Japan Frozen Dessert Market Size, Share, and COVID-19 Impact Analysis, By Product (Confectionaries & Candies, Icecream, Frozen Yogurts, and Others), By Distribution Channel (Supermarket hypermarket, Convenience Store, Café & Bakery Shops, Online, and Others), and Japan Frozen Dessert Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Frozen Dessert Market Insights Forecasts to 2035

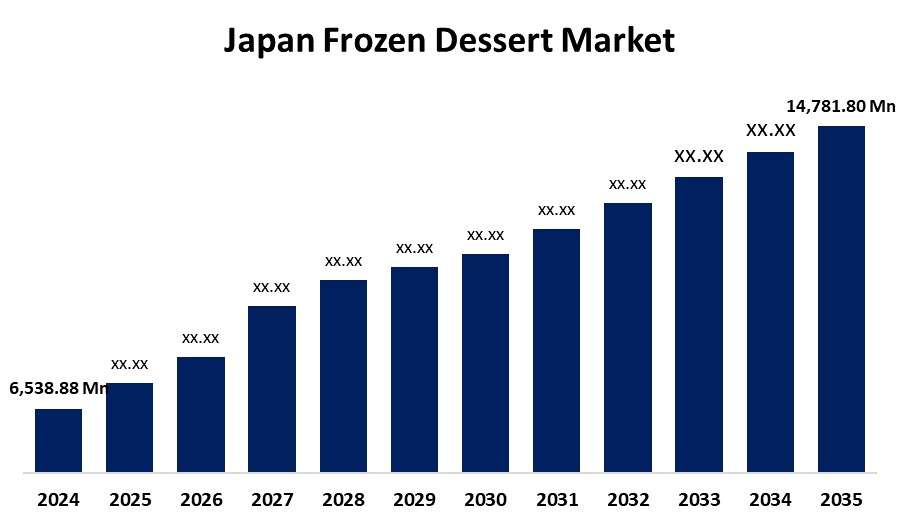

- The Japan Frozen Dessert Market Size Was Estimated at USD 6,538.88 million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.70 % from 2025 to 2035

- The Japan Frozen Dessert Market Size is Expected to Reach USD 14,781.80 million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Frozen Dessert Market Size is anticipated to reach USD 14,781.80 million by 2035, growing at a CAGR of 7.70 % from 2025 to 2035. The frozen dessert market in Japan is driven by various factors, including rising health consciousness among consumers, rising demand for premium frozen desserts, increased availability of international brands, and technological advancements in production.

Market Overview

Frozen desserts are sweet products made by freezing a mixture of ingredients such as milk, cream, sugar, flavorings, and sometimes fruit, nuts, or other inclusions. Low temperatures are essential to preserve their texture, consistency, and flavor, unlike ordinary desserts. The Japan frozen desserts market involves the manufacturing, distribution, and sale of these treats. Types include ice cream, frozen yogurt, gelato, sorbet, sherbet, frozen custard, mochi ice cream, and plant-based frozen options. The market in Japan appears to be shifting toward high-end, small-batch products that feature regional ingredients and traditional flavors like yokan, matcha, sakura, and black sesame. Especially in upscale retail environments, these handcrafted offerings boost customer engagement and are expected to grow steadily in the premium segment. The rising demand for artisanal, premium products with distinctive tastes is a key driver of the Japanese frozen dessert industry; over 30% of consumers favor locally sourced, gourmet options. Additionally, there is an increasing trend for frozen desserts that are low in calories and sugar, and made with natural ingredients.

Report Coverage

This research report categorizes the market for the Japan frozen dessert market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan frozen dessert market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan frozen dessert market.

Driving Factors

The people are becoming health-conscious, which is driving demand for frozen desserts with natural ingredients, low in calories, and sugar is one of the major factors contributing to the market growth. The rise in disposable income led to an increasing consumer preference for premium and gourmet frozen desserts, which boosts the market growth. As a result of ease in trade regulations and rising interest in exotic tastes, more foreign frozen dessert companies are expanding into Japan. The market is expanding as a result of customers having more options and local firms being encouraged to be more inventive. Additionally, technological advancements in refrigeration and freezing play an important role in market expansion.

Restraining Factors

The high cost of production specifically for premium and organic products is one of the notable restraints for this market. Additionally, the availability and cost of materials like fruits and dairy are directly impacted by the shifting temperature and weather patterns, which further limit the market expansion.

Market Segmentation

The Japan frozen dessert market share is classified into product and distribution channel.

- The icecream segment held the dominant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan frozen dessert market is segmented by product into confectionaries & candies, icecream, frozen yogurts, and others. Among these, the icecream segment held the dominant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period. This is due to their large-scale popularity among all generations. Additionally, ice cream is frequently consumed after meals as a useful digestive aid.

- The supermarket/hypermarket segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan frozen dessert market is segmented by distribution channel into supermarket/hypermarket, convenience store, café & bakery shops, online, and others. Among these, the supermarket/hypermarket segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment includes grocery shopping; these marketplaces are handy one-stop shops. They are perfect for selling frozen desserts because of their wide reach and convenience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan frozen dessert market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lotte

- Akagi Nyugyo

- Suntory

- Ajinomoto

- Meiji Holdings

- Glico

- Kirin Holdings

- UHA Mikakuto

- Morinaga

- Unilever

- Nestlé

- Yasuda Gakuen

- Others

Recent Developments

- In October 2024, Meiji Co., Ltd. launched Dear Milk, a pure milk ice cream made solely from dairy ingredients using proprietary techniques

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan frozen dessert market based on the below-mentioned segments:

Japan Frozen Dessert Market, By Product

- Confectionaries & Candies

- Icecream

- Frozen Yogurts

- Others

Japan Frozen Dessert Market, By Distribution Channel

- Supermarket/hypermarket

- Convenience Store

- Café & Bakery Shops

- Online

- Others

Need help to buy this report?