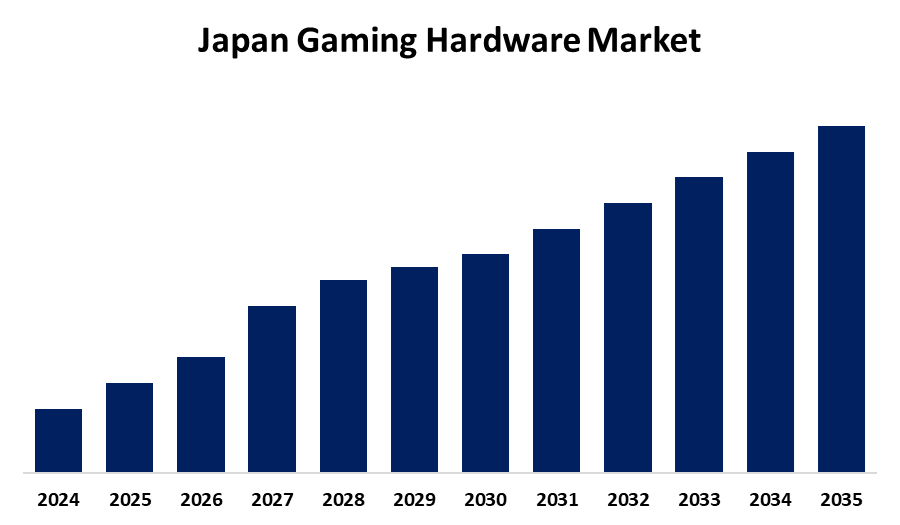

- The Japan Gaming Hardware Market Size is Expected to Grow at a CAGR of 8.7% from 2025 to 2035

- The Japan Gaming Hardware Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan gaming hardware market is expected to hold a significant share by 2035, at a CAGR of 8.7% during the forecast period 2025-2035. The market for gaming hardware in Japan is growing based on numerous drivers, among them a robust gaming culture, growing esports popularity, and developments in technology. In particular, the growth of esports, the desire to access quality gaming experiences, and the popularity of mobile gaming are spurring demand for sophisticated hardware.

Market Overview

The Japan Gaming Hardware Market Size refers to a broad spectrum of physical gaming equipment home console systems, handheld and hybrid handhelds, VR/AR headsets, PC gaming peripherals, and their associated accessories. Entertaining, playing competitively in esports, being productive, and experiencing virtual reality are the main uses of these products, catering to both casual and hardcore gamers of various demographics. Japans advantage is top-class manufacturers (Nintendo, Sony, etc.), dedicated fan bases, high R&D, and easy integration of hardware with top-tier software franchises. Potential is found in the growth of esports events, VR/AR technology, niche handheld machines, and cloud-enabled gaming consoles, supplemented by world-leading trade fairs such as Tokyo Game Show. Mobile game dominance, increasing disposable income, and technological innovation drive hardware demand. Government policies encourage digital content businesses and assist the game industry through METI support of TGS, technology infrastructure improvements, and IP-protection legislation, indirectly stimulating gaming hardware expansion and cementing Japans world lead in gaming.

Report Coverage

This research report categorizes the market for the Japan gaming hardware market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan gaming hardware market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan gaming hardware market.

Japan Gaming Hardware Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Platform, By End-User |

| Companies covered:: | Sega Sammy Holdings, Nintendo Co., Ltd., Sony Interactive Entertainment, Microsoft (Xbox), Bandai Namco, Square Enix, Razer Inc., Bandai Namco, Elecom Co., Ltd., Koei Tecmo, SNK Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan gaming hardware market is spurred by an established gaming culture, the popularity of hybrid consoles such as the Nintendo Switch, and increasing demand for interactive experiences using VR and AR. High consumer spending power, technology innovations, increasing popularity of esports, and high consumer purchasing power further drive industry growth. Cloud gaming trends, seamless integration between hardware and exclusive titles, as well as the expansion of mobile games, also drive increasing demand. Japans internationally renowned gaming franchises, such as Nintendo and Sony, also drive the markets momentum.

Restraining Factors

The Japan gaming hardware market is confronted by constraints such as costly devices, short upgrade cycles, and stiff competition from mobile gaming. Supply chain interruptions, silicon shortages, and declining youth populations also test persistent hardware demand and market growth.

Market Segmentation

The Japan gaming hardware market share is classified into product type, platform, and end-user.

- The consoles segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gaming hardware market is segmented by product type into consoles, gaming PCs, accessories, and VR headsets. Among these, the consoles segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they have a variety of exclusive games that further attract consumers, making them have a high pull factor in the market. The fact that they can be connected online to accept multiplayer experiences also makes them more attractive, hence being a favorite among most players.

- The PC segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gaming hardware market is segmented by platform into PC, console, and mobile. Among these, the PC segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to its flexibility and capacity to support high-end graphics and intricate game mechanics. The PC platform is especially popular among hardcore gamers and professionals who need higher-grade graphics processing and tailor-made configurations. The presence of a vast list of games, many of which can only be found on PC, also adds to the strength of the PC gaming market.

- The casual gamers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gaming hardware market is segmented by end-user into casual gamers and professional gamers. Among these, the casual gamers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their ease of play, normally choosing consoles or handhelds with easy-to-understand gameplay mechanics. Casual gamers are also more susceptible to social influence, for example, playing games suggested by friends or joining a popular gaming craze. Therefore, those products providing social connectivity and easy-to-use interfaces will have more appeal to this audience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations or companies involved within the Japan gaming hardware market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sega Sammy Holdings

- Nintendo Co., Ltd.

- Sony Interactive Entertainment

- Microsoft (Xbox)

- Bandai Namco

- Square Enix

- Razer Inc.

- Bandai Namco

- Elecom Co., Ltd.

- Koei Tecmo

- SNK Corporation

- Others

Recent Developments:

- In May 2024, the Medium-term Management Plan, Sega Sammy established a new Gaming Business, which comprises Sega Sammy Creation (gaming machines), Paradise Sega Sammy (Incheon resort joint venture), and a newly created iGaming business from its 2023 acquisition of GAN Limited, supplying U.S. casino operators with B2B platforms.

- In June 2025, Nintendo announced that its latest console, Nintendo Switch 2, sold more than 3.5 million units worldwide in the first four days of release, the best for any Nintendo console. Switch 2 boasts a bigger display, magnetic Joy-Con 2 controllers, improved performance, and a new GameChat feature supporting voice, video, and screen-sharing while gaming.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan gaming hardware market based on the below-mentioned segments:

Japan Gaming Hardware Market, By Product Type

- Consoles

- Gaming PCs

- Accessories

- VR Headsets

Japan Gaming Hardware Market, By Platform

- PC

- Console

- Mobile

Japan Gaming Hardware Market, By End-User

- Casual Gamers

- Professional Gamers

Need help to buy this report?