Japan Food Sweetener Market Size, Share, and COVID-19 Impact Analysis, By Type (Sucrose, Starch Sweeteners and Sugar Alcohols, and High-Intensity Sweeteners (HIS)), By Application (Bakery and Confectionery, Dairy and Desserts, Meat and Meat Products, Soups, Sauces and Dressings, and Other Applications), and Japan Food Sweetener Market Insights, Industry Trend, Forecasts to 2032

Industry: Food & BeveragesJapan Food Sweetener Market Insights Forecasts to 2032.

Get more details on this report -

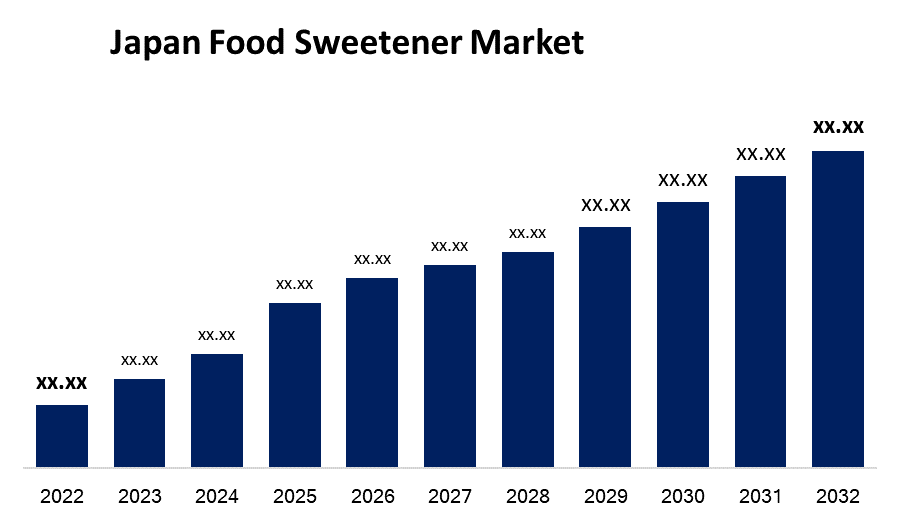

The Japan Food Sweetener Market Size is anticipated To Grow at a CAGR of 3.78% from 2022 to 2032.

The food sweetener market in Japan is a dynamic and evolving sector, driven by consumer demand for healthier and lower-calorie sweetening options, as well as manufacturers' pursuit of innovative solutions.

Market Overview

The Japan food sweetener market is the industry that manufactures and supplies sweetening agents used in a variety of food and beverage products in Japan. Sweeteners are substances that add sweetness to food and beverages, and are frequently used as substitutes for traditional sugar. This market meets the increasing demand for low-calorie and healthier sweetening options, as well as specialised dietary requirements. Several factors have contributed to the significant growth of the Japanese food sweetener market. One of the primary drivers is rising consumer health consciousness, which is leading to a reduction in sugar consumption. Furthermore, the rising prevalence of diabetes and obesity has increased demand for sweeteners with low blood sugar impact. The market has responded by providing a variety of natural and artificial sweeteners, including stevia, aspartame, sucralose, and monk fruit extract. The market is distinguished by a diverse range of sweetener products that cater to a variety of food and beverage applications. Sweeteners are used in a variety of industries, including bakery, confectionery, beverages, dairy, and processed foods. Japanese consumers are known for their refined palates and preference for high-quality goods, which has influenced the market's focus on developing innovative sweetening solutions to meet these expectations.

Report Coverage

This research report categorizes the market for the Japan food sweetener market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the food sweetener market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the food sweetener market.

Japan Food Sweetener Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.78% |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application, and Country Statistics (Demand, Price, Growth, Trends, Competitors, Challenges) |

| Companies covered:: | Tate & Lyle PLC, Cargill, Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, DuPont de Nemours Inc., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising prevalence of diabetes and obesity in Japan has created a demand for sweeteners with low blood sugar impact. Sweeteners with a low or zero glycemic index, such as stevia and monk fruit extract, are gaining popularity among sugar substitutes. As Japanese consumers become more concerned with their health, there is an increasing demand for low-calorie and healthier sweetening alternatives. Sweeteners are a sugar substitute that allow consumers to reduce their sugar intake without sacrificing taste. The market is distinguished by a diverse range of sweetener products that serve a variety of food and beverage applications. Manufacturers are creating specialised sweeteners for industries such as bakery, confectionery, beverages, dairy, and processed foods, which is broadening the market's reach and potential. The overall expansion of Japan's food and beverage industry creates a favourable environment for the food sweetener market. As the industry develops and innovates new products, the demand for sweeteners to enhance taste and meet consumer expectations grows.

Restraining Factors

Sweetener manufacturers may face difficulties in replicating the taste and texture of sugar. Consumers have high expectations for the sensory experience of food and beverages, and any deviations from sugar's taste and texture can affect their acceptance of sweeteners. For food sweeteners, the Japanese government maintains stringent regulations and safety standards. While these regulations protect consumers, they can also create barriers to market entry because the approval process for new sweeteners is time-consuming and expensive for manufacturers. While there is a growing demand for natural sweeteners in Japan, their availability and sourcing can be difficult. Natural sweeteners like stevia and monk fruit may have limited production capacity, resulting in higher prices and limited supply.

Market Segmentation

The Japan Food Sweetener Market share is classified into type and application.

- The high-intensity sweeteners segment is expected to hold the largest share of the Japan food sweetener market during the forecast period.

The Japan food sweetener market is segmented by type into sucrose, starch sweeteners and sugar alcohols, and high-intensity sweeteners (HIS). Among these, the high-intensity sweeteners segment is expected to hold the largest share of the Japan food sweetener market during the forecast period. The need for low-calorie and sugar-free products has increased in recent years, owing to increased health awareness and the prevalence of lifestyle diseases such as diabetes and obesity. HIS allow products to retain sweetness while reducing calorie content, making them highly desirable to consumers. As manufacturers develop new formulations and improve the taste profiles of these sweeteners to meet consumer expectations, the market for HIS continues to grow.

- The bakery and confectionery segment is accounted for the highest growth rate in the Japan food sweetener market.

Based on the application, the Japan food sweetener market is divided into bakery and confectionery, dairy and desserts, meat and meat products, soups, sauces and dressings, and other applications. Among these, the bakery and confectionery segment is accounted for the highest growth rate in the Japan food sweetener market. The demand for sweeteners in this segment is being driven by Japan's rich culinary tradition of intricate and indulgent sweets. Sugar-free and reduced-sugar options that meet consumer expectations without sacrificing taste or quality are constantly being developed by manufacturers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan food sweetener market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tate & Lyle PLC

- Cargill, Incorporated

- Archer Daniels Midland Company

- Ingredion Incorporated

- DuPont de Nemours Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development:

- In March 2022, Cargill announced its stevia sweetening strategy with the commercial availability of its flagship stevia sweetener technology, EverSweet + ClearFlo, in Japan and globally. Sweeteners from the company can now be combined with other all-natural flavours. This mixture can provide flavour modification, improved solubility, formulation stability, and faster dissolution.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Japan Food Sweetener Market based on the below-mentioned segments:

Japan Food Sweetener Market, By Type

- Sucrose

- Starch Sweeteners and Sugar Alcohols

- High-Intensity Sweeteners (HIS)

Japan Food Sweetener Market, By Application

- Bakery and Confectionery

- Dairy and Desserts

- Meat and Meat Products

- Soups, Sauces and Dressings

- Other Applications

Need help to buy this report?